Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Identity theft affects millions of people in the U.S. every year. From phishing attempts to the loss of someone’s life savings, the effects of ID theft are wide ranging and impact individuals in a variety of ways. But how common is identity theft, and how do people recover from it?

To find out, the All About Cookies team surveyed 1,000 people to discover if they’ve ever had their identity stolen, how their identity was compromised, how long it took them to recover, and more.

Do you know anyone who has had their identity stolen?

What are the most common ways to have your identity stolen?

What do thieves use these stolen identities for?

When do victims realize they’ve had their identity stolen?

How long does it take to recover from identity theft?

Tips for keeping your identity safe

Methodology

Key findings

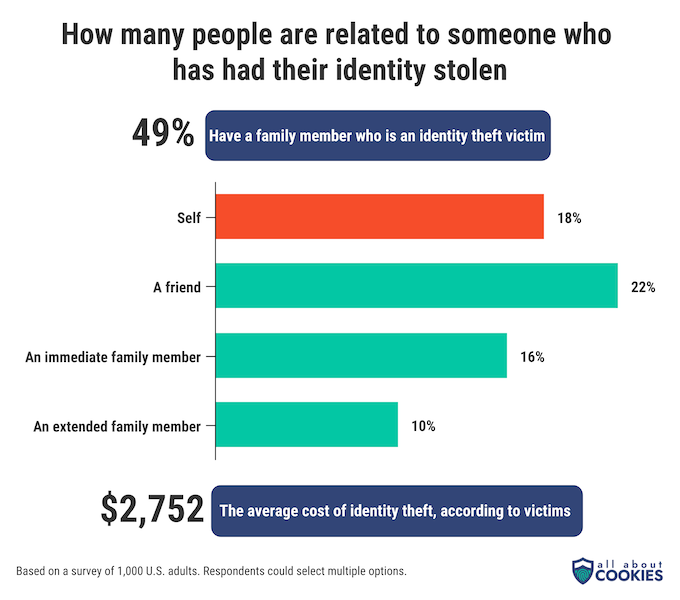

- Identity theft is ubiquitous: 51% of respondents said it’s happened to them or someone close to them, including 18% who have had their own identity stolen.

- Victims report identity theft has cost them $2,750 on average.

- More than one-third of ID theft victims found out only after discovering missing money or unusual charges on their accounts.

- More than a quarter of people who have had their identities stolen do not know how thieves acquired their data.

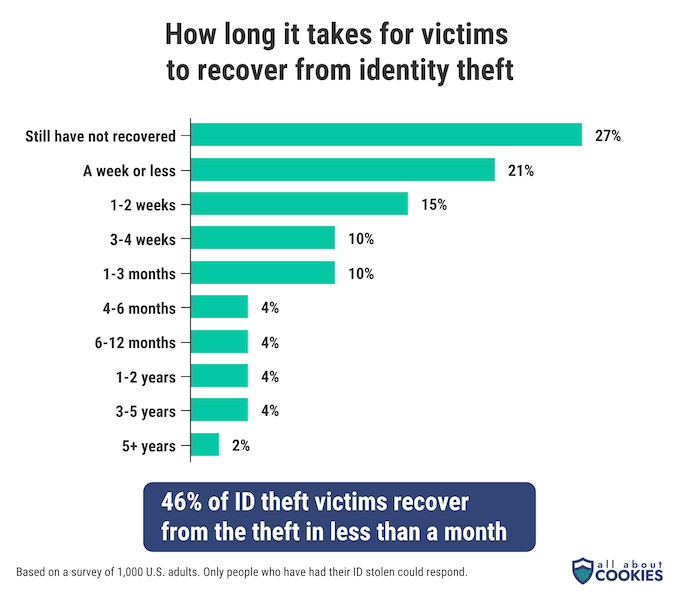

- 46% of victims were able to resolve their identity theft issues in under one month, but 27% said they are still actively dealing with the repercussions today.

Do you know anyone who has had their identity stolen?

Identity theft hits close to home for many, many people. In fact, our survey revealed that more than half of the U.S. population have a close connection to this crime.

Nearly one out of every five people (18%) have been victims of identity theft, but the commonality doesn’t stop there.

A deeper dive into our respondents’ social circles reveals that if you include family members, friends, and coworkers in addition to themselves, then more than half the population (51%) knows someone who has had their identity stolen. On average, ID theft victims say these crimes cost them $2,752, in both direct harm and the repair of any direct harm.

What are the most common ways to have your identity stolen?

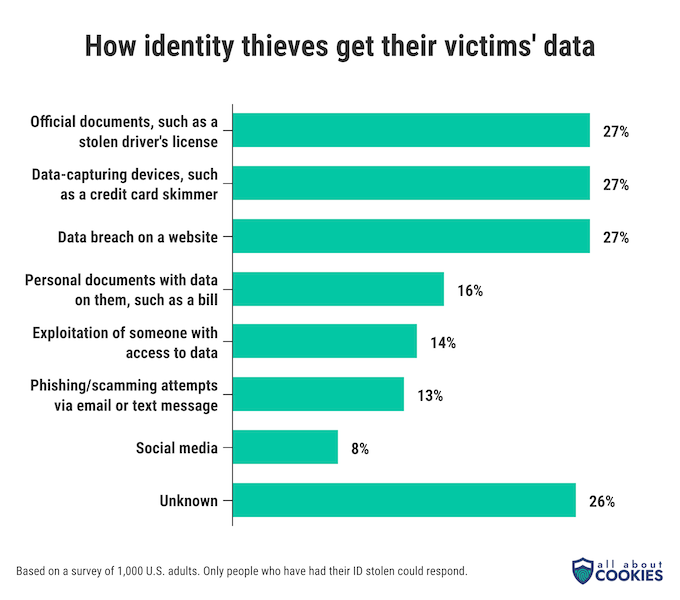

Stealing someone’s identity requires access to personal identifying information that is typically difficult to find, such as Social Security numbers and banking or credit account information.

Given the prevalence of identity theft, despite protective measures, it’s clear that thieves are finding ways to access delicate information. But how exactly are they getting their hands on it?

While thieves use a number of different methods to steal information, three methods seem to be most common:

- Stealing documents that contain personal information

- Using a device to capture personal information

- Accessing data breaches that leak personal information

What do thieves use these stolen identities for?

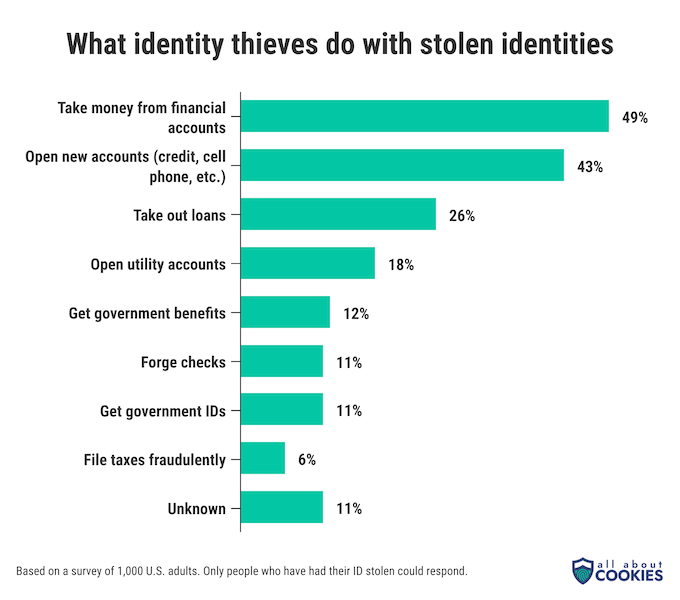

Access to someone’s personal data is merely the first step for identity thieves. Once they have the information, they can cause real problems for their victims. We found some of the most common crimes thieves use stolen identities for.

The top answer is also the most obvious: actual theft. Nearly half of identity theft victims (49%) say that thieves used their data to take money from banking and other financial accounts.

43% of victims say that their information was used to open new accounts in their name, such as lines of credit or cell phone plans. And 26% of victims say that the thieves took out loans in their name, including things like car loans or mortgages.

More than 1 in 10 victims (11%) do not know what their identity was used for at all, leaving them open to any number of nasty surprises.

When do victims realize they’ve had their identity stolen?

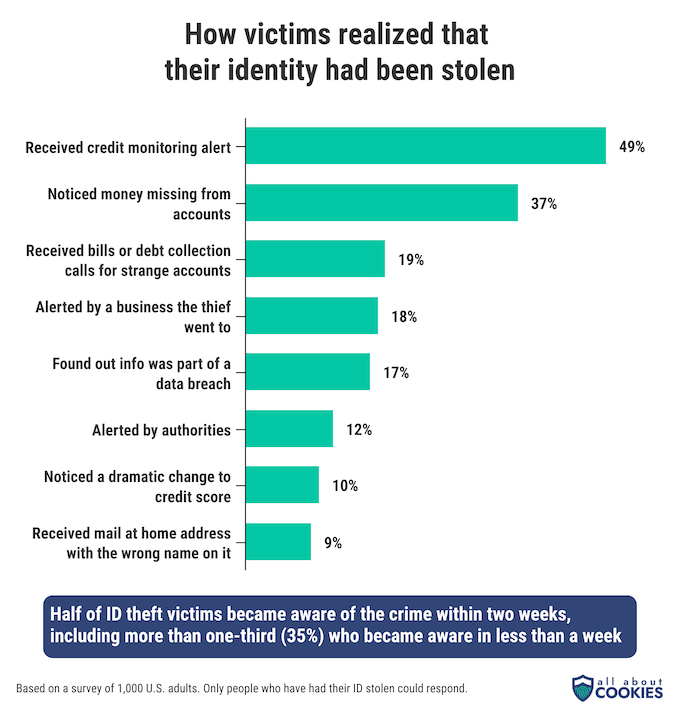

Identity crimes don’t often go undiscovered for long. Most major banks and credit cards send security alerts for suspicious activity, and most people notice if money’s missing from their accounts. We investigated the efficacy of typical fraud alerts like these.

As for timing, 50% of people report that they became aware that their identity had been stolen within two weeks of the crime occurring. This includes more than one-third of people (35%) that became aware within the same week their identity had been stolen.

Nearly half of victims were alerted to the theft by a credit monitoring service, which flagged suspicious activity on their accounts. Alternatively, a significant portion of victims (37%) say that they noticed the theft on their own after money was taken from their accounts.

How long does it take to recover from identity theft?

Identity theft victims have to take steps to reverse or mitigate any damage the thieves have caused, including to financial accounts and credit scores. They also have to protect their data going forward.

Thankfully, many victims (46%) report that it took them less than one month to fully recover after their identity was stolen, with one-fifth saying it took just one week or less.

But that does not mean it is simple for everyone. More than one-quarter of victims (27%) say they are still actively dealing with the fallout from their identity being stolen, while 10% of victims report that it took more than one year to fully recover from the crime.

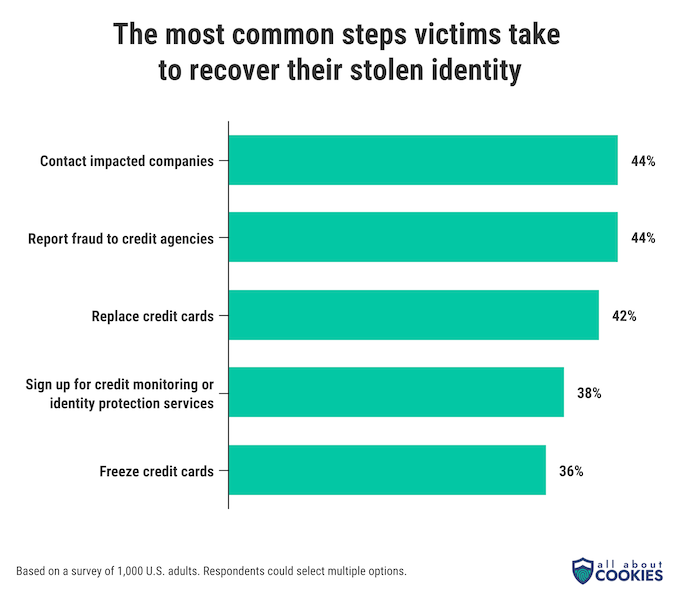

44% of victims took two common reparative steps once they realized their identity had been stolen:

- Contacting affected financial institutions, such as banks and fraudulent account issuers

- Reporting the fraud to credit reporting agencies.

Other common steps include replacing credit cards (42%), signing up for credit monitoring or identity theft protection (38%), and freezing credit (36%). Only 3% of victims said they did absolutely nothing after learning their identity had been stolen.

Tips for keeping your identity safe

Despite its prevalence, there are still plenty of steps you can take to make sure your identity and personal information stay safe online:

- Learn about PII. Your personally identifiable information (PII) can include details such as your name, address, or Social Security number. This is all information that can reveal your identity to online criminals if it’s compromised.

- Recognize ID theft signs. Knowing what the early signs of identity theft look like will help you recognize what’s going on much sooner if your information is stolen, so you can recover much quicker.

- Secure your accounts with a password manager. Your accounts will not be harder to access if they’re protected by unique secure passwords. If you have a lot of accounts to manage, look into using a password manager to keep everything secure and organized.

Methodology

All About Cookies surveyed 1,000 U.S. adults in June, 2023. Only respondents who indicated that they have personally had their identity stolen were asked to answer specific questions relating to the experience of dealing with identity theft. In most cases respondents were able to select multiple responses to account for instances where multiple methods may have been used to access or exploit a stolen identity.

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking