Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Best for family protection

-

Provides VantageScore and not FICO score updates

Best for long-term pricing

Best for insurance coverage

Aura, Identity Guard, and Norton LifeLock offer the best identity theft protection with restoration services. Aura will keep your entire family safe with unique tools not found in other ID protection services. Identity Guard utilizes AI to evolve as your protection needs change. Finally, Norton offers more insurance than its competitors. Which one is right for you hinges on your individual needs and goals.

Aura: Best for family protection

Identity Guard: Best for long-term pricing

Norton LifeLock: Best for insurance coverage

Honorable mentions

Best identity theft restoration services FAQs

Bottom line: The best ID theft restoration services

How we tested the best identity theft restoration services

How to choose the best identity theft protection service

The best identity theft restoration services 2024

- Aura: Best for family protection

- Identity Guard: Best for long-term pricing

- Norton LifeLock: Best for insurance coverage

Top 3 identity theft restoration services compared

| Service |  Aura |  Identity Guard |

Norton LifeLock |

| Individual plan | Starts at $12.00/mo | Starts at $6.67/mo | Starts at $7.50/mo for first yr |

| Family plan | Starts at $22.00/mo | Starts at $10.00/mo | Starts at $13.24/mo for first yr |

| ID theft insurance | Up to $1 million | Up to $1 million | Up to $1.05 million through $3 million, depending on plan |

| Credit monitoring | |||

| 3-bureau credit reports | |||

| Details | View Plans | View Plans | View Plans |

Aura: Best for family protection

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates

Who it’s best for

If you’ve read recently about data leaks at schools that have exposed children’s Social Security numbers (SSNs), you may be wondering what you can do to protect your kids’ identity. Child identity theft and credit card fraud are real crimes that can be a complete nightmare to address. These are some ways kids’ identities are stolen:

- Hackers (accessing schools, doctor offices, sports team info, etc.)

- Scams (parents can get scammed and lose their kids’ info)

- Phishing (either kids themselves or family members)

- Identity thieves (purchasing SSNs from ransomware attacks)

But Aura has your family covered. Not only does the service provide protection for children, but it also provides parental controls, safe gaming features, as well as the ability to freeze your child’s credit. This can assist your children in starting their credit journey with a clean slate when it comes time.

What we liked

Aura walks you through the setup process so you have all your settings activated from the beginning. The dashboard is comprehensive, easy to navigate, and user-friendly. The features are robust, including, as previously mentioned, child protection features. We were also impressed with Aura’s additional features that go beyond identity theft protection:

- Credit protection for all adults on the plan

- Monthly credit scores

- Reports from all three major credit bureaus

- Safe gaming with cyberbullying alerts

- Credit freeze

- Sex offender geo-alerts

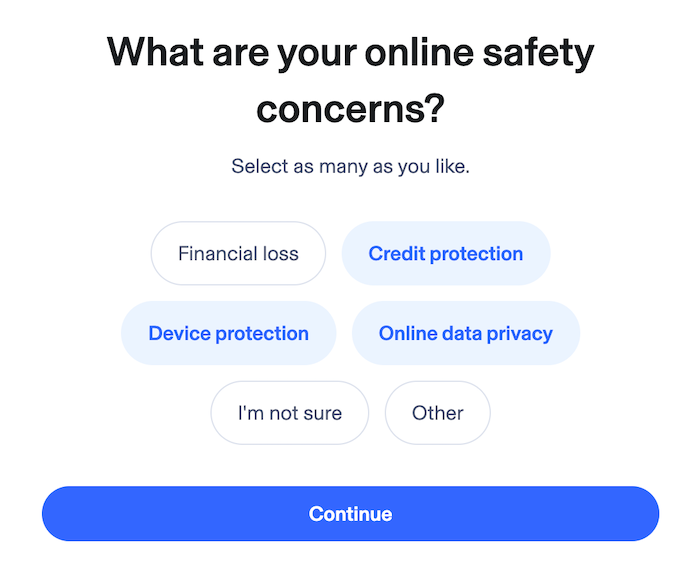

One feature unique to Aura is the ability to monitor your individual transactions, so you can receive a notification if there’s a purchase made over your spending limit. Additionally, Aura can prioritize what’s important to you by allowing you to customize your experience at the very beginning. When you sign up, Aura asks a series of questions about your goals to really hone in on what’s important for you.

What we didn’t like

All of Aura’s extras and features don’t come cheap. Aura has one of the highest price tags we’ve seen. If you want to cover your family, you’ll be paying $24.00/mo monthly. The annual plans will save you money, but you’ll still be spending about $288 annually for the family plan.

Aura may not work for you if you have a large family and a tight budget. That’s ok. Other services like Identity Guard are less expensive and still have the core features you need to have identity recovery services for your family.

Aura features

| Plan | Individual | Couples | Family |

| Paid annually | $12.00/mo | $22.00/mo | $24.00/mo |

| Paid monthly | $15.00/mo | $29.00/mo | $39.00/mo |

| Free trial | Yes — 14 days | Yes — 14 days | Yes — 14 days |

| Number of people covered | 1 adult | 2 adults | 5 adults, unlimited children |

| ID theft insurance | Up to $1 million | Up to $2 million ($1 million per adult) | Up to $5 million ($1 million per adult) |

| 3-bureau monitoring | |||

| Credit reports | |||

| Identity recovery | |||

| Learn more | View Plan | View Plan | View Plan |

Identity Guard: Best for long-term pricing

-

Easy-to-use identity theft protection service

-

Includes extra features like a password manager

-

No dedicated remediation assistance available

Who it’s best for

While Identity Guard and LifeLock look like they’re similar in pricing, LifeLock jumps up for the second year while Identity Guard doesn’t. If huge price hikes for something you like aren’t your thing, Identity Guard may be the answer.

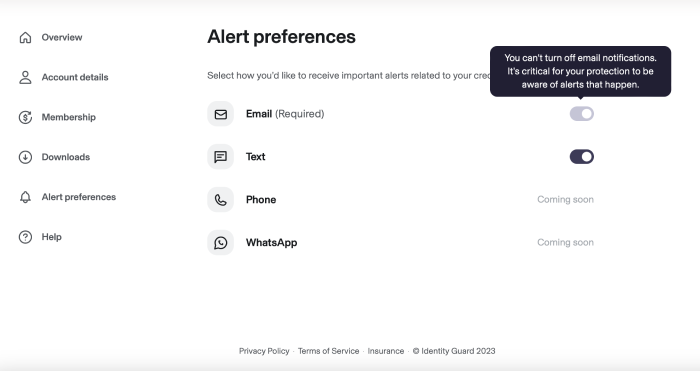

What we liked

We loved the price on the Value plan because it’s one of the lowest we’ve seen. We were also impressed with how easy it is to use Identity Guard. The portal is clean, and you can navigate through it with ease. Its additional features, like the password manager, were a bonus that we appreciated.

Identity Guard is designed with the user in mind. Its intuitive artificial intelligence monitoring, which is powered by IBM Watson, scans the dark web for any mention of you. Identity Guard’s use of AI means that it is learning and evolving to protect you, even as threats become more advanced. We love tools that work smarter, not harder.

Even though Identity Guard is inexpensive, it still offers plenty of features that we loved:

- Bank account monitoring

- Data breach notifications

- Dark web monitoring

- High-risk transaction monitoring

- Three-bureau credit monitoring

- Password manager

What we didn’t like

We found that Identity Guard only offers dedicated identity restoration assistance on its Ultra plan, which is the most premium plan. If you're looking for an identity theft protection plan on a budget, you'll be on your own with rectifying any cases of identity theft if you opt for one of Identity Guard's basic plans.

We also had a slight issue when trying to check out with our Identity Guard subscription, but we tried a different payment method and succeeded. Although this is a minor issue, it can still be annoying to try multiple payment methods.

Identity Guard features

| Plan | Individual | Family |

| Paid annually | Starts at $6.67/mo | Starts at $10.00/mo |

| Paid monthly | Starts at $8.99/mo | Starts at $14.99/mo |

| Free trial | ||

| Number of people covered | 1 adult | 5 adults, unlimited children |

| ID theft insurance | Up to $1 million | Up to $1 million |

| 3-bureau monitoring | ||

| Credit reports | ||

| Identity recovery | ||

| Learn more | View Plan | View Plan |

Read Our Identity Guard Review

Norton LifeLock: Best for insurance coverage

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Who it’s best for

If you’re looking for extensive insurance coverage with your identity theft prevention service, Norton LifeLock has it. While this isn't the only feature available to you, LifeLock’s insurance is more generous than other plans.

Most services offer up to $1 million in coverage per adult, but LifeLock starts with over $1 million in coverage, and its Ultimate Plus plan covers up to $3 million for an adult. Those funds cover lawyers, stolen funds reimbursement, personal expense compensation, and any other costs accrued from restoring your identity. This is great news if you ever need Norton’s remediation services.

What we liked

LifeLock includes a LOT of identity monitoring features:

- Dark web monitoring

- Home title monitoring

- 401k and investment account activity alerts

- Credit file lock and payday loan lock

If you want to try LifeLock before committing to a subscription, it offers a 60-day money-back guarantee on annual accounts and a 14-day money-back guarantee on monthly accounts. Norton even offers plans that bundle Norton 360 with LifeLock, so you can meet many of your cybersecurity needs with just one subscription.

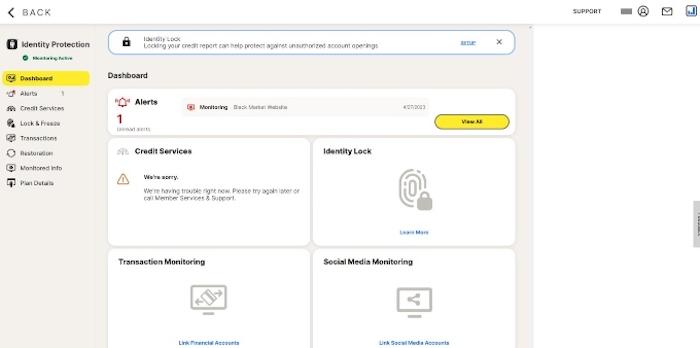

We tested LifeLock on iOS for an iPhone and found the app easy to install and use. This isn’t the case for all ID protection services, so knowing we could easily access our account in case of emergency impressed us.

Continuing the theme of access, we found the dashboard easy to use as well. It has a clean design that allows you to access all the services quickly. We didn’t need to hunt for features. Overall, this experience was good, and we are comfortable recommending LifeLock.

What we didn’t like

We didn’t have a great experience with customer service. We used both the live chat feature and called, but we found the reps to be less than knowledgeable. Now, these were not the remediation representatives you would work with in case of identity theft, but they are the support staff for the LifeLock product. We received conflicting information from them and overall didn’t enjoy the experience.

New accounts were relatively well-priced, but prices after the first year went way up. And some features aren't available unless you opt for the Ultimate Plus plan. For example, you'll only get one-bureau credit monitoring with the Standard and Advantage plans but you'll get three-bureau credit monitoring with the Ultimate Plus plan.

Norton LifeLock features

| Plan | Individual | Family Plan (2 Adults) | Family Plan (2 Adults + 5 Kids) |

| Paid annually | Starts at $7.50/mo for first yr | Starts at $13.24/mo for first yr | Starts at $18.99/mo for first yr |

| Paid monthly | Starts at $11.99/mo for first yr | Starts at $23.99/mo for first yr | Starts at $35.99/mo for first yr |

| Free trial | Yes — 30 days | Yes — 30 days | Yes — 30 days |

| Number of people covered | 1 adult | 2 adults | 2 adults, 5 children |

| ID theft insurance | Up to $3 million | Up to $3 million per adult | Up to $3 million per adult and up to $1.05 million per child |

| 3-bureau monitoring | |||

| Credit reports | |||

| Identity recovery | |||

| Learn more | View Plan | View Plan | View Plan |

Read Our Norton LifeLock Review

Honorable mentions

While these ID theft protection services didn’t quite make the cut this time, they still have a lot to offer. Protection software is a personal choice, and we want to give you plenty of options to find what works best for you. The three service providers below are worth checking out, but we also have an identity theft protection and credit monitoring guide with even more options.

- IdentityIQ: IdentityIQ has quite a few useful features but cannot freeze credit, which could be damaging in an emergency. The included features and functionality, however, worked exactly as advertised.

Get IdentityIQ | Read Our IdentityIQ Review

- ID Watchdog: ID Watchdog provides you with extras like a password manager and virtual private network (VPN), as well as end-to-end remediation services if needed. However, it lacks a lot of features in its least expensive plan as well as some key financial monitoring features. The protection for what it does offer isn’t lacking, and the customer support is on point.

Get ID Watchdog | Read Our ID Watchdog Review

- IDShield: IDShield by LegalShield tends to be a little buggy, especially on Safari, but it has a great price point and many features. If you aren’t trying to access it from a macOS or iOS device, you’ll enjoy features like “Reputation Management,” which scans social media to make sure you aren’t being impersonated or misrepresented online.

Get IDShield | Read Our IDShield Review

Best identity theft restoration services FAQs

Why is it so important to have restoration services with your ID theft protection?

Restoring your identity after it’s been stolen can be an incredibly frustrating process. If you purchase ID theft protection, make sure you choose one that also helps you restore your identity. That way, you won’t need to worry about calling the right agencies, dealing with the credit bureaus, or juggling lawyers to deal with identity theft losses. An agent will be able to help you deal with all the legal ramifications of identity theft without the headache.

What is the best way to restore my identity?

While restoring your identity without a service is possible, you’ll find it much easier if you have a professional on your side. Identity theft protection services are well-equipped to assist you in restoring your good name. Most will even pay for the remediation services when involving outside parties like lawyers and private investigators. Getting your identity back can get pretty pricey, so these services provide the tools and insurance to help.

How do I know if I have been a victim of identity theft?

To know if you’re a victim of identity theft, look for obvious signs of suspicious activity. Unrecognized purchases on your financial accounts, stolen funds, or unfamiliar line items on your credit report are all indicators. Sometimes, however, you won’t know until it’s too late. If someone is able to steal the deed to your home or change your address to intercept mail, it could be a long time until you realize this is happening.

Bottom line: The best ID theft restoration services

ID theft protection is definitely worth it for your peace of mind, especially if you find yourself affected by identity theft. Aura will make sure everyone from your grandma to your kids is covered to prevent theft. Identity Guard gives you AI-enabled technology that evolves over time. And LifeLock offers high insurance coverage that ensures you won’t pay out-of-pocket for remediation. Even if our top picks aren’t what you’re looking for, there are other choices listed in this post with features that should work for you.

3 best ID theft restoration services 2024

| Starting price | Best for | Learn more | |

Aura |

Starts at $12.00/mo | Best for family protection | View Plans |

Identity Guard |

Starts at $6.67/mo | Best for long-term pricing | View Plans |

Norton LifeLock |

Starts at $7.50/mo for first yr | Best for insurance coverage | View Plans |

How we tested the best identity theft restoration services

We chose each of these based on their star rating on our site. Once our reviewers went through and tried out each service, it was assigned a rating based on key factors like price, features, accessibility, etc. These were all 5-star or 4.5-star products that excelled above the competition.

How to choose the best identity theft protection service

If you’re in the market for identity theft protection services, there are questions you should ask when doing research. Whether you’re looking for just yourself or your entire family, some core features are indicative of a good identity theft protection company. Ask yourself these questions when comparing brands:

- How much does it cost?

- Does it alert users to data breaches in multiple areas?

- Does it monitor credit reports from all three bureaus, Experian, TransUnion, and Equifax?

- How often does it provide credit score updates?

- Does it assist with identity recovery?

- Does it provide identity theft insurance, and if so, how much? (Up to $1 million is most common.)

- Are there extras like antivirus software or malware protection?

- Does it offer apps for multiple common device types and operating systems?

- Does its privacy policy state it doesn’t sell data?

- Does it cover children or other family members?

- How is the customer service experience?

- Is the mobile app highly rated?

- Does it make it easy to monitor your identity from anywhere?

- Are there fraud alerts?

- Extra features like social media monitoring, sex offender maps, credit report monitoring, device protection, credit freeze, and credit monitoring services.

- Is it recognized by the Federal Trade Commission?

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates