Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Best for Full Protection

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Best for Credit Score Insights

-

Free access to credit scores and credit reports

-

Financial education and tools are available through the Help and Resource Center

-

Does not offer all three credit bureaus, only TransUnion and Equifax

LifeLock and Credit Karma both give their users identity theft and credit score alerts. Credit Karma’s free service and monitoring may be sufficient to give most people peace of mind.

But if you’re looking for extra protection and reassurance that you won’t suffer any financial losses if your identity is stolen, investing in a LifeLock plan may be worth the cost. With identity theft reported every 22 seconds, we believe LifeLock’s extra protections are well worth the cost.[1] Better to have protection and not need it, as they say.

Let’s compare these two services to find out which one offers the level of protection you need.

LifeLock vs. Credit Karma: prices

LifeLock vs. Credit Karma: monitoring and alerts

Which is safer, LifeLock vs. Credit Karma?

LifeLock vs. Credit Karma: compatibility and ease of use

LifeLock vs. Credit Karma: customer service

LifeLock vs. Credit Karma FAQs

LifeLock vs. Credit Karma: which is better?

LifeLock vs. Credit Karma review at a glance

LifeLock and Credit Karma mainly differ on the pricing and insurance offers. While LifeLock may be expensive, it offers much more comprehensive coverage while the free Credit Karma offers valuable insights into your credit score. If you’re unsure whether to take the extra step or are unclear on why you would need this, check out our complete identity theft protection and credit monitoring guide.

- LifeLock: Best for full protection

- Credit Karma: Best for credit score insights

LifeLock vs. Credit Karma review at a glance

LifeLock |

Credit Karma |

|

| Price | $7.50–$38.99/mo for first yr | Free |

| Identity theft insurance | Up to $3 million | |

| Credit monitoring | ||

| 3-bureau credit reports | No, only TransUnion and Equifax | |

| Credit score | ||

| Dark web alerts | ||

| Identity recovery | ||

| Social media account alerts | ||

| Get LifeLock

Read LifeLock Review |

Get Credit Karma

Read Credit Karma Review |

There are many differences between LifeLock and Credit Karma; the most obvious being the price. LifeLock has several plans that vary by the number of people protected, the amount of protection, and whether you want to pay monthly or annually. Credit Karma is free.

Credit Karma does not offer bundles to review multiple people’s credit scores and information at once like LifeLock does. Each individual will have to register for their own account. In LifeLock, you can sign up for a plan that includes up to two adults and five kids.

LifeLock provides much more in terms of identity protection. Though they both offer identity monitoring, LifeLock takes it a step further by offering several levels of insurance and more monitoring than Credit Karma does. Credit Karma provides your credit score, free credit monitoring services, and customized financial suggestions like different credit cards and loan options.

LifeLock pros and cons

- Provides comprehensive coverage beyond basic identity theft

- Offers flexible packages and payment plans for individuals and families

- Ensures users for millions of dollars if identity theft were to happen

- It is relatively expensive

- The average person may not need this much protection and insurance

Credit Karma pros and cons

- Gives free access to all features

- Provides customers with recommendations and reviews for credit cards, loans, and buying/selling cars

- Provides calculators to give estimates of buying power for cars, homes, and borrowing power

- Doesn’t offer as many different monitoring services

- Does not insure users against identity theft

LifeLock vs. Credit Karma: prices

LifeLock |

Credit Karma |

|

| Monthly price range | $7.50–$38.99/mo for first yr | Free |

| Best value plan | Advantage Plan for $7.50/mo for first yr when paid annually | Basic plan |

| Identity theft insurance | Up to $3 million | |

| Get LifeLock

Read LifeLock Review |

Get Credit Karma

Read Credit Karma Review |

Norton LifeLock plans

Lifelock offers three different plans with three tiers: individual, family (for two adults), and family (for two adults and five kids). In each tier, there are three levels of plans: standard, advantage, and ultimate plus. There is an option to pay monthly or annually for each. LifeLock offers a 30-day free trial, which does require a credit card, and a 60-day money-back guarantee.

Let’s take a closer look at what each plan offers.

Standard plan

Advantage plan

- $1 million lawyer and expert coverage

- $100,000 in stolen funds reimbursement

- $100,000 personal expense compensation

- Identity lock for TransUnion and payday loans

- Phone takeover monitoring

- Alerts on crimes in your name

- Buy Now Pay Later alerts

- All features from the Standard plan

Ultimate Plus plan

- $1 million lawyer and expert coverage

- $1 million in stolen funds reimbursement

- $1 million personal expense compensation

- Three-bureau credit monitoring

- Credit reports and scores from one bureau (three bureaus available for annual payment plans)

- Home title monitoring

- Social media monitoring

- All features from the Standard and Advantage plans

Credit Karma plans

Credit Karma is free and has no plan tiers like LifeLock has. Once you make an account, you can gain all sorts of insight into your credit score, including:

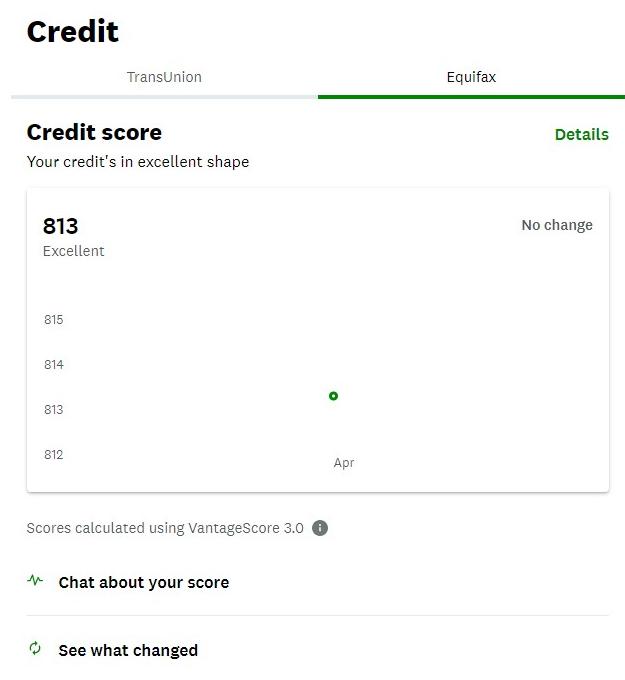

- Credit Score: Credit Karma lets you see your TransUnion and Equifax credit scores, along with history on how your credit score has changed, what factors affected changes in the score, and tips on how to help your credit score go up.

- Credit Karma Money Spend: An online checking account offered by Credit Karma, it is free to open and has no penalties or minimum balance requirements. It also can deliver paychecks up to two days early with direct deposit, give cashback rewards, offer free withdrawals at more than 50,000 ATMs across the country, and is FDIC insured.

- Credit Karma Money Save: Credit Karma’s savings account that offers automatic saving, no fees, a 4.10% APY (as of 8/25/2023), and is FDIC insured.

- Recommendations: Using your credit score and income data, Credit Karma offers suggestions and calculators to help you figure out your loan borrowing power, your vehicle or home buying power, and more.

LifeLock offers much more value and protection against identity theft than Credit Karma. Although Credit Karma gives a lot of information about your credit score, it does not offer the reassurances that LifeLock does.

LifeLock vs. Credit Karma: protection features

| Feature |  LifeLock |

Credit Karma |

| Credit monitoring | ||

| Financial activity alerts | ||

| 3-bureau credit reports | No – Equifax and TransUnion only | |

| Credit score | ||

| FICO score | ||

| Credit lock and freeze | ||

| Identity recovery | ||

| Dark web alerts | ||

| Social media account alerts | ||

| Social Security number monitoring | ||

| Home title monitoring | ||

| Address change alerts | ||

| Get LifeLock

Read LifeLock Review |

Get Credit Karma

Read Credit Karma Review |

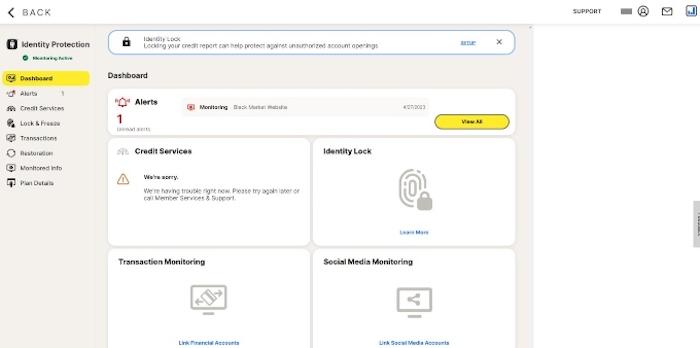

LifeLock and Credit Karma are very different in terms of what identity theft protection services they offer. While both are credit monitoring services that watch for and alert you of suspicious activity and a VantageScore credit score, LifeLock offers identity theft insurance and other protections that Credit Karma does not.

VantageScore is one of a few different methods credit agencies use to assign a number based on the information in your credit reports. You may see some services offer myFICO scores, which is another method for scoring your credit profile.

LifeLock provides information from all three credit bureaus, Experian, Equifax, and TransUnion, with a subscription to the Ultimate Plus plan, but for the other two lower-tier plans there is only one-bureau monitoring. With Credit Karma, which is free and does not have different plans, you get two-bureau monitoring. So, you’ll only get more information if you use LifeLock’s most expensive and most comprehensive plan.

LifeLock also offers identity locking, which is important if you suspect you’re a victim of identity theft. Credit locks differ from credit freezes. Both services prevent new lenders from accessing your credit report, at your request. But a credit lock is a paid service offered by credit bureaus and companies like LifeLock. Credit locks are convenient and can be lifted instantly. A credit freeze is a free service governed by federal law. You’ll have more legal protections, but lifting a freeze takes more time.

LifeLock also offers several other ways to monitor your identity online, such as Buy Now, Pay Later alerts, 401(K) and investment account activity, home title monitoring, social media monitoring, and phone takeover monitoring. These go beyond what Credit Karma offers, which is just your credit score and links so you can freeze and lock your credit yourself.

One other feature of LifeLock that we found valuable was its identity restoration services. If you just found out you've been scammed, chances are you're in a panic and aren't sure what to do next. LifeLock offers restoration services with all of its plans, which means you'll have someone in your corner right away to help you combat identity fraud and remove fraudulent activity from your credit report.

Credit Karma offers suggestions based on your credit score and income, like offering information on credit cards, a calculator to estimate buying power, loans, and taxes, and a checking and savings account option. These tools, like its credit simulator, can help you decide whether you should open a new credit card or not.

LifeLock offers several more services than Credit Karma. Most people probably only need Credit Karma — it’s free and provides enough information for the average person. But for those wanting to add an extra layer of protection, LifeLock clearly comes out on top with its suite of monitoring features and insurance coverage.

Which is safer, LifeLock vs. Credit Karma?

If you’re trusting a company to help protect and monitor your identity, that company's security determines whether you’re choosing the best place for ID theft protection. We look for specific features while evaluating a company's safety, such as two-factor and multi-factor authentication, data collection, and data sharing policies. There is some data collection and sharing needed for account administration purposes, payment, and monitoring. But we’re skeptical of anything beyond required use, such as sharing data with third parties.

LifeLock vs. Credit Karma data security

LifeLock |

Credit Karma |

|

| Two-factor authentication | ||

| Multi-factor authentication | ||

| Collects data | Minimal | Minimal |

| Shares data with third parties | ||

| Get LifeLock

Read LifeLock Review |

Get Credit Karma

Read Credit Karma Review |

Credit Karma collects data, but says in its private policy statement that it does not sell its data to third parties for marketing or advertising. However, it does state that it shares data with third-party partners. You can read more in our Credit Karma review.

LifeLock states in its private policy it doesn’t sell your data, though it will share data with its partners for certain features to work. You can read more about this in our LifeLock review.

LifeLock and Credit Karma’s data security are about equal. They each collect data, state they don’t sell it, but do share your data with third parties to use some of the features they offer.

LifeLock vs. Credit Karma: compatibility and ease of use

| Platform |  LifeLock |

Credit Karma |

| Windows | ||

| macOS | ||

| Android | ||

| iOS |

Both LifeLock and Credit Karma work on different browsers. Each also has its own mobile app available for both iOS and Android.

LifeLock vs. Credit Karma: customer service

LifeLock |

Credit Karma |

|

| 24/7 live chat | ||

| Phone | ||

| Support forums | ||

| Online guides |

Though many of us prefer to help ourselves with online guides or live chat, some problems are best resolved by picking up the phone and speaking to an agent directly. LifeLock offers phone support all day, every day. Credit Karma, on the other hand, doesn’t even have a phone number.

Both providers have help centers with extensive FAQ and informative guides.

LifeLock vs. Credit Karma FAQs

Is there a difference between credit monitoring and identity theft protection?

Yes, there is. Credit monitoring is when you receive an alert whenever a company notices suspicious activity in your credit reports. Identity theft protection also sends you notifications about suspicious activity but takes it a step further. It can monitor and alert you for suspicious activity in your bank accounts, credit cards, criminal databases, social media, and more.

Do I need credit monitoring?

Yes, credit monitoring is great to have to ensure that nobody is stealing your identity and possibly your money. There are many websites, such as Credit Karma, that will do it for free, so it doesn’t cost anything for you to have that added security. Or you can request a free copy of your credit report on your own through AnnualCreditReport.com every 12 months.

There are also paid credit monitoring services you can use if you feel that extra ID theft protection is worth the money.

Do I need to monitor all three credit bureaus?

No, you don’t. Though your credit score may vary slightly from each bureau, there’s so much overlapping data used to calculate your credit score that it won’t make much of a difference. Most people will be fine monitoring just one or two of the three major credit bureaus.

Is LifeLock worth the money?

That depends on your situation and how much extra precaution you want to take. Though LifeLock provides a ton of extra security measures for monitoring your identity, many people find that paying for credit monitoring and insurance isn’t worth the money, especially because there are so many free options out there. However, if you are worried about identity theft and want that extra layer of security, or don’t feel like doing a little extra research to figure out free alternatives, then LifeLock could be worth it to you and your family.

LifeLock vs. Credit Karma: which is better?

Well, that depends. If you just want to monitor your credit score, get insights into how to improve it, and basic monitoring for identity theft, Credit Karma may be enough.

But if you're at higher risk for identity theft or want extra insurance and peace of mind, LifeLock clearly comes out on top. There are a ton of different ways in which LifeLock monitors your identity online that Credit Karma lacks, like dark web alerts, social media monitoring, and more. For a bit of extra money every month, this could be worth it to you.

LifeLock vs. Credit Karma alternatives

If neither of these identity theft protection services offer what you need, here are a few more of the best identity theft protection services we recommend.

- McAfee: You may know McAfee from its antivirus software, and its identity protection services are just as reputable. You'll get help monitoring your bank accounts and credit records so fraud can be spotted and stopped quickly. Plus, you can bundle its ID theft protection with antivirus for double coverage.

Get McAfee - Aura: Looking for a full identity and digital security suite? Aura delivers. It uses AI to block spam calls and texts while monitoring your financial accounts for anything out of sorts. Parents also get a helping hand with the Safe Gaming feature, which helps keep kiddos safe online.

Get Aura - Identity Guard: Another option for mid-level identity protection, Identity Guard is a budget-friendly service that also uses AI to monitor your accounts and alert you if it spots suspicious activities. As a bonus, Identity Guard also includes extra security features like a password manager.

Get Identity Guard

If you're looking for basic credit monitoring services similar to Credit Karma, be sure to check out our Credit Sesame and myFICO reviews as well.

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking