-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates

Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Protecting your identity and ensuring the financial well-being of yourself and your family should be a high priority. Identity theft and fraud are continuing to grow. More than 5.7 million fraud and identity theft crimes have been reported to the Federal Trade Commission (FTC) so far in 2023.[1]

The good news is that there are several solutions available to help you protect your identity, including your online presence, your credit and Social Security number, and your overall identity. These services look at various sources to see if your identity has been stolen and used on a platform where you may not have access to find the fraudster.

Aura is one identity theft service that we particularly like. Aura offers solutions for individuals, couples, and families to help them protect their future. We liked that Aura had easy-to-understand plans that focused on the number of people you’re protecting, and every plan is packed full of additional services to make your life easier.

Let’s see why we found Aura to be such a great identity theft protection solution.

What does Aura protect against?

Aura features

Aura prices and subscriptions

Our experience with Aura identity theft protection

Does Aura keep your data safe?

Aura compatibility

Aura customer support

Aura FAQs

Bottom line: Is Aura good?

Aura review at a glance

| Price | $12.00–$45.00/mo |

| Identity theft insurance | Up to $1 million per adult |

| Credit monitoring | Yes |

| Credit reports | Yes — Experian, Equifax, TransUnion |

| Credit score | Yes — VantageScore |

| Financial fraud protection | Yes |

| White glove fraud resolution | Yes |

| Dark web alerts | Yes |

| Social media account alerts | Yes |

| Details | Get Aura |

All of Aura’s plans provide a foundation of identity theft protection, including credit monitoring, SSN monitoring, and at least $1 million in identity theft protection to help offset any identity theft losses. Your biggest decision when choosing an Aura plan is deciding how many people you want to protect.

The Aura Family plan is the most robust and protects up to five adults and an unlimited number of children. The Family plan also includes features to help you protect your children online and offline, too, like the Safe Gaming feature.

Safe Gaming gives parents peace of mind by alerting them to cyberbullying inside 200 of the most popular PC games. Aura monitors in-game voice and text chats and alerts parents of scams or cyberbullying their kids might encounter.

Aura identity theft protection pros and cons

- Up to $1 million in identity theft protection

- Safe Gaming keeps kids safe online

- Includes a password manager

- Pricey when you pay monthly

- Provides only VantageScore, not FICO Score

What does Aura protect against?

Aura safeguards a range of personal information as well as provides you with secure tools to help protect your identity. Features include:

- Online account theft protection

- Identity theft protection

- Auto and home title theft monitoring

- Bank fraud monitoring

- Credit fraud monitoring

- Child Social Security number (SSN) theft monitoring

- Cyberbullying monitoring

- Malware and antivirus protection

- Password manager

- Encrypted file storage

- Safe browsing

- Ad blocker

- Anti-tracking

- Spam call and message protection

- Virtual private network (VPN)

- Email alias

- $1 million in identity theft protection insurance per adult

- Fraud/theft remediation services

- Criminal and court record monitoring

- Lost wallet remediation

Aura features

One of the things we liked about Aura is that it offers a well-rounded approach to protecting your identity and monitoring your credit. Not only does it monitor your credit report, but it also offers tools to help you avoid identity theft before it happens, such as a virtual private network (VPN) and antivirus protection. Aura also gives you online storage, a password manager, and an ad blocker.

There are plenty of identity theft protection services out there, but we feel that Aura is at the top of the list. The integrated tools it provides like Safe Browsing and an email alias are bonuses that you don’t find in some of the other services.

Combining all of the extras with data broker deletion services make it an extremely valuable service. From our experience, Aura gives you all the tools you need to make sure that your identity and credit are protected.

Aura credit monitoring

Credit monitoring is one of the most important aspects of identity theft protection. Without timely and accurate monitoring, someone could use your Social Security number and credit profile to steal your identity for months before you find out.

This is just one reason why you should keep an eye on your VantageScore offered by Aura. Fluctuations and changes in your credit score can be an alert that something isn’t quite right with your personal information.

Your credit score can affect everything from buying a new car to being able to rent an apartment, so making sure it’s in good standing can save you time, money, and headaches in the future.

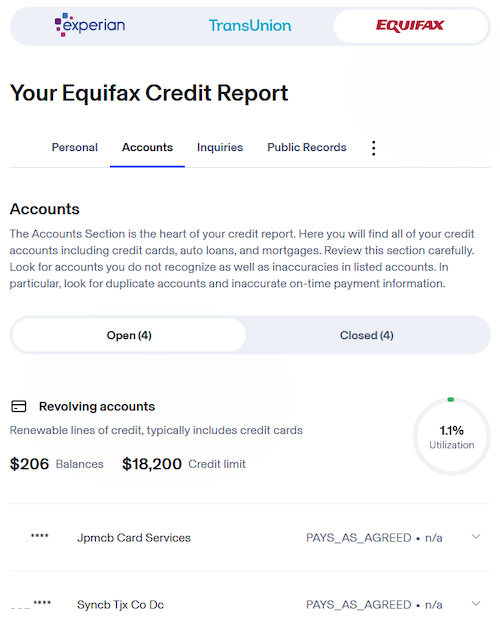

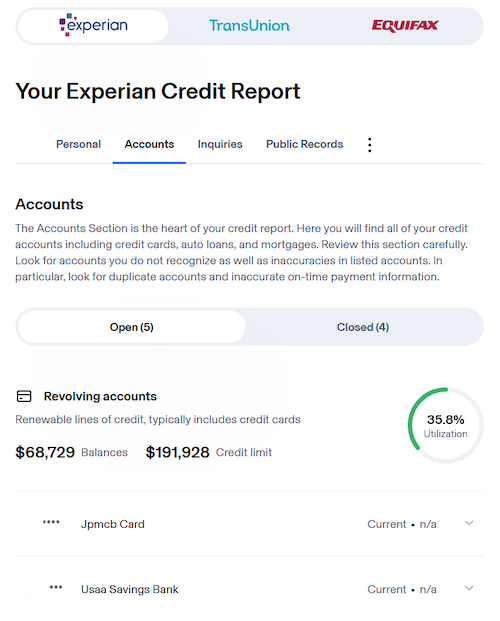

Aura monitors all three credit bureaus, including TransUnion, Experian, and Equifax, so you get the most accurate and fastest alerts if hackers open any new credit card or bank accounts in your name or use your credit to open a new loan. You have the ability with Aura, no matter what tier you purchase, to request your credit report annually from each of the three credit bureaus.

Each bureau evaluates your credit individually using its own metrics, so there may be variations on each report worth monitoring. That’s why it’s a good idea to read through each of the three on an annual basis.

When we checked our credit reports through Aura, we saw two wildly different credit balances and limits. This is because each service is collecting its data differently and at various times. These are snapshots of a single moment in time and can vary depending on each bureau, what information it collects, and when the information is collected.

Credit reports and credit scores

Along with credit monitoring, you can also access your credit reports and your VantageScore. Aura provides a monthly VantageScore report and you’ll get updated credit reports from each of the major credit bureaus every year.

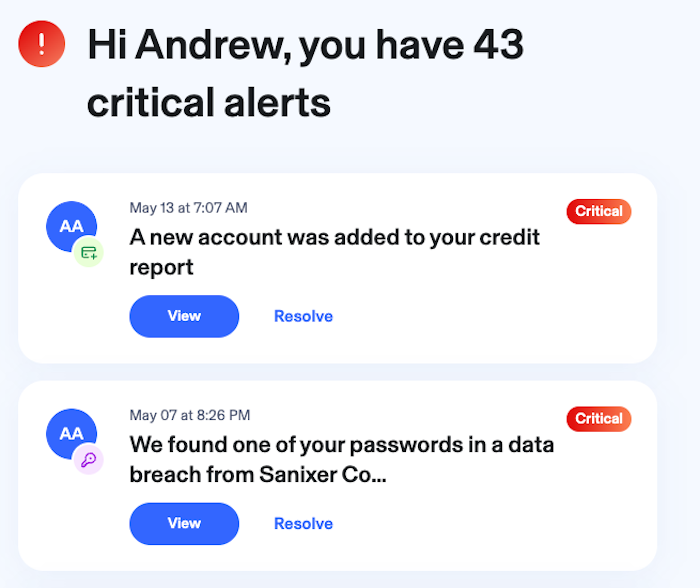

Alerts

When you log in to your Aura account, the first thing you’ll see is a dashboard of all the available alerts related to the account monitoring you've set up.

These alerts notify you of any potential issues that have to do with your credit and financial transactions. You'll also receive digital security alerts if any of your passwords are compromised in data breaches, the Aura antivirus detects malware, or your personal info is found on a data broker site.

Credit alerts

This type of alert includes anything found on your credit report, such as new accounts, changes to your credit usage, or new inquiries.

If you receive an alert, double-check the source reporting to your credit. Is this a company you’ve done business with or one with whom you’re currently engaged? Do you recognize the request/report?

If something seems suspicious, you can contact Aura’s support team to help you figure out what the item is and how you should handle it.

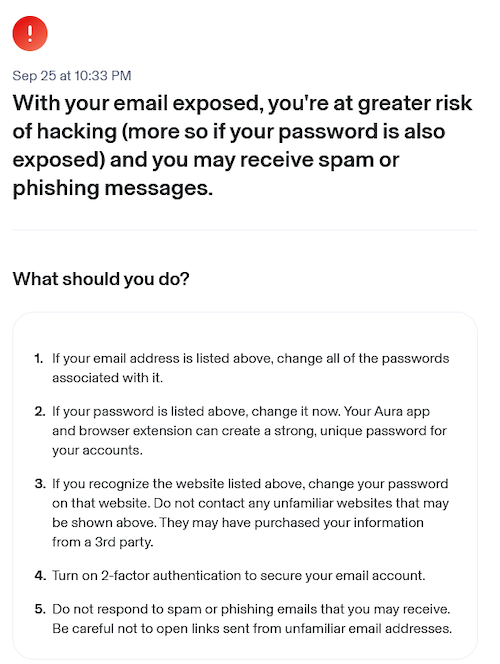

Vault alerts

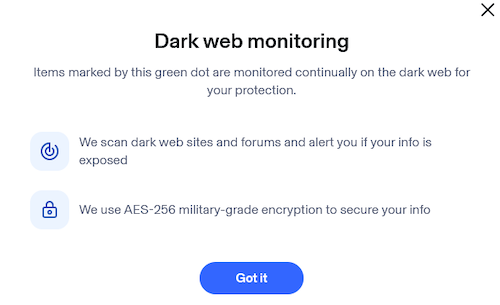

These notifications show up any time your information is found on the dark web. Aura separates dark web monitoring alerts into four categories in the Vault: personal data, home and property, passwords, and documents.

This can feel daunting and frustrating, but Aura provides guides on how to deal with these types of alerts. If you still don’t feel like it’s been handled, you can reach out to Aura’s support team for more assistance.

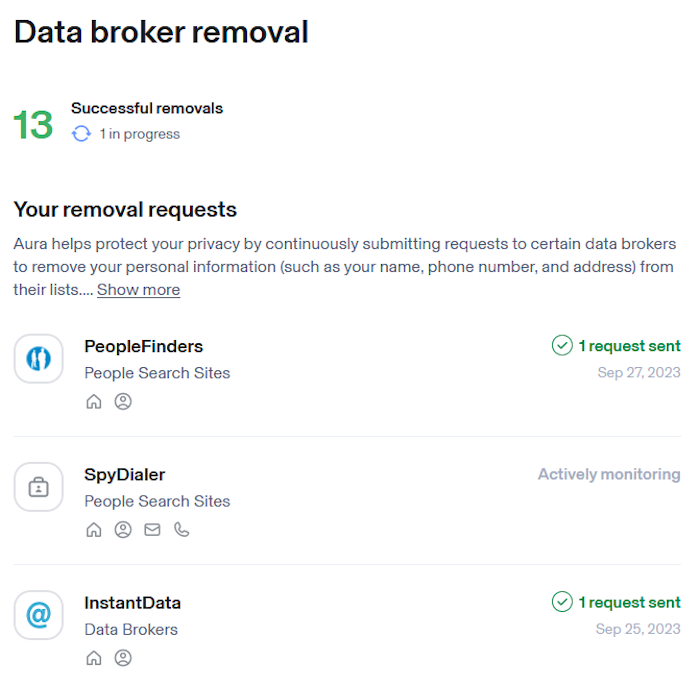

Data broker alerts

These pertain to any time you ask Aura to help remove your personal information from a data broker site like Whitepages or LexisNexis. When you set up your Aura account, it prompts you to opt-in to data broker removal if you wish.

You should absolutely opt in. It’s included in the service and helps remove your personal information from aggregated data broker sites across the web, which, in turn, makes you a less likely target of identity theft and fraud.

The best data broker removal services like Aura not only help you delete your info from these predatory sites, but these services also monitor to make sure it stays gone.

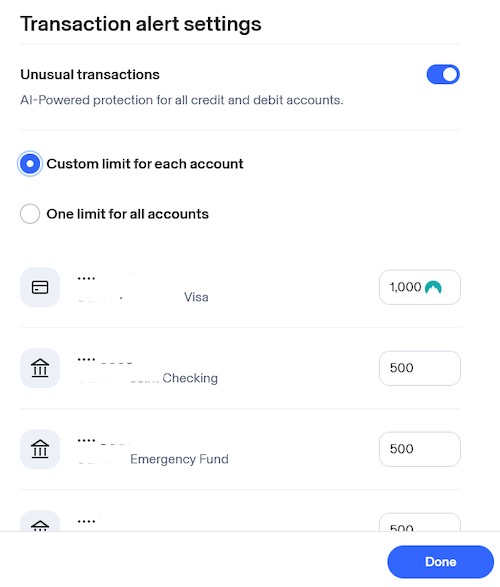

Transaction alerts

These alerts are based on any financial accounts you link to your Aura dashboard and a spending limit that you can set for all accounts or set individually for each.

For example, if you set a spending limit of $500 and someone withdraws $600 from your bank account, Aura alerts you so you can review the withdrawal and make sure it’s legit.

Aura can go beyond the limits you set within its dashboard. It uses machine learning and artificial intelligence (AI) to observe your spending habits, alerting you if something falls outside of those norms.

You can help Aura’s AI by being vigilant and marking any unusual transactions you may see within your Aura dashboard. If you do notice suspicious activity, make sure to notify your bank and the merchant right away. You may be able to stop payment, cancel the transaction, or get the amount returned to you — but time is of the essence.

If you have a Family plan, you’ll gain access to additional alerts to help protect your family, including:

- Sex offender geo alerts: Receive alerts if a known sex offender lives within one mile of your provided address.

- Child SSN monitoring: Receive alerts if any of your children listed on your account had their Social Security number used unknowingly.

- Family fraud alerts: Get alerts for threats that affect all family members on your account so you can better protect everyone.

- Safe Gaming alerts: Protect your children from cyberbullying with alerts for any voice or text threats your child may encounter while playing online games.

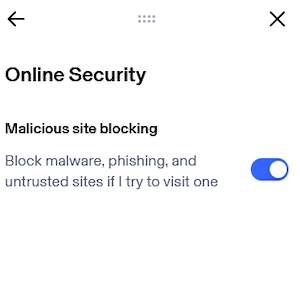

Online security

Not only does Aura give you the tools to protect your identity, but it also includes a variety of online security tools to help you improve your online safety. Some standout features include a password manager, VPN, and antivirus software.

These online security tools are limited to a certain number of devices based on your plan, so an individual plan gets 10 devices while a family plan gets 50. Other included online security features include:

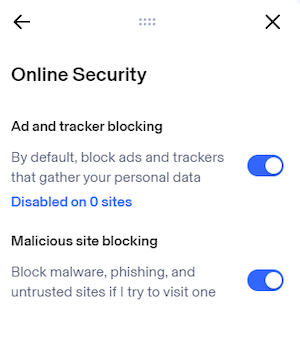

Anti-track and ad blocker

Get rid of annoying ads and website tracking. By downloading and enabling the Aura browser extension, Aura can help you browse safely without ads or tracking cookies following you around the web. This is compatible with iOS, Android, Chrome, Firefox, and Edge.

As you reduce the amount of ads and trackers, you’ll notice fewer creepy ads and spam messages. Companies can’t buy your marketing data if you’ve blocked it from being collected. It’s worth noting that Aura’s ad blocker extension is not made equal across browsers. Chrome definitely has the most options and gives you the best protection.

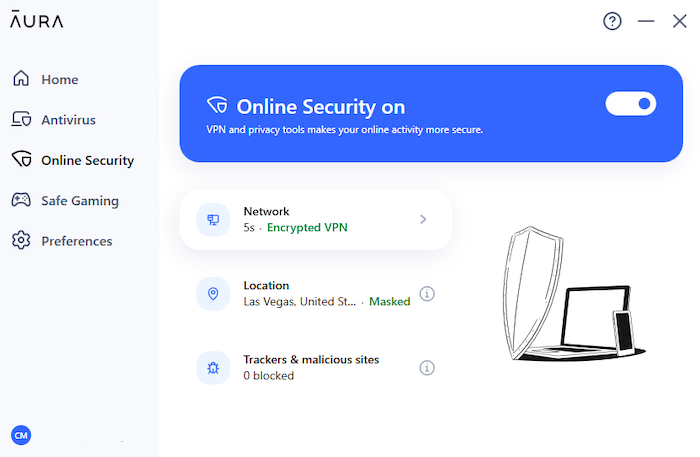

VPN

A VPN adds further security to your Wi-Fi connection and is a must-have for digital security when using public Wi-Fi.

Aura’s VPN is a security feature that is easy to toggle off and on within the antivirus product. While you can’t choose the server you connect to, you will see the location and any trackers and malicious sites it helped to block.

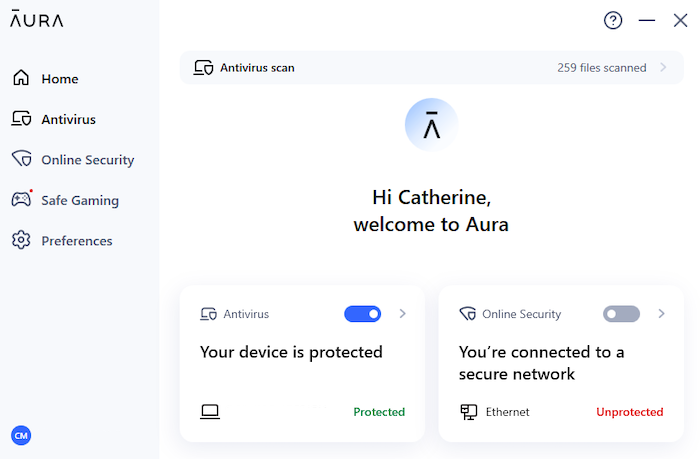

Aura antivirus

Aura’s antivirus feature is enhanced with AI to enable Safe Browsing on all your protected devices. It’s available on Windows PC, macOS, and Android and must be downloaded separately (don’t worry, it’s easy).

You’ll find the VPN and an ad blocker within the antivirus. The included ad blocker is useful if your browser doesn’t meet Aura’s compatibility requirements for the browser extension or if you don’t want to download an extra extension.

Many of Aura’s features are located within the antivirus dashboard. You have the ability to access Safe Gaming and virus scans. If you want to enable Safe Gaming for a minor, add their profile to your Aura vault and then download ProtectMe. After that, follow the instructions for your device to activate ProtectMe and Safe Gaming.

For antivirus scans, you won’t be able to schedule one, but you can run a manual scan upon download and any time after. In between, Aura protects you with real-time malware detection.

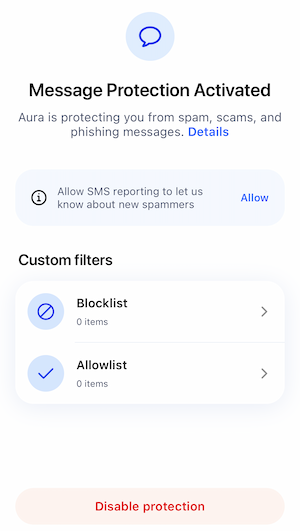

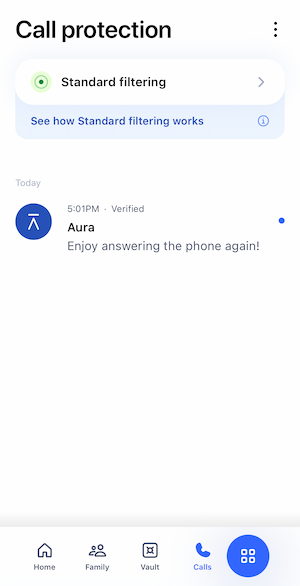

Spam call and message protection

Aura can scan your unknown calls and messages for you before they reach your phone. To do this, you’ll need to download the mobile app on your iOS or Android device.

For iOS, Aura will scan your texts and messages and dump spam into your junk folder. For both iOS and Android, Aura uses its AI assistant to screen your calls. It only forwards legitimate calls to you while also using an industry-leading spam list to filter out known spammers.

Most likely you’ll need to select your mobile carrier and adjust settings. You’ll also likely have a few tests from Aura to make sure everything is configured properly. When you’re done, however, you’ll enjoy a much quieter life. And we could all do with fewer voicemail alerts letting us know our car’s extended warranty has expired.

Other online security features

A few additional Aura features you can enjoy include encrypted vault storage, the Safe Browsing feature built-in with the browser extension, and dark web monitoring.

Encrypting and monitoring your data is a cornerstone of internet security. The internet has evolved, and our ability to protect ourselves while using it needs to evolve as well. These features help you move into your next era.

- Vault: 1 GB of cloud storage per adult for important documents. You can also save passwords and create child profiles for Safe Gaming.

- Safe Browsing: Set up Aura’s Safe Browsing extension on your browser to protect against scams and phishing attacks. It also alerts you to malicious websites you’ve clicked on and blocks them so you don’t accidentally download malware.

- Dark web monitoring: Scans the dark web for your information. Stolen credentials, financial information, medical records, and any corporate information like your intellectual property, patents, and company information can be leaked on the dark web.

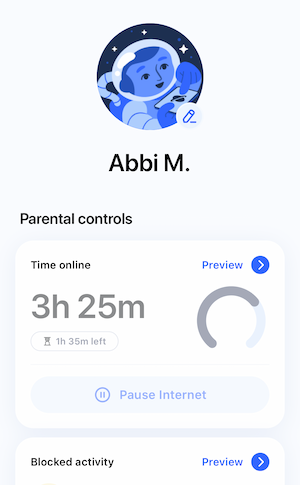

Child protection

Aura offers a robust set of tools to help protect your children. These features are only included with the Aura Family plan, which lets you add an unlimited number of kids to your account. Here are the ways Aura helps prevent child identity theft:

- Parental controls: Using Circle, Aura lets you block inappropriate sites and monitor how much time your child spends on apps and games like YouTube and Roblox. To access this service, you’ll download Aura’s app onto your and your child’s phones. From there, you can track internet usage, what sites they’re visiting, as well as being able to block sites, pause internet access, and set time limits.

- Safe Gaming with cyberbullying alerts: Get alerted to cyberbullying, scams, and even online predators that may try to target your child while they game online. ProtectMe by Kidas is offered with family plans of Aura. You can download it onto your child’s Windows PC or Mac. ProtectMe monitors voice and text for bullying, predatory behavior, and scams within your child’s games.

- Child SSN monitoring: Aura checks public records to ensure no one uses your child’s Social Security number.

- Credit freeze for kids: Freezing your own credit can be tedious, let alone trying to do the same for your child. Aura simplifies the process so you can request a freeze on your child’s credit through Equifax, Experian, and TransUnion.

- Geo-alerts for sex offenders: Get alerts for registered sex offenders who live within a one-mile radius of your location.

One thing to note is that Aura doesn’t offer identity theft insurance for children, so only adults are covered by identity theft insurance.

Aura prices and subscriptions

Given all you receive with Aura, we definitely recommend it for not just identity theft protection, but as a robust cybersecurity suite.

There are three plans, and we would recommend you purchase the one that covers all the people in your life. If you’re a parent, go for the family plan. If it’s you and someone special (that includes your roommate and besties for life) then grab Aura Couple plan. If you’re loving the single life, don’t hesitate to grab the Aura Individual plan.

Aura also offers a 60-day money-back guarantee on all of its annual plans so you can try one of its plans and request a refund if it doesn't meet your needs.

Aura plans comparison

| Plan | Individual | Couple | Family |

| Annual plan | $12.00/mo | $22.00/mo | $24.00/mo |

| Monthly plan | $15.00/mo | $29.00/mo | $50.00/mo |

| Who’s covered | 1 adult | 2 adults | 5 adults, unlimited children |

| Identity theft insurance (adult members only) | Up to $1 million | Up to $2 million | Up to $5 million |

| Credit reports | Yes — Experian, Equifax, TransUnion | Yes — Experian, Equifax, TransUnion | Yes — Experian, Equifax, TransUnion |

| Credit lock and freeze | Yes — Experian only | Yes — Experian only | Yes — Experian only |

| Vault | Yes — 1 GB | Yes — 2 GB | Yes — 5 GB |

| Antivirus | Yes — 10 devices | Yes — 20 devices | Yes — 50 devices |

| VPN | Yes — 10 devices | Yes — 20 devices | Yes — 50 devices |

| Safe browsing blocker | Yes — 10 devices | Yes — 20 devices | Yes — 50 devices |

| Password manager | Yes — 10 devices | Yes — 20 devices | Yes — 50 devices |

| Parental controls | |||

| Safe Gaming and cyberbully alerts | |||

| Spam call and text protection | |||

| Details | View Plan | View Plan | View Plan |

Our experience with Aura identity theft protection

Overall, we were very impressed with Aura identity theft protection. Signing up for the service, downloading from the Aura website, and installing it was fairly simple. We found it easy to activate credit monitoring, identity monitoring, and financial account alerts.

Although, we did see the deed from a car we sold in 2021 come up. We weren’t sure if that was Aura’s error or if something went wonky with the title transfer. We continued by setting up the data broker removal service, which was also a breeze. We were able to enter our personal information and get the removal requests going quickly.

The antivirus product was equally as easy. It may come off as simpler than other antivirus, but that just means it’s more user-friendly. We were able to find the features like the VPN without having to search.

Speaking of the VPN, it doesn’t have the same functionality as robust VPNs like Surfshark or NordVPN, but it is secure. There aren’t server choices or the ability to switch protocols, but it does protect you quickly by flipping the toggle on.

On the other hand, the antivirus flagged our Bluetooth mouse software as suspicious. We weren’t able to let Aura know it was a false positive, but we were able to quarantine and ignore the warning.

We weren’t in love with the process for Safe Gaming — it required another download of ProtectMe to work. There was a smidgen of game lag while testing, but not the entire time. Uninstalling was the most difficult since it had to be done from the Aura portal, but this method does help protect against kids uninstalling on their own.

Finally, we played around with the browser extension. It was nice to have a built-in password manager (because, you know, Google’s password manager isn’t safe) as well as ad blockers and anti-tracker tech. Since the browser extension didn’t really cover our Firefox browser, we liked that we could get the same protection through the Aura portal. Running them simultaneously didn’t cause any issues.

While the price tag may seem like a steep commitment, especially if you’re protecting your entire family, we thought that Aura ID theft protection was worth it thanks to the high level of protection and additional security tools. It’s definitely a tool we’d feel comfortable recommending and using ourselves.

Does Aura keep your data safe?

Aura’s privacy policy is very thorough and organized so you can easily read through it. We read through the privacy policy and didn’t see anything that stood out as being out of the norm — until we got to the section that details how our info is used.

While it makes sense that Aura collects information in order to provide its services, it concerned us when we saw how that data could be used. Aura notes it may use your information to promote co-branded offers with its partners, including notifying you about services the company thinks you might be interested in. That’s a red flag for us since it’s basically saying Aura shares your info to let its partners advertise to you.

We did like that Aura doesn’t allow its partners to use our personal information for purposes outside of communicating, evaluating, improving, and administering offers.

You should also note that Aura shares your data with partners that help it provide certain services. For example, Aura uses Circle to provide parental controls with its Family plan, and Circle requires your data to work properly.

Last but not least, Aura also offers multi-factor authentication so you can add extra security to your account.

Aura compatibility

You can use Aura on almost any device, including your iPhone or Android devices so you can access alerts from anywhere. Aura also offers a browser extension for its password manager as well as a desktop app for its VPN and antivirus.

VPN and antivirus

- Microsoft Windows

- Mac

- Android

- iOS (VPN only)

Password manager browser extension

- Google Chrome

- Mozilla Firefox

- Microsoft Edge

Aura customer support

Aura offers a variety of ways to contact support. It also offers a thorough help section if you want to find answers to your questions without talking to someone.

If you do prefer to chat with someone, Aura has a virtual chat assistant. From our testing, this was just a chatbot and you had to go through a few steps before it allowed you to talk to a security specialist.

Aura also has a support email and phone number that you can use to get help.

Aura vs. LifeLock

There’s much debate as to which is the best identity theft protection service - Aura or Norton LifeLock. There are a ton of similarities between the two. They both offer identity theft protection, identity theft insurance, and a variety of alerts.

But we do feel like Aura has an edge because it bases pricing on how many people you need to cover rather than adding features. LifeLock gets more expensive the more coverage you want.

Norton LifeLock is definitely more expensive than Aura when compared to the number of people covered and amount of features offered. For family coverage with Aura, you’ll pay $24.00/mo, for LifeLock’s similar product you’ll shell out $40.99/mo for first yr. And this is the monthly breakdown if you pay annually upfront. It’s a little more if you decide to month-to-month it with Aura costing $45.00/mo and LifeLock costing about $80.00/mo.

Overall, we feel like Aura is the better value for money. While we love Norton products, Aura definitely edges it out with quality protection for a lower cost. The parental controls and Safe Gaming features included with Aura help parents have more control over how their child experiences the internet. For couples and singles, LifeLock can’t beat Aura’s prices.

Aura vs. Identity Guard

Aura and Identity Guard both offer identity theft protection services. While Identity Guard does come in slightly cheaper per month, $6.67–$19.99/mo depending on the plan you choose, it doesn’t offer the features that Aura does. Even with the family plan, you won’t receive parental controls, gaming protection, or even a VPN.

For someone looking for a slightly cheaper option without the additional features, Identity Guard’s prices could be a better choice. If you’re looking for the bare minimum identity theft protection, Identity Guard does offer a less expensive monthly price tag for singles.

If you’re looking for a security suite, protection for couples, or extra features for families, however, Aura is going to be the better value for money.

We love Identity Guard! But it definitely isn’t comparable to Aura as far as features like ad blockers and anti-malware. It also doesn’t offer cybersecurity software for a well-rounded product. Identity Guard is better for singles who want identity theft protection. If that’s not you, Aura’s got you covered with its full security suite.

Aura FAQs

Is Aura worth it?

From our testing, Aura is very much worth it. Not only does it protect your identity, but it also includes a VPN, password manager, and antivirus protection.

Does Aura actually work?

Yes, Aura does actually work. You must give Aura your personal information so the service can monitor your credit reports, bank accounts, Social Security number, and more.

Is LifeLock or Aura better?

Aura and LifeLock each have their own pros and cons. To pick the best identity theft monitoring for you, determine what features are most important and pick a service that covers those.

We like LifeLock for its large amount of identity theft insurance (up to $3 million) and generally affordable prices, at least for the first year.

But we think Aura offers more in the way of online protection with its antivirus, VPN, and ad blocker. Plus Aura provides credit reports from all three bureaus with every plan, something LifeLock only provides with its most expensive plan.

Is Aura a legitimate company?

Yes, Aura is a legitimate company. It has an A+ rating from the Better Business Bureau and has been in business since 2019.

Is it safe to link bank accounts to Aura?

Yes, it is safe to link your bank accounts with Aura. Aura uses Plaid to sync with your bank accounts. Plaid states it doesn’t sell or share your data and also uses secure AES-256 encryption plus Transport Layer Security (TLS) to protect your information.[2]

Does Aura lock your credit?

Yes, Aura can lock your Experian credit file. If you want to lock your Equifax or TransUnion credit files, however, you’ll need to contact the bureaus on your own.

Bottom line: Is Aura good?

Overall, we were really impressed with Aura. From setting up our account to the robust list of features, we thought it was a great solution to keep your identity protected, not to mention all of the other ways that it helps you protect yourself online, like the VPN and password manager.

Aura gives you real-time alerts on your credit report so you can know quickly if your Social Security number has been compromised. One thing we didn’t love was that you only get access to your VantageScore. Since so many lenders use the FICO model, we thought it was missing an important piece in the overall credit profile.

If you want to add extra security to your online activity and protect your identity, Aura is a great option. And with all the extra bells and whistles, the price tag isn’t too much to ask, either, since you could cancel your existing password manager, VPN, and antivirus with an Aura membership. But if the price tag is still too high, you might consider Identity Guard as a simpler, more budget-friendly alternative — or check out our picks for the best ID theft protection.

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates