Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Best for Low Costs In Your First Year

Best for Additional Device Security

-

Provides VantageScore and not FICO score updates

Best for Comprehensive ID Restoration

Identity theft prevention services can help you monitor and even repair your identity and credit if your info is ever used fraudulently. But it’s difficult to know which one is the best for you.

We chose Norton LifeLock, Aura, and ID Watchdog as the best identity theft protection for seniors, thanks to their features, customer service, and remediation services. All three include lower starting prices, additional device security, and end-to-end identity restoration. Dive in with us to see which identity theft protection company is best for you.

Norton LifeLock: Best for a low cost during your first year

Aura: Best for additional device security

ID Watchdog: Best for comprehensive identity restoration

Honorable mentions

Best identity theft protection for seniors FAQs

Bottom line: The best ID theft protection for seniors

How we tested the best identity theft protection for seniors

How to choose the best identity theft protection service for seniors

The best identity theft protection services for seniors 2024

- Norton LifeLock: Best for low cost during your first year

- Aura: Best for additional device security

- ID Watchdog: Best for comprehensive identity restoration

Top 3 identity theft protection services for seniors compared

| Service |  Norton LifeLock |  Aura |

ID Watchdog |

| Monthly price | Starts at $7.50/mo for first yr | Starts at $12.00/mo | Starts at $14.95/mo |

| ID theft insurance | Up to $3 million | Up to $1 million | Up to $1 million |

| Senior discount | Yes — 25% | ||

| Credit monitoring | |||

| Identity recovery | |||

| Details | Get LifeLock Read Our LifeLock Review |

Get Aura Read Our Aura Review |

Get ID Watchdog Jump to ID Watchdog Review |

Norton LifeLock: Best for a low cost during your first year

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Who it’s best for

LifeLock is best for anyone looking for a good value identity protection service that’s worth it. Norton Lifelock has many features in all three pricing tiers with a low cost for the first year. Lifelock also offers the most identity theft insurance out of our three picks. This means you’re getting a lot of bang for your buck.

Norton LifeLock pros and cons

- Up to $3 million in ID theft insurance reimbursement

- Cybersecurity option with malware and phishing protection

- 60-day money-back guarantee

- Cost increases after 1st year

What we liked

LifeLock is a Norton product, and that brand recognition comes with a certain level of trust.

It has the highest individual identity fraud insurance payout of any of the protection plans here. We also loved that it came with a plan that included two adults and no children. This is also useful after someone’s gone because it protects against ghosting identity theft. You can also add on device protection like a VPN or antivirus software for an additional charge.

In addition, Norton LifeLock lets you choose to pay monthly or yearly, making it feasible for almost all budgets. The pricing only increases minimally after the first year, and you can enjoy all of the Norton products in one convenient portal. Norton’s services are customizable, depending on what you need, with its Ultimate Plus plan including reports from all three major credit bureaus and home title monitoring for complete coverage.

What we didn’t like

The introductory price for LifeLock is good, but once you get past the first year, it auto-renews at a higher price. (The renewal prices are listed on each plan, so you know what it will cost.) Also, renewal is automatic, so you’ll need to set a reminder to either cancel or remember that the second-year price is coming out of your account on the date of purchase.

Plan ahead of time with a reminder or calendar note to avoid being blindsided by a price increase.

Norton LifeLock prices

| Plan | LifeLock Standard Individual |

LifeLock Advantage Individual |

LifeLock Ultimate Plus Individual |

| Annual plan monthly price | Starts at $7.50/mo for first yr | Starts at $14.99/mo for first yr | Starts at $19.99/mo for first yr |

| Monthly price | Starts at $9.99/mo for first yr | Starts at $17.99/mo for first yr | Starts at $23.99/mo for first yr |

| Senior discount | |||

| Credit monitoring | Yes — 1 bureau | Yes — 1 bureau | Yes — 3 bureaus |

| Identity recovery | |||

| Learn more | View Plan | View Plan | View Plan |

Read Our Norton LifeLock Review

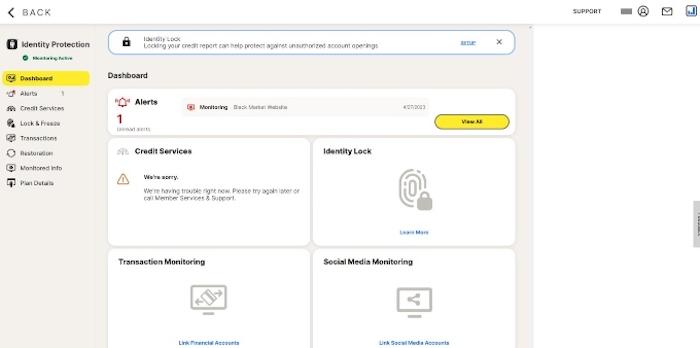

Aura: Best for additional device security

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates

Who it’s best for

Aura is best for anyone who wants to protect their devices and their identity. All Aura plans come with antivirus, a VPN, Smart Vault (a file and password manager), and Safe Browsing for up to 10 devices per adult along with a full kit of identity theft monitoring tools.

And since Aura also includes a 25% senior discount, it’s like buying a full security suite for your identity and devices at a discounted price. All of this together is meant to help keep seniors safe online.

Aura pros and cons

- 14-day free trial

- White glove fraud remediation

- Senior discount

- Offenders list only available with the family plan

What we liked

With an antivirus, VPN, and password manager built-in, even the most expensive Aura plan stands to save you money in the long run while protecting you from hackers and scammers. It also offers a free 14-day trial to determine if the service is for you. Pair all of this with the 25% senior discount, and you’ll be paying less for these services than if you purchased them separately.

If you live in a multi-generational household, the family plan includes protections for kids, including parental controls, safe gaming, and cyberbullying alerts. We also like that there’s an option for couples without kids. Many other identity protection services don’t offer protection for more than one adult without including children. If you want to cover you and your partner without children, the couples plan gives you that option.

What we didn’t like

The registered sex offenders list is only available with the family plan. Offenders can target anyone, not just children, so we aren’t sure why this wouldn’t be an across-the-board feature. Since the registered offender lists are available from a Department of Justice (DoJ) website, it wasn’t a deal breaker. But with so many extras included in Aura, we’re not sure why this one was left out.

Aura prices

| Plan | Aura Individual Annual |

Aura Couple Annual |

Aura Family Annual |

| Annual plan monthly price | $12.00/mo | $22.00/mo | $24.00/mo |

| Monthly price | $15.00/mo | $29.00/mo | $50.00/mo |

| Senior discount | Yes — 25% | Yes — 25% | Yes — 25% |

| Credit monitoring | Yes — 3 bureaus | Yes — 3 bureaus | Yes — 3 bureaus |

| Identity recovery | |||

| Learn more | View Plan | View Plan | View Plan |

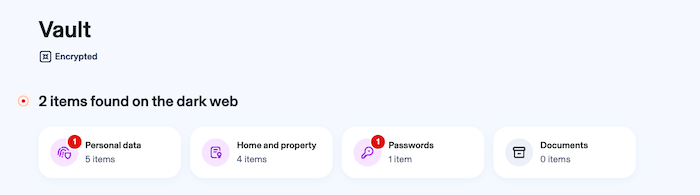

ID Watchdog: Best for comprehensive identity restoration

-

Comprehensive identity restoration services

-

Additional premium features like a VPN and password manager

-

Lack of financial account monitoring

Who it’s best for

ID Watchdog is best for anyone who wants a team of professionals working on identity restoration from end to end. With ID Watchdog’s fully managed identity restoration service, it doesn’t just assist you in restoring your identity. This service handles every aspect of your identity restoration to completion. If the idea of calling creditors and dealing with the IRS doesn’t thrill you, this may be the service for you.

ID Watchdog pros and cons

- Comprehensive identity restoration services

- Customizable alert and notification options

- Additional premium features like a VPN and password manager

- Lack of financial account monitoring

What we liked

ID Watchdog gets granular with each of its protection features. There’s support for 401(k) theft and subprime loan monitoring, which are any loans that occur outside a normal banking environment. Most ID theft prevention services monitor financial accounts like banks and credit cards, but personal loans and rent-to-own agreements can be made outside of these institutions. ID Watchdog monitors all of it.

In addition, ID Watchdog allows customizable alert options. That means you can choose how you’ll be alerted and the device where you’ll receive alerts. You also have the option to share alerts with other adult family members. If you have a family member who shares in your monetary decisions, you can easily keep them in the know.

What we didn’t like

We didn’t love the lack of financial account monitoring. Alerts aren’t really available with Select either. It’s a very pared-down plan that only helps with recovery if your identity is compromised rather than helping prevent or catch it.

ID Watchdog prices

| Plan | ID Watchdog Select Individual |

ID Watchdog Premium Individual |

| Annual plan price | $150.00/yr ($12.50/mo) | $220.00/yr ($18.33/mo) |

| Monthly price | $14.95/mo | $21.95/mo |

| Senior discount | ||

| Credit monitoring | Yes — 1 bureau | Yes — 3 bureaus |

| Identity recovery | ||

| Learn more | View Plan | View Plan |

Honorable mentions

PrivacyGuard and Identity Guard are two more services available for identity protection that offer a variety of features and price points. These two didn’t quite make the cut because PrivacyGuard looks great but sells your data, and Identity Guard is under the Aura company umbrella.

PrivacyGuard

PrivacyGuard is good at what it does. When we reviewed it, we found the features helpful and the dashboard well laid out. It does offer reports from all three bureaus and has a comprehensive list of features like monitoring your driver’s license for misuse and including children’s Social Security number (SSN) monitoring for free.

We did have difficulty getting the registered offenders map to populate, even after disabling our ad blockers and VPN. That wasn’t the most egregious part of PrivacyGuard, though. When we took a deep dive into the privacy policy, we found that the company sells your data. It’s counterintuitive for a privacy protection company to sell data, so we ultimately couldn’t recommend it.

Identity Guard

Identity Guard has one of the most affordable basic plans we’ve seen, coming in at around $7.50 a month for an individual plan. It also includes a password manager, which saves you an additional fee if you already use that service.

We were also impressed that Identity Guard immediately requested our data be deleted by data broker sites that access public records and sell personal information to anyone, including identity thieves. We didn’t have to opt-in to that feature as it worked automatically. Additionally, Identity Guard had many customer support options that would work for any communication style.

Ultimately we didn’t go with Identity Guard in this review because the signup process was a little buggy. While it offers multiple payment options, we couldn’t get Apple Pay or PayPal to work. Since we weren’t thrilled about inputting our credit card, we decided this one just barely missed the list. Identity Guard is under the Aura brand of products, so if you like Aura but want a little different plan, Identity Guard might be for you.

Read Our Identity Guard Review

Best identity theft protection for seniors FAQs

How much does Home Title Lock cost?

Home Title Lock starts at $19.95/mo but drops to around $16.50/mo if you buy an Annual or 4-year plan. Home Title Lock protects against home title theft and nothing else. There are no identity and credit monitoring guides and no remediation if your data is used fraudulently.

Does AAA offer identity theft protection?

Yes, AAA partnered with ProtectMyID for ID theft protection for customers. The Essential Plan is free for all AAA members, while the Deluxe Plan is about $11 a month and the Platinum Plan is about $16 a month.

What identity protection does AARP recommend?

While we couldn’t find an AARP endorsement for any specific identity protection service, AARP offers a Fraud Watch Network for members. The organization offers information, support, and reporting features to help members stay secure.

Does LifeLock have a senior discount?

No, Norton LifeLock does not offer a senior discount. It is one of the lower-priced identity theft protection options on the market, but the price increases after the first year. Aura identity protection services offer a 25% senior discount on products and services.

Bottom line: The best ID theft protection for seniors

Norton LifeLock, Aura, and ID Watchdog are three of the best ID theft protection services for seniors because of their prices and offerings. While there is a myriad of services across the internet, these three provide bonus features like additional device security and couples plans. Each option here makes protecting your identity a little easier and can help with identity theft losses.

If you're looking for more options or features to protect against fraud and cybercrime, check out our guide to the best identity protection companies for services that offer extra security.

3 best ID theft protection services for seniors 2024

| Starting price | Best for | Learn more | |

Norton LifeLock |

Starts at $7.50/mo for first yr | Best for a low cost during your first year | Get LifeLock

Read Norton LifeLock Review |

Aura |

Starts at $12.00/mo | Best for additional device security | Get Aura Read Our Aura Review |

ID Watchdog |

Starts at $14.95/mo | Best for comprehensive identity restoration | Get ID Watchdog |

How we tested the best identity theft protection for seniors

We looked at issues that may be important to different people over the age of 60. While family plans tend to include children and there are multigenerational households where this may apply, we chose to focus on identity theft protection plans for individuals or couples. Comprehensive identity restoration was high on the list as well as 24/7 customer service.

Other features we found important include:

- Price

- Credit monitoring services

- Fraud alerts

- Identity theft insurance

- Remediation for victims of identity theft

- Stolen wallet protection

- Financial account monitoring like payday loans or private loan providers

- New account alerts

- Monthly credit scores

How to choose the best identity theft protection service for seniors

If none of the options we listed suit your needs, there are questions you should ask when exploring other identity theft prevention services. Consider what’s important to you, your budget, and your overall comfortability with navigating remediation if you ever need it.

Let’s look at a few of the questions you should consider when shopping for ID protection:

- How much does it cost?

- Does it alert you to data breaches?

- Will it alert you to address changes?

- Does it monitor credit reports from all three credit bureaus: Experian, TransUnion, and Equifax?

- Is there dark web monitoring?

- Will it monitor court records for your name?

- How often does it provide credit score updates?

- Does it monitor suspicious activity on bank accounts or investment accounts?

- Does it assist with identity recovery?

- Does it provide identity theft insurance and, if so, how much? (Up to $1 million is most common.)

- Is the service’s mobile app encrypted with AES-256?

- Does it offer apps for the devices and operating systems you use?

- Does its privacy policy state it doesn’t sell data?

- Will it scan for social media scams and fraud?

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking