Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Best for comprehensive coverage

Best for families on a budget

When cybercriminals steal your personal data, you feel violated, as though you’ve lost control of everything. The first hint of identity theft might be an unexplained credit card purchase. Then, the identity thief may start making financial bank accounts and filing unemployment claims under your name. Now, you have to start monitoring everything from bank accounts to sex offender registries, which becomes increasingly overwhelming, especially when you have multiple family members you wish to protect from identity theft losses.

You never want to be a victim of identity theft, and luckily help is out there with identity theft protection. In fact, so many identity theft protection companies exist that it can be challenging to figure out which ones are best for your family. Although most services offer similar features, three options stand out for families:

- Norton LifeLock: At its highest tier, LifeLock provides the most insurance coverage and monitors gamertags, which is especially important for parents with kids who play a lot of online video games.

- IdentityForce: For the biggest bang for your buck, IdentityForce provides social media monitoring with its most basic plan, which is important for parents worried about their kids online.

- IDShield by LegalShield: For people worried about their reputation, IDShield provides the most comprehensive court document monitoring.

Norton LifeLock: Best for comprehensive coverage

IdentityForce: Best for families on a budget and single-caregiver families

IDShield by LegalShield: Best for reputation monitoring

Honorable mentions

Best identity theft protection for families FAQs

Bottom line: The best ID theft protection for families

How we tested the best identity theft protection for families

How to choose the best identity theft protection service for families

The best identity theft protection services for families 2024

- Norton LifeLock: Best for comprehensive coverage

- IdentityForce: Best for families on a budget and single-caregiver families

- IDShield by LegalShield: Best for reputation monitoring

Top 3 identity theft protection services for families compared

| Service |  Norton LifeLock |

IdentityForce |

IDShield |

| Family plan | Starts at $13.24/mo for first yr | Starts at $14.95/mo | Starts at $29.95/mo |

| ID theft insurance | Up to $1.05 million through $3 million, depending on plan | Up to $1 million | Up to $1 million |

| Credit monitoring | |||

| Three-bureau credit reports | |||

| Details | View Plans | View Plans | View Plans |

Norton LifeLock: Best for comprehensive coverage

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Who it’s best for

At the Standard level, LifeLock is solid and provides more insurance than other service providers. However, its real value comes with its higher-tier identity theft protection plans. At its mid-tier level, the Advantage subscription gives you two protection features that other services don’t: phone takeover monitoring and alerts for Buy Now Pay Later scams. The Ultimate Plus plan comes with additional monitoring and alerts for more types of identity theft, comprehensive credit monitoring services, and more.

For parents, the biggest value here comes from the ability to monitor gamertags on the dark web. Hackers are increasingly using social engineering to gain access to gaming accounts, often targeting kids.

What we liked

Norton is a long-established name in the personal digital protection world, thanks to its antivirus software. It’s been around since 1990, and its services have continued to evolve with the times. LifeLock even has apps for iOS and Android.

LifeLock has considered almost every potential risk. Some of LifeLock’s key benefits at the Advantage tier are:

- Financial and criminal alerts for credit cards, bank accounts, Buy Now Pay Later scams, and crimes in your name

- Monthly credit score updates

- Credit lock with TransUnion

- Unique features, like phone takeover and fictitious identity monitoring

Some of LifeLock’s key benefits at the Ultimate Plus tier are:

- Monitoring and alerts for home titles, checking and savings plan applications, 401K and investment accounts, and bank account takeover

- Unlimited access to your Equifax credit report and score

- Annual credit reports from all three bureaus

- Unique features, like file-sharing network searches and monitoring your social media accounts

And for its identity restoration services, every LifeLock tier comes with varying amounts of fund reimbursement for lawyers and identity theft experts, stolen funds, and personal expenses. It also offers a 60-day money-back guarantee, so you have plenty of time to determine if LifeLock is right for you.

What we didn’t like

Considering LifeLock is one of the pricier options, we expected the customer service to be a bit better. While you can get live chat and phone support, the representatives aren’t always the most knowledgeable. LifeLock also has a competitive price, but it renews at a higher rate after the first year, regardless of which plan you choose.

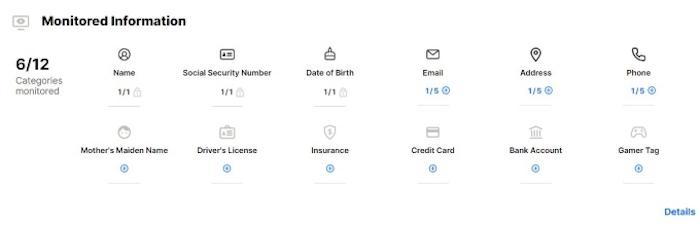

LifeLock features

| Plan | Family Plan (2 Adults) | Family Plan (2 Adults + 5 Kids) |

| Paid annually | Starts at $13.24/mo for first yr | Starts at $18.99/mo for first yr |

| Paid monthly | Starts at $23.99/mo | Starts at $35.99/mo |

| Free trial | ||

| Number of people covered | 2 adults | 2 adults, 5 children |

| ID theft insurance |

|

|

| Three-bureau monitoring | Yes, at the Ultimate Plus Level | Yes, at the Ultimate Plus Level |

| Credit reports | ||

| Identity recovery | ||

| Learn more | View Plan | View Plan |

Read Our Norton LifeLock Review

IdentityForce: Best for families on a budget and single-caregiver families

-

Lots of features

-

Easy-to-use dashboard

-

Dicey privacy policy

Who it’s best for

IdentityForce offers two plans, which keeps the comparison between them simple. Although IdentityForce’s basic plan is more expensive than some others, it also gives you a lot more bang for your buck. You have to pay for each member separately, meaning that each adult is full price. However, you can add on the child identity theft protection for only an additional $2.75/mo.

ChildWatch offers very basic coverage:

- Ongoing identity monitoring

- Smart Social Security number (SSN) tracker for Social Security monitoring

- Identity restoration specialist

- $1 million in identity theft insurance

For families on a budget, IdentityForce has a good balance of must-have services and monitoring. You can also add child identity theft protection on an as-needed basis, saving you money.

For single-caregiver families, you can add child identity theft protection to your subscription without having to pay at a higher rate that assumes a two-caregiver household.

What we liked

No matter what your family looks like or its needs, you can use IdentityForce to build out a protection and monitoring plan. While IdentityForce may not have as many bells and whistles as some other services, it does give you all the basics plus a few protection features you didn’t know you needed.

The basic IdentityForce plan includes some monitoring that other basic plans don’t offer, like:

- Daily credit score updates

- Short-term loan monitoring

- Social media account monitoring

If you invest a little extra into the UltraSecure+Credit plan, you get some proactive cybersecurity as well with:

- A virtual private network (VPN)

- Mobile threat management

These offerings can help you put proactive cybersecurity protections in place that can prevent identity theft from happening.

What we didn’t like

As with any budget-friendly option, you’re going to find that getting some services means giving up others, so you have to think about what matters most to you. The following IdentityForce factors gave us pause or led to a lackluster experience.

- Data collection/use: Logs data from your device and imports any third-party data it can find on you for marketing purposes

- Identity theft insurance: Remediation specialists are required before identity theft insurance payout

- Customer service: No live chat, but you can call or fill out an online form, and support was hard to get a hold of or unhelpful

- Mobile apps: Slow, buggy, and crashed pretty often

IdentityForce features

Since IdentityForce charges on a per-member (person) and per-child basis, you can compare the subscription’s value more effectively by looking at the offerings side by side.

| Plan | UltraSecure |

UltraSecure+Credit |

| Paid annually | $14.95/mo per member and $2.75/mo per child | $19.95/mo per member and $2.75/mo per child |

| Paid monthly | $17.95/mo per member and $2.75/mo per child | $23.95/mo per member and $2.75/mo per child |

| Free trial | Yes — 30 days for adults but billed for Child Watch immediately | Yes — 30 days for adults but billed for Child Watch immediately |

| Number of people covered | 1 adult, unlimited kids | 1 adult, unlimited kids |

| ID theft insurance | Up to $1 million | Up to $1 million |

| Three-bureau monitoring | ||

| Credit reports | ||

| Identity recovery | ||

| Learn more | View Plan | View Plan |

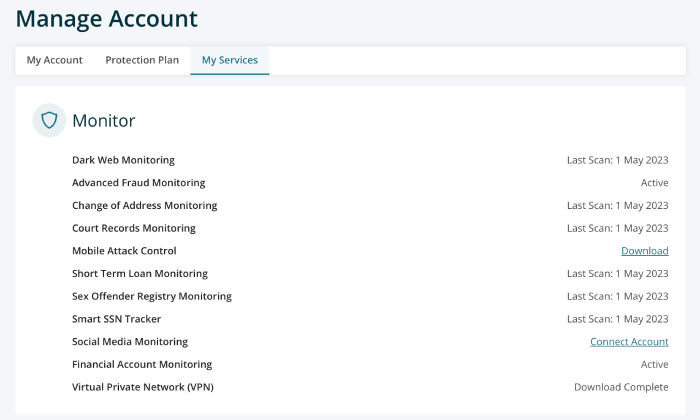

IDShield by LegalShield: Best for reputation monitoring

-

Lots of included features

-

Lower cost than most ID theft protection

-

Can be buggy

Who it’s best for

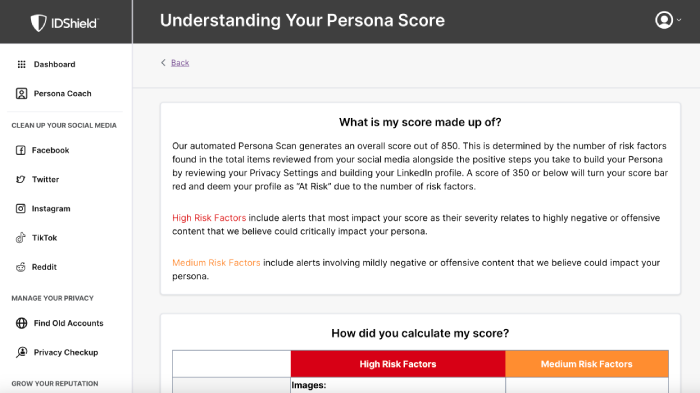

IDShield offers a few unique reputation management tools that other services lack. For families, reputation monitoring becomes important for several reasons. You want to protect your reputation for both personal and professional reasons. You also want to protect your kids’ reputations for social and academic reasons. Today, your digital profile is part of how companies and other parents determine your trustworthiness.

IDShield has really strong reputation management capabilities, and it also offers some unique proactive security options that other services lack.

What we liked

All IDShield plans come with the same identity protection, SSN protection, and credit protection features. The only difference is the number of major credit bureaus that your plan monitors.

IDShield is the most expensive of the top three identity theft protection tools, but it also provides some of the most unique services:

- Public records monitoring: Monitors 34 different personally identifiable information (PII) elements, including all personal and professional licenses, registrations, property data, Social Security data repositories, phones, aliases, and criminal records.

- Social media monitoring: Monitors content feed reputation risks like vulgar, harmful, threatening, discriminatory, or sexual language as well as drug and alcohol references

- Parental control tools: Sets up schedules for when your kids can browse the internet with content and web filters to limit what they can view.

All the IDShield Family plans also cover up to 15 devices, so there’s extensive coverage for you and your loved ones. Beyond accessing the website, IDShield also has apps for iOS and Android that both have ratings above 4.5 stars.

What we didn’t like

While IDShield has several unique features, all of those come with an expensive price tag attached. Unless you’re specifically concerned about your reputation, specifically social media monitoring, you can get most of the other services from other providers. With the 1 Credit Bureau monitoring option clocking in at $29.95/mo, IDShield’s lowest tier is more expensive than other services’ most costly tiers.

IDShield features

IDShield has a very simple pricing model based on the number of credit bureaus you want the service to monitor. Otherwise, all the features are the same between the two different options, so there’s not a lot of opportunity to customize it to what you need.

| Plan | IDShield Family (1 bureau) |

IDShield Family (3 bureau) |

| Family plan monthly price | $29.95/mo | $34.95/mo |

| Free trial | ||

| Number of people covered | 2 adults and all dependents under 18 years of age | 2 adults and all dependents under 18 years of age |

| ID theft insurance | Up to $1 million | Up to $1 million |

| Three-bureau monitoring | ||

| Credit reports | ||

| Identity recovery | ||

| Learn more | View Plan | View Plan |

Honorable mentions

Today, identity theft protection is an entire industry with so many vendors that choosing just the top three was challenging. The following two services deserve an honorable mention because while they didn’t crack the top three, they were strong candidates straight through the home stretch:

- Identity Guard

- Aura

Identity Guard

Identity Guard’s biggest positive is that it’s an excellent choice for families that have more than two adults, making it a great candidate if you have elderly parents or adult children living at home.

All three IdentityGuard plans offer:

- A U.S.-based customer care team

- Up to $1 million in identity theft insurance

- Basic data breach notifications, dark web monitoring, and high-risk transaction monitoring

- Safe browsing

- Password manager

The mid-tier level gives you the added benefit of three-bureau credit monitoring. The upper tier, Ultra, provides the most extensive identity theft monitoring, including criminal and sex offense monitoring and social media monitoring. However, it doesn’t include any of the following features:

- Proactive security monitoring, like mobile threat management

- Short-term loan monitoring

- SSN tracking

Get Identity Guard | Read Our Identity Guard Review

Aura

Aura offers so many features that it might almost have too many. While Aura provides many of the same identity theft protection capabilities as other tools, the primary focus is really more on data security and privacy. Additionally, it has an all-inclusive pricing model rather than a tiered one, meaning that you pay a hefty price for a lot of protection.

For the steep price of $24.00/mo billed annually ($50.00/mo billed monthly!), a family of five adults and unlimited kids gets:

- Online and device security for 50 devices

- Spam call and message protection

- Identity theft protection with family alerts sharing

- Up to $5 million in identity theft insurance ($1 million per adult)

- Financial fraud protection

- Privacy assistant

- Safe gaming with cyberbullying alerts

- Family vault

- Child identity protection with SSN alerts, credit freezes, and sex offender location alerts

Aura offers a lot of valuable services, but the one price may not really fit all families, which is why it deserves an honorable mention.

Get Aura | Read Our Aura Review

Best identity theft protection for families FAQs

How can I protect my family from identity theft?

The best way to protect your family from identity theft is to put privacy protections in place, like using password managers to create strong and unique passwords and using a VPN.

Does LifeLock have a family plan?

LifeLock has both a family plan for two adults and a family plan for two adults and five children available at each of its three tiers:

- Standard

- Advantage

- Ultimate Plus

Which ID theft service has the cheapest family plans?

Identity Guard has the cheapest family plans:

- Value: $10.00/mo billed annually or $14.99/mo billed monthly

- Total: $17.99/mo billed annually or $29.99/mo billed monthly

- Ultra: $19.99/mo billed annually or $39.99/mo billed monthly

Bottom line: The best ID theft protection for families

When you’re a cybercrime victim, you can feel as though you’ve lost control of everything. With identity theft protection services like LifeLock, IdentityForce, or IDShield, you can monitor your family’s digital presence and have control over your digital identity for peace of mind.

If you’re still trying to figure out which of the services mentioned in this article are right for your family, then you can read this identity theft protection and credit monitoring guide for more information.

3 best ID theft protection services for families 2024

| Starting price for families | Best for | Learn more | |

Norton LifeLock |

Starts at $13.24/mo for first yr | Best for comprehensive coverage | View Plans |

IdentityForce |

Starts at $14.95/mo | Best for families on a budget and single-caregiver families | View Plans |

IDShield |

Starts at $29.95/mo | Best for reputation monitoring | Get IDShield |

How we tested the best identity theft protection for families

Nearly every identity theft protection solution will provide a basic set of capabilities:

- Credit monitoring

- Transaction monitoring

- Dark web monitoring

- Identity theft insurance

When looking for differentiators among the various services, the stand-out technologies all offered something that no one else did. With families, ID theft protection capabilities really focus on how kids and teens use the internet, as well as the types of family structures that might struggle to pay for services.

When considering what families need and why they need them, each of the top three offered something unique in one of the following categories:

- How adults and children use the internet: Cybercriminals target everyone, and increasingly they focus on tweens and teens, so identity theft protection needs to cover every location that can be compromised, including social media and online gaming.

- Number of caregivers in a household: Data protection should be affordable for everyone, so it is important to consider the households that are trying to get by on one caregiver's salary.

- Non-financial harm: Identity theft protection often focuses on money rather than how cybercriminals can use a victim’s digital identity to engage in social engineering online, which harms the person’s real-world reputation.

How to choose the best identity theft protection service for families

With so many different technologies available, choosing just one requires a lot of thought and comparison. While the three top technologies for families in this guide are a good starting point, you want to make sure that you understand your unique family’s needs.

When you’re evaluating a service, you might want to ask yourself::

- How much do its family plans cost?

- How many adults and how many children are included in each family plan?

- Is there protection against child identity theft?

- What level of protection does it provide for children, and how does it define “child”?

- Does it alert users to data breaches in multiple areas, including social media and gaming?

- Does it monitor credit reports from all three bureaus: Experian, TransUnion, and Equifax?

- How often does it provide credit score updates?

- Does it assist with identity recovery for all family members?

- Does it provide identity theft insurance? If so, how much? (Up to $1 million is most common.)

- Does it offer apps for multiple common device types and operating systems?

- Does its privacy policy state it doesn’t sell data?

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates