-

Has family plans for you and up to 10 family members

-

Provides identity, credit, financial, dark web, and social media monitoring

-

Only works with TransUnion, not Experian or Equifax, on the Essentials and Premier plans

Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Allstate Identity Protection comes from a well-known company and provides plenty of ways to monitor different aspects of your identity and personal data, including your credit, your finances, and your online accounts.

We recommend Allstate Identity Protection for its affordable pricing (starting at $9.99 per month), especially if you want full family coverage to help combat child identity theft. We also like how many different types of alerts you can set up, including customizing preferences for financial alerts.

But we don’t love that Allstate Identity Protection only monitors your TransUnion credit report and doesn’t include reports from Experian or Equifax (unless you’re on its most expensive plan). And we ran into a few issues with our experience using the Digital Footprint tool and iOS mobile app.

Let’s explore our Allstate Identity Protection review to see whether it makes sense for you.

What does Allstate Identity Protection protect against?

Allstate Identity Protection features

Does Allstate Identity Protection keep your data safe?

Allstate Identity Protection compatibility

Allstate Identity Protection customer support

Allstate Identity Protection prices and subscriptions

Allstate Identity Protection FAQs

Bottom line: Is Allstate Identity Protection good?

Allstate Identity Protection review at a glance

| Price | $9.99–$36.00/mo |

| Identity theft insurance | Up to $2 million |

| Credit monitoring | Yes |

| Credit reports | Yes — TransUnion, Experian, and Equifax (all three on Blue plan only) |

| Credit score | Yes |

| Identity recovery | Yes |

| Dark web alerts | Yes |

| Social media account alerts | Yes |

Allstate Identity Protection offers three subscription plans overall. The two lower-priced plans, Essentials and Premier, offer up to $1 million in expense coverage for fraud. The highest-priced subscription, Blue, provides up to $2 million in expense coverage for fraud if you choose a family plan. All three subscription plans also provide assistance for identity restoration (remediation) if you’re a victim of identity theft.

The primary services you can expect from Allstate Identity Protection include credit monitoring (only with the TransUnion credit bureau on the Essentials and Premier plans), financial monitoring, and dark web monitoring. A service for ID theft protection is worth it, in general, if it can help you monitor different aspects of your identity, including credit and financial information.

Depending on your plan, you can receive alerts about changes to your credit report(s) or any suspicious activity involving certain types of personal information and financial accounts. The Blue plan includes more types of alerts and additional coverage for more types of fraud, including home title fraud and 401(k)/Health Savings Account (HSA) fraud.

Allstate Identity Protection makes sense if you want an affordable identity monitoring provider for the whole family. You can choose family options that cover you and up to 10 family members with the Essentials, Premier, or Blue plans.

Allstate Identity Protection pros and cons

- Has family plans for you and up to 10 family members

- Provides identity, credit, financial, dark web, and social media monitoring

- Offers Allstate Digital Footprint to track your online accounts for potential threats

- Only works with TransUnion, not Experian or Equifax, on the Essentials and Premier plans

- Mobile apps don’t have the best ratings

What does Allstate Identity Protection protect against?

In general, Allstate Identity Protection can help protect against the following identity theft situations:

- Identity theft and identity theft losses: You can receive alerts about potential identity theft activity, including changes to your TransUnion credit report, or all three reports if you have a Blue plan. You can also receive reimbursement for eligible out-of-pocket expenses related to identity theft.

- Family member and child identity theft: You can extend identity theft protection to up to 10 family members, including children, if you choose an Essentials, Premier, or Blue family plan.

- Fraudulent financial activity: You can receive enhanced financial monitoring with a Premier or Blue plan, which provides alerts for suspicious activity with student loans, medical bills, credit cards, bank accounts, and 401(k) accounts.

- Social media account takeover: You can receive social media monitoring with a Premier or Blue plan, which includes alerts for any suspicious activity that indicates someone trying to hack or take over a linked account.

Allstate Identity Protection features

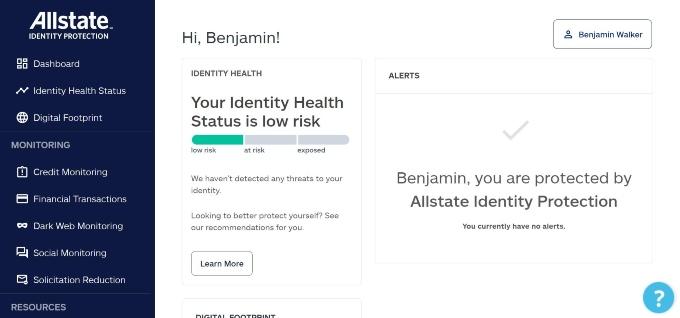

From our experience, we found that Allstate Identity Protection provides a large number of useful fraud alerts that can help you stay on top of your finances and protect against identity theft. This includes being able to monitor your TransUnion credit report (or all three reports with a Blue plan) and many different types of financial transactions.

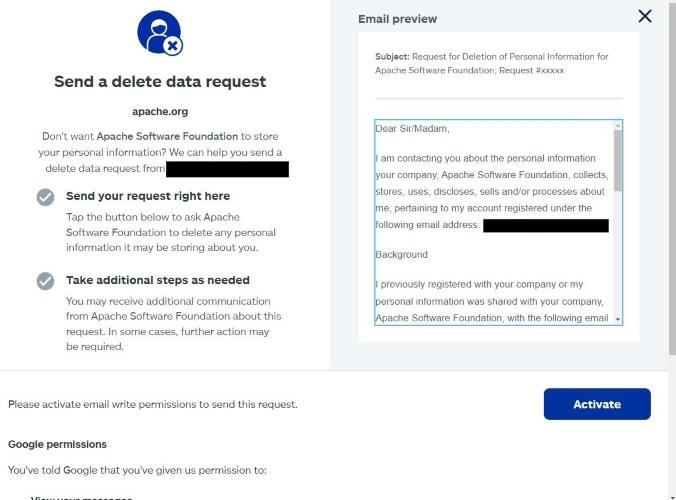

We like the idea of Allstate Digital Footprint and being able to check for old online accounts you may have forgotten about. But the actual experience of trying to use this tool was frustrating.

It simply took a very long time to scan our email and we couldn’t really do anything with it in the meantime. So we recommend starting an email scan and just letting it do its thing while you explore other features. Once the scan is done, which could be as long as a day or more, you can explore and use Digital Footprint some more.

Credit monitoring

Allstate has a partnership with TransUnion — and that’s the only credit bureau Allstate Identity Protection monitors if you’re on an Essentials or Premier plan. If you want to monitor all three major credit bureaus, you should look into the Blue subscription plan.

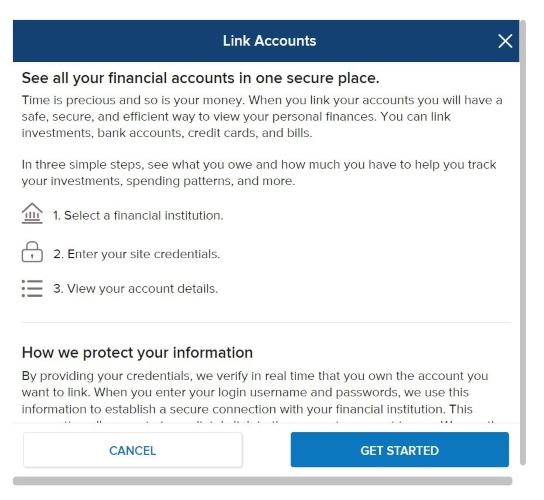

You have to activate the credit monitoring service, which we did immediately after subscribing and logging in to our online account.

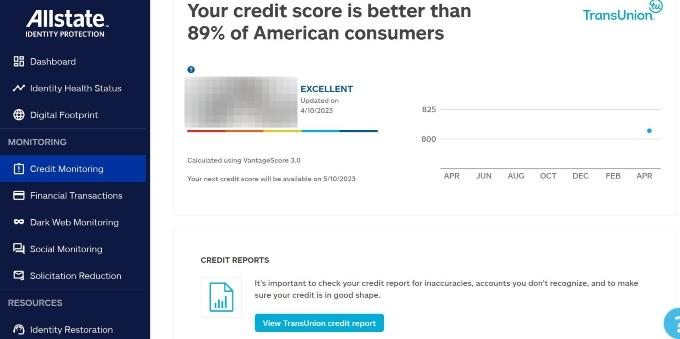

After activating the credit monitoring feature, we were able to see our credit score using the VantageScore 3.0 scoring model and we could access our TransUnion credit report.

Note that if Allstate Identity Protection detects any fraudulent activity, its representatives will work with you to restore your identity. You can receive up to $1 million in funds reimbursement for out-of-pocket expenses related to fraud with either the Essentials or Premier plans. This coverage is increased to $2 million if you’re on a Blue family plan.

Allstate Identity Protection also provides monitoring for certain financial transactions.

Some of the accounts you can add for monitoring financial transactions include investments, bank accounts, credit cards, and bills.

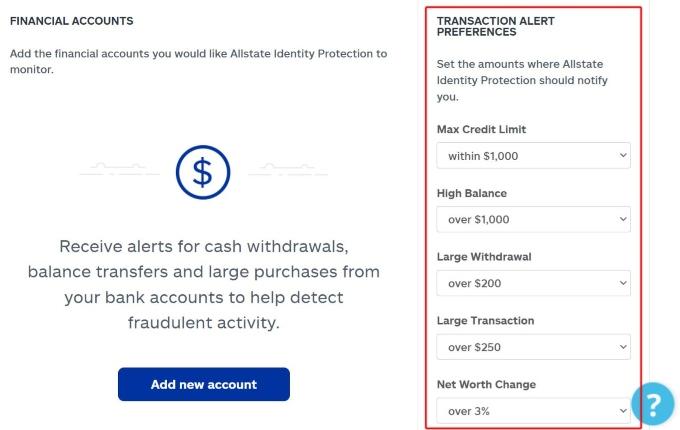

You can customize financial transaction alerts to help know if there’s anything suspicious going on with your linked accounts. For example, setting your alert preferences for withdrawals over a certain dollar amount can help you track whether someone else is trying to remove money from one of your accounts.

Overall, you can set transaction alert preferences for:

- Max credit limit

- High balance

- Large withdrawal

- Large transaction

- Net worth change

- Low balance

- Portfolio value change

Credit reports and credit scores

After you activate the credit monitoring feature with Allstate Identity Protection, you can see your VantageScore credit score. You can also access your TransUnion credit report, but you can’t access credit reports from Experian or Equifax unless you have a Blue plan.

It can be helpful to have access to this information yourself so you can manually check for any changes to your credit report(s) and credit score(s). But it would be more helpful if you could access credit reports from all three credit bureaus on any plan since the information can vary between each report.

The credit score shown in the dashboard is updated on a monthly basis. Keep in mind that this credit score is based on the VantageScore credit scoring model, not FICO, using the TransUnion credit report. Blue plans should show information from all three reports.

Alerts

ID theft protection services often provide different types of alerts for suspicious activity that could compromise your security. Allstate Identity Protection provides these alerts that are available in the Essentials, Premier, and Blue plans:

- Credit monitoring: Monitors and alerts you to key changes to your TransUnion credit report. This can include real-time alerts if someone is trying to open a credit card or bank account in your name.

- Dark web monitoring: Notifies you of any potential data breaches that may affect you. Also alerts you if your email, credit or debit cards, web logins, driver’s license, or passport numbers are mentioned or used on the dark web.

The Premier and Blue plans also provide a few additional alerts you won’t find with the Essentials plan:

- Address change monitoring: Alerts you if an address change is reported to TransUnion.

- High-risk transaction monitoring: Alerts you about activity with non-credit-based transactions, which could include student loans and medical bills.

- Student loan activity monitoring: Alerts you if you have new student loan applications made in your name.

- Credit card transaction monitoring: Alerts you to help confirm credit card transactions are actually yours.

- Bank account transaction monitoring: Alerts you about different types of bank transactions so you can keep an eye on your financial activity.

- 401(k) transaction monitoring: Alerts you about 401(k) account transactions.

- Social media monitoring: Alerts you of any suspicious activity on linked social media accounts that could indicate hacking or a takeover.

The Blue plan also provides sex offender alerts, which you won’t find with the Essentials or Premier plans.

Note that you can change your alert preferences in your account settings. You can choose email, text/SMS, or both.

Allstate Digital Footprint

Your digital footprint is a record of everything you do online. The Allstate Digital Footprint tool uses your email address to help track your digital footprint and give you options to protect your online security.

For example, you can see if your email or other online accounts have been involved in any breaches. You can also, if possible, adjust your privacy preferences with different websites, unsubscribe from emails, and/or send a request to have a company delete any of your stored information.

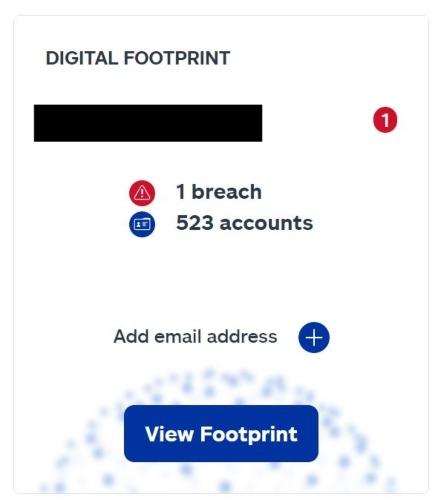

We think Allstate Digital Footprint is a unique tool that has the potential to be very useful, as it can gather information about accounts you may have forgotten about. But we found the tool to be largely unusable when we tested it.

We added one of our emails that gets a lot of junk mail to Digital Footprint and it started its scan. After a few hours, the scan was still going. We weren’t able to do much while the scan was going and we ran into multiple errors while initially trying to connect our email account.

We also tried to access Digital Footprint from the Allstate Identity Protection mobile app on our iPhone, but it froze the app. We aren’t sure how long the scan is supposed to take, but it didn’t seem like much progress was made in multiple hours and we couldn’t do much with the tool while the scan was going.

The Digital Footprint scan appeared to finish the next day after we started it, which is quite a long time for what we thought would be a simple scan. The scan found over 500 accounts associated with our email and one potential breach.

We tried to use Digital Footprint to send an email to the company with the potential breach to delete our data, but the attempt failed because that company apparently no longer accepts support requests via email.

So that wasn’t very helpful, but it turns out Allstate Digital Footprint has some redeeming qualities that deserve more attention, even if the email scan was slow. Namely, letting us know about a breach we weren’t aware of and giving us options to request our data be deleted from different sites we may have forgotten about.

Additional features

The Allstate Identity Protection Blue plan provides a few additional features that you won’t find on the Essentials or Premier plans.

Cybersecurity

Identity theft protection and cybersecurity go hand in hand. After all, your personal information could easily be leaked through any number of online scams or phishing attempts.

The Allstate Identity Protection Blue plan provides a full cybersecurity suite of features, including a virtual private network (VPN), password manager, firewall, antivirus protection, webcam protection, and more.

Family digital safety

The Blue plan provides a few different features to help protect the digital safety of your family. We’re not sure if all of these features are necessary for identity theft protection, but they can be helpful to have anyway.

For example, you can set rules to limit screen time on different devices, as well as block access to specific sites or whole categories of websites, such as streaming services or sexual content.

Our experience with Allstate Identity Protection

Our experience with researching and signing up for Allstate Identity Protection was generally painless and straightforward. We had no issues creating an account or understanding how the cancellation process works.

We also had no issues logging in to our account and navigating through the web app’s dashboard. Everything was clearly labeled and easy to understand.

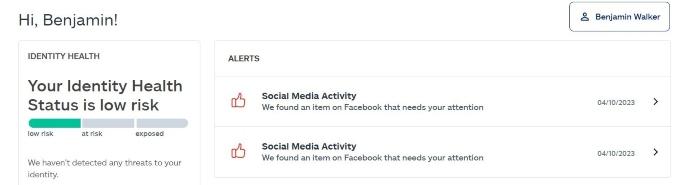

We were able to start setting up different alerts without a hitch and even received a few alerts the same day we connected a few social media accounts for monitoring.

We didn’t actually find the social media alerts to be very useful since the service was tagging old comments it deemed inappropriate because of specific words. For example, one word it tagged as profanity was “crap,” which wasn’t overly concerning for us.

Fortunately, we didn’t receive any alarming alerts during our testing, but we feel the service was reliable enough that we would receive notifications for any alerts we activate, including for credit monitoring.

Our main issues with Allstate Identity Protection are that it:

- Doesn’t monitor all three major credit bureaus with the Essentials or Premier plans

- Gave us loads of issues with its Digital Footprint tool

- Needs to update the functionality of its mobile apps

- Doesn’t provide a live chat feature

Not providing credit monitoring for Equifax and Experian on all plans means you can miss out on important changes to those specific credit reports (not all lenders use TransUnion). But we like that Allstate provides many different types of alerts, including customizable financial transaction alerts.

Does Allstate Identity Protection keep your data safe?

Allstate Identity Protection states that it doesn’t sell any of your personal information. But as an identity theft protection service, it makes sense that Allstate Identity Protection does collect personal information to help protect you against identity theft.

As we went through the sign-up process and started activating different features, Allstate Identity Protection collected our name, address, Social Security number, and birthdate. We also connected different social media accounts, financial accounts, email addresses, and more.

We knew we would have to provide this type of information going into our testing of this product, so it wasn’t a big deal. But we still wanted to see if the terms and conditions and privacy policy made sense to us.

In general, we didn’t see any glaring issues. Allstate Identity Protection says that it doesn’t sell any personal information, but it might have to share some of our information for proper use of its products and services. That made sense to us since different features can actually be different types of services included within the Allstate Identity Protection suite.

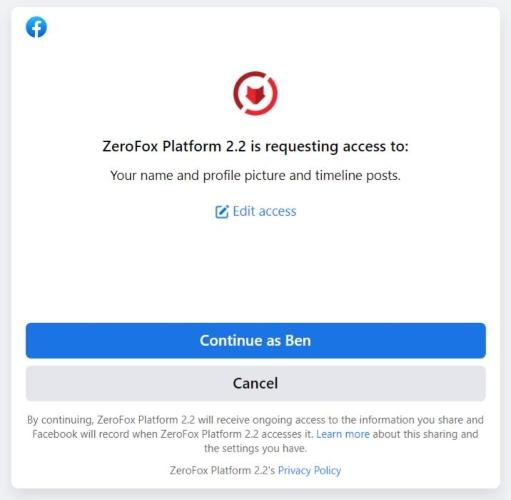

For example, we noticed that we had to give some permissions to “ZeroFox Platform 2.2” while connecting some of our social media accounts. We found that this is a separate cybersecurity platform, but one that Allstate is clearly using within its own service.

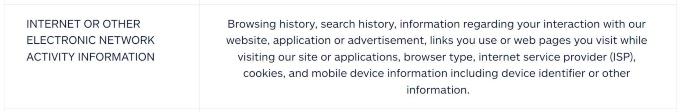

Something we didn’t particularly love about the privacy policy is that Allstate Identity Protection may collect your IP address, cookies, browsing history, and other device and internet information. While some of this information is normal for everyday internet usage, we’re not sure why Allstate needs browsing history as well.

Note that we had to verify our identity each time we tried to log in to our online account via the Allstate Identity Protection website. The verification method was a code texted to our phone number. We didn’t actually see any way to change this method in our account settings and we don’t remember turning it on ourselves when we signed up.

The privacy policy doesn’t state what kind of security the company uses, but we noticed a sentence while inputting some personal information that said something along the lines of using “the highest-level encryption,” which is a bit too vague for our liking.

Allstate Identity Protection compatibility

You can access your Allstate Identity Protection account by logging in to the website from any number of devices, including a laptop, phone, or tablet. Or you can use the Allstate Identity Protection mobile app from an iOS or Android device, such as an iPhone or Samsung Galaxy phone.

For iOS devices, the Allstate Identity Protection app on the Apple App Store has a below-average rating of 2.4 out of 5 stars. In general, the reviews mention how the app doesn’t work well.

We tested the Allstate Identity Protection app on our iPhone and within 30 seconds of logging in to our account, we were stuck on a loading screen. After a few minutes of waiting, we had to force close the app and reload it to get back in.

Frustratingly (but perhaps as a security measure?), we had to log in again even though we were just logged in. Needless to say, the low app store reviews seem to be warranted for an overall bad user experience.

For Android devices, the Allstate Identity Protection app on the Google Play Store has an above-average rating of 3.6 out of 5 stars. In general, the reviews mention issues with app functionality.

Allstate Identity Protection customer support

We were disappointed to find that Allstate Identity Protection doesn’t seem to offer live chat support, which is our preferred method of communicating with customer service representatives.

We checked before signing up for a subscription and then after signing up for a subscription (in case it was a member-only perk), but we still couldn’t locate any chat option at all.

We filled out the online form to ask some questions and also sent a message to the Allstate Identity Protection Facebook page. We didn’t receive any immediate response to either method and still hadn’t received a response over 24 hours later. Over a week later, we still didn’t receive a response using either method.

Allstate Identity Protection also advertises a 24/7 customer service phone line you can reach at 1-800-789-2720.

Allstate Identity Protection prices and subscriptions

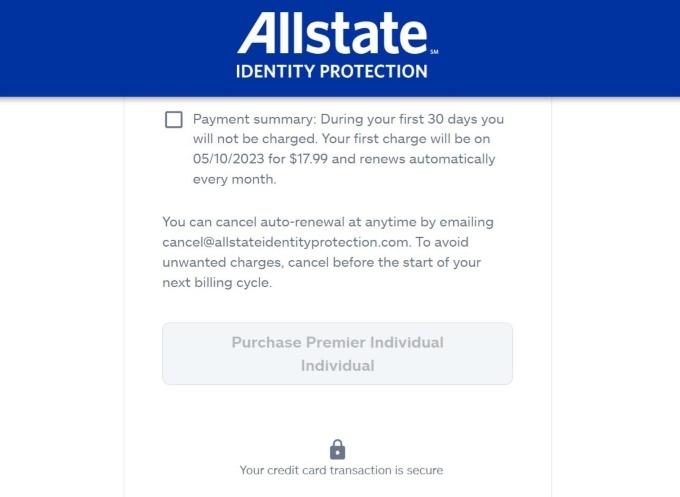

Allstate Identity Protection costs $9.99 to $19 for individual plans and $18.99 to $36 for family plans. Individual plans work for one person and family plans work for you and up to 10 family members.

The pricing is comparable to other identity protection services and could definitely be worth it depending on the specific features you want. For example, here’s how much it costs for identity protection from a few popular companies:

- Aura: Starting from $12 per month for individuals and $37 per month for families with kids.

- LifeLock by Norton: Starting from $7.50 per month for individuals and $18.49 per month for families with kids.

- IdentityForce: Starting from $17.95 per month for individuals. IdentityForce doesn’t list pricing for families online.

Of course, you would also have to compare the features of each plan between different companies to see if they’re actually comparable. But, in general, Allstate Identity Protection pricing is right around what you can expect to pay for identity protection services. And its family plans seem like a decent deal considering they cover you and up to 10 family members, which is generally more than what Aura and LifeLock by Norton provide.

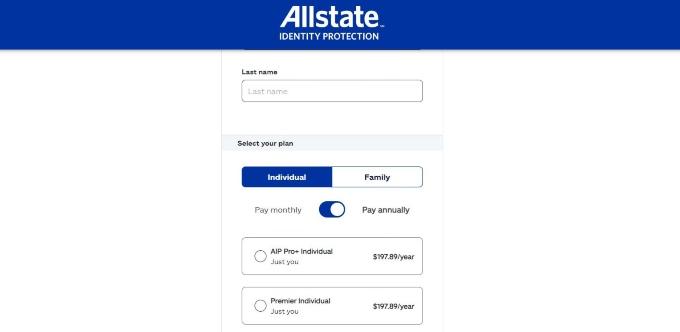

There’s a slight discount if you purchase an Allstate Identity Protection annual plan versus paying monthly for 12 months. When we signed up for a monthly individual plan, it was $17.99 for the month. That would be $215.88 for a year.

But we also had the option to pay for a full year of service upfront, which would have been $197.89. That’s essentially one free month (a $17.99 discount) if you choose the annual plan instead of paying for 12 months separately.

It was slightly confusing that we had two individual plans to choose from on an annual basis, “AIP Pro+ Individual” and “Premier Individual.” The AIP Pro+ plan wasn’t listed in the available plans on the Allstate Identity Protection website, so we weren’t sure what features were included. But it was the same price as the Premier Individual plan.

Allstate Identity Protection plans comparison

| Plan | Allstate Identity Protection Essentials | Allstate Identity Protection Premier | Allstate Identity Protection Blue |

| Individual price per month | $9.99/mo | $17.99/mo | $19.00/mo |

| Family price per month | $18.99/mo | $34.99/mo | $36.00/mo |

| Who’s covered |

|

|

|

| Identity theft insurance | Up to $1 million max coverage | Up to $1 million max coverage | Up to $2 million max coverage on family plans |

| Credit monitoring | |||

| Financial activity alerts | |||

| Credit reports | Yes — TransUnion | Yes — TransUnion | Yes — TransUnion, Experian, and Equifax |

| Credit score | |||

| FICO score | |||

| Credit freeze assistance | |||

| Identity recovery | |||

| Dark web alerts | |||

| Social media account alerts | |||

| USPS address change alerts | |||

| Details | View Plan | View Plan | View Plan |

Note that Allstate Identity Protection can provide credit freeze assistance if you want to freeze or unfreeze your credit with TransUnion. This likely means Allstate can help walk you through the steps of freezing and unfreezing your credit, but doesn’t actually provide a way to freeze or unfreeze your credit from your Allstate Identity Protection account.

At least, we didn’t see any options for freezing or unfreezing our TransUnion credit when looking through the Allstate Identity Protection mobile or web apps. However, the Blue plan has an in-portal credit lock option to lock or unlock your TransUnion credit report with a simple click or tap of a button.

Allstate Identity Protection FAQs

Is Allstate Identity Protection worth it?

Allstate Identity Protection can be especially worth it if you want identity theft protection and monitoring for your whole family. It offers plans for both individuals and families, with the family plans covering you and up to 10 family members. Family plans range from $18.99 to $36 per month, which is quite affordable for family identity theft protection.

How much is Allstate Identity Protection?

Allstate Identity Protection costs between $9.99 to $36 per month depending on the plan you choose. The Essentials plan costs $9.99 to $18.99 per month and the Premier plan costs $17.99 to $34.99 per month. The Blue plan, which has the most features, costs $19 to $36 per month.

Is there an Allstate app?

Yes, you can download Allstate Mobile on the Apple App Store or Google Play Store for iOS or Android devices to access your Allstate Insurance ID cards, 24/7 roadside assistance, and more. You can also use the Allstate Identity Protection app on iOS or Android devices to help monitor your identity theft protection services and related alerts.

What does the Allstate Digital Footprint feature do?

Allstate Digital Footprint tracks the history of your online activity for any potential threats of identity fraud or theft. This involves finding any accounts you’ve created, including accounts you may have forgotten about and could leave your personal information exposed. Allstate Digital Footprint will also let you know if your data has been breached so you can take appropriate action.

Bottom line: Is Allstate Identity Protection good?

So, are you in good hands with Allstate Identity Protection?

We think Allstate Identity Protection is a decent and affordable solution for identity theft protection. We don’t think it’s the best identity theft protection service available because some of its features didn’t work as expected and the customer support is lacking. Also, the Essentials and Premier plans only monitor your TransUnion credit report, which isn’t complete protection.

But you still get access to loads of different alerts and the option to get a plan for the whole family. For these reasons, we think Allstate Identity Protection can work as an affordable option for families with children.

The mobile apps need some work and a live chat feature would be nice, but the primary concern is making sure you have some additional protection from identity theft, which Allstate can provide.

If you're looking for more complete protection or different features, check out our list of the best identity theft protection services.

-

Has family plans for you and up to 10 family members

-

Provides identity, credit, financial, dark web, and social media monitoring

-

Only works with TransUnion, not Experian or Equifax, on the Essentials and Premier plans