-

Variety of plans to meet your needs

-

Unlimited monitoring for children

-

Nearly impossible to contact customer support

Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Are you looking for an affordable and effective way to manage your credit and minimize identity theft? Several companies offer credit monitoring services to help keep track of your credit information or let you know if your Social Security number (SSN) has been compromised. These services also offer identity restoration services to help you offset any losses that you may incur if your identity is stolen.

IdentityIQ includes identity theft monitoring and credit protection. All of IdentityIQ’s plans include up to $1 million in identity theft insurance, as well as credit monitoring for any children under the age of 24. You can also upgrade your IdentityIQ plan to include a virtual private network (VPN) and antivirus protection. This upgrade costs users an extra $3.00 a month. The addition of VPN and antivirus also provides parental controls and a password manager for Windows.

Let’s look at what else IdentityIQ offers, including features, pricing, and more.

What does IdentityIQ protect against?

IdentityIQ features

Our experience with IdentityIQ

Does IdentityIQ keep your data safe?

IdentityIQ compatibility

IdentityIQ customer support

IdentityIQ prices and subscriptions

IdentityIQ FAQs

Bottom line: Is IdentityIQ good?

IdentityIQ review at a glance

| Price | $5.94–$25.50/mo |

| Identity theft insurance | Up to $1 million |

| Credit monitoring | Yes |

| Credit reports | Yes — Experian, TransUnion, Equifax |

| Credit score | Yes |

| Identity recovery | Yes |

| Dark web alerts | Yes |

| Social media account alerts | No |

| Details | Get IdentityIQ |

IdentityIQ offers four different plan types so you can determine how much identity theft protection you need. IdentityIQ Secure is its most basic plan, which comes with daily one-bureau credit report monitoring. Although it doesn’t include any credit reports or credit scores, it does come with dark web and internet monitoring, coverage for lawyers and experts, SSN alerts, and more.

IdentityIQ’s premium plans all provide access to credit reports and credit scores from the three major credit bureaus, but the frequency at which you can refresh those reports is based on your chosen plan.

IdentityIQ also offers application monitoring to look for instances where scammers may be using your information for utility applications, cell phone applications, payday loans, or credit applications. Sometimes, these accounts don’t pull your credit report and can go under the radar for a while. IdentityIQ will still send you alerts even if your credit wasn’t pulled.

Another perk that IdentityIQ includes is the ability to report utility payments to credit bureaus to help your overall credit score. These utility payments aren’t usually reported as part of your credit score, but your timely utility payment history can help boost your credit score.

IdentityIQ’s Secure Max plan, the most premium plan, also offers a credit score simulator and credit score tracker to give you more details about your score and how it's changing. The Secure Max plan also comes with family protection, so you can monitor your children’s identities. There is no limit on how many kids you can monitor with this plan.

Identity theft protection and credit monitoring are important in protecting your personal information from fraud. IdentityIQ also offers a robust identity theft insurance program with your account. These insurance funds can be used for lost wages, lawyer fees, and reimbursement of any stolen funds.

IdentityIQ pros and cons

- Variety of plans to meet your needs

- Unlimited VPN

- Unlimited monitoring for children

- No ability to freeze credit

- Nearly impossible to contact customer support

What does IdentityIQ protect against?

IdentityIQ helps protect you against various fraud and identity theft situations. IdentityIQ monitors your credit report, the dark web, criminal records, and more. If there are changes to any of these records, IdentityIQ will send you an alert of the change via email or text message. You can also see all the alerts in the IdentityIQ dashboard on a computer or mobile device.

IdentityIQ can also assist you if you lose your wallet or purse. Inside the IdentityIQ dashboard, you can save all of your credit card information and other important documents. So if you lose your wallet or purse, you can use this saved information to help recover your accounts.

IdentityIQ features

IdentityIQ’s features depend heavily on which plan you choose. The higher-tier plans give you access to your credit report more often, along with more advanced features like enhanced credit report monitoring and credit score change alerts.

All of IdentityIQ’s plans include $1 million in identity theft insurance and at least daily credit monitoring with one credit bureau. The highest tier includes additional features such as fraud restoration and access to a credit score simulator.

Credit monitoring

IdentityIQ’s credit monitoring looks for the following changes to your credit history:

- Credit inquiries: These alerts will happen any time there is a hard inquiry on your credit, like from a bank or car dealership.

- Public records: If you buy a new property or something changes with your home, a public record alert may be triggered.

- New credit accounts: You’ll receive alerts any time you open a new account that would be reported on your credit report.

- Change of address: If you move or change your address, this will also show on your credit report.

- Delinquent accounts: If you’re late on payments or your credit card is over-extended, you will see a delinquent account alert.

Credit monitoring can help you identify possible fraud quickly so you can stop it before scammers can access more of your credit. It is important to pay attention to the credit monitoring alerts you receive so you can identify any fraud. But note that not all of these alerts will be immediate. A change of address or a delinquent account may only happen when that account reports to the credit bureau, which is usually once a month.

Credit reports and credit scores

Your credit report and credit score include detailed information about how you’ve paid back your debts in the past, how much debt you currently have, and if you’ve paid those debts on time. Your credit report also shows any of your public records, your address, and other personal information.

Your credit report is one of the first ways to identify identity theft, as long as you’re monitoring your credit report often. If a scammer uses your SSN to open a new account, frequent credit report monitoring would allow you to find that fraud more quickly.

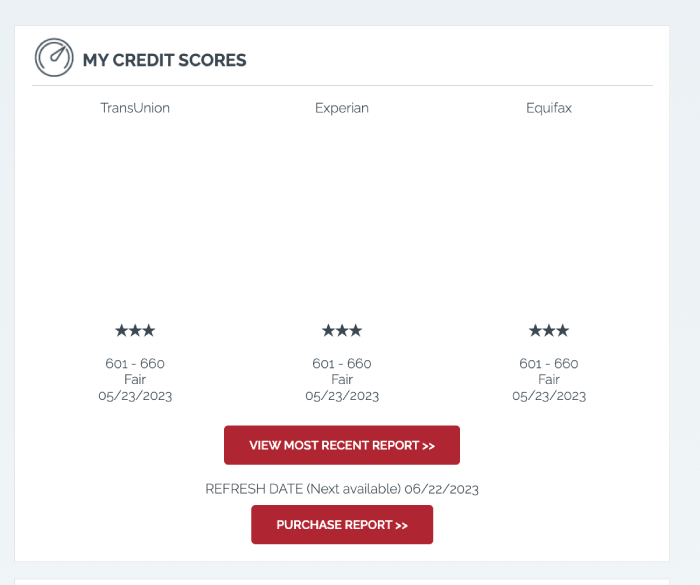

Not including the Secure plan, IdentityIQ comes with access to credit reports and credit scores from all three credit bureaus: Equifax, Experian, and TransUnion. Depending on the plan you choose, you can access your credit report annually, biannually, or monthly.

Your credit score is also an indicator of identity theft. If you are monitoring your credit score often and notice a major change in your score, this can indicate a new account or change in your credit report. IdentityIQ sends alerts if your TransUnion credit score changes by more than 10 points.

Alerts

Alerts are one of the most important parts of monitoring your identity. Without alerts, you’d need to check your identity monitoring dashboard often to see if there were any changes. IdentityIQ will send you email and/or text notifications for monitoring alerts. You can also access these alerts from the IdentityIQ mobile app or your browser.

IdentityIQ will also send you alerts if your information is found on the dark web or if your information has been used on a utility or other application.

Identity monitoring

Identity Monitoring is another key component in protecting your credit and identity. While credit monitoring looks at your credit report for changes, IdentityIQ scans a variety of sources for your SSN or other sensitive information.

Identity monitoring alerts include the following:

- Applications using your SSN

- USPS address changes

- Criminal records with your SSN

- Personal information found on the dark web

Identity restoration services

Having your identity stolen is a difficult experience. In the event your identity is compromised, there are a myriad of tasks to complete to help secure your information for the future.

IdentityIQ offers some identity theft restoration services, which can help ease the burden after your information was compromised. It offers quite a few restoration services and consultations, including:

- Credit report analysis

- Police report filing

- Fraudulent account dispute assistance

- Fraud alert and credit freeze consultation

Our experience with IdentityIQ

Starting our free trial and setting up our IdentityIQ account was pretty simple. Once we downloaded it, IdentityIQ walked us through setting up our account.

Once you enter your information, IdentityIQ’s dashboard is easy to navigate. You’ll immediately see your credit scores from all three credit bureaus, and you can look into the entire report easily from the dashboard. If you want to set up family protection or utility reporting, you can also easily add those from the dashboard menu.

Overall, IdentityIQ offers many tools to help you monitor your identity and secure your credit profile. However, we were disappointed that we couldn’t freeze our credit. And depending on the plan you choose, you may only get credit alerts once a day instead of immediately.

Does IdentityIQ keep your data safe?

As with any identity theft protection service, you need to provide a significant amount of information in order for the service to work. Although IdentityIQ claims not to share any of your information without your consent, we read through its privacy policy and found some conflicting information.

IdentityIQ works with outside vendors to provide its services, so your information could be shared with other companies. Its privacy policy also states that your personal information may be shared with third parties to send you promotional offers, advertising, or other marketing content. However, the privacy policy provides guidance on how to opt out of certain commercial marketing emails if you're not interested in the service sharing your data for these reasons.

IdentityIQ compatibility

IdentityIQ is compatible with Windows, macOS, iOS, and Android. However, the iOS app left a lot to be desired. You can only access your VantageScore and monitoring alerts from the app. Although you can access your most recent credit score in the app, it loads the credit reports from the website. The limited features and usability made it feel lacking in substance.

IdentityIQ customer support

IdentityIQ is definitely lacking when it comes to customer support. We searched for contact information so we could contact customer support, but we could only find a phone number hidden in the footer of the website. We also logged in to our account to see if members got a better customer support option, but we were redirected to the same phone number.

IdentityIQ customer service also has limited hours. You can contact them Monday through Friday from 7:00 a.m. to 7:00 p.m. CST and Saturdays from 8:30 a.m. to 5:00 p.m. CST.

To cancel your free trial, you’ll also have to call customer service, which we found to be a hassle. It took us a few tries to get through to a customer service agent. We finally got through to an agent when we called first thing on a Monday morning, but it took about 45 minutes to get through. Luckily, after about 10 minutes on hold, they gave us the option for a call back instead of waiting on hold. It also took about 15 minutes with customer service to actually get our account canceled as they tried to offer us discounts on the service and ask why we were canceling.

IdentityIQ prices and subscriptions

IdentityIQ offers a variety of plans based on your needs. Many of the key components, like credit monitoring, SSN monitoring, and identity theft insurance, are included with all of the plans. However, the plan offerings change when you look at how often you can access your credit report and how many bureaus are included in those reports.

IdentityIQ’s Secure Max plan includes the most benefit for users. With this plan, you get monthly access to your credit report, and you can add unlimited children to your account. The SecureMax plan also gives you access to a credit score simulator and fraud restoration with limited power of attorney (LPOA). An LPOA allows IdentityIQ to act on your behalf to remedy the issues of fraud.

IdentityIQ plans comparison

| Plan | Secure (Annual) | Secure Plus (Annual) | Secure Pro (Annual) | Secure Max (Annual) |

| Annual plan | $5.94/mo | $8.50/mo | $16.99/mo | $25.50/mo |

| Monthly plan | $6.99/mo | $9.99/mo | $19.99/mo | $29.99/mo |

| Who’s covered | One adult | One adult | One adult | One adult, unlimited children |

| Identity theft insurance | Up to $1 million | Up to $1 million | Up to $ 1 million | Up to $1 million |

| Credit monitoring | Yes — 1 bureau | Yes — 1 bureau | Yes — 3 bureaus | Yes — 3 bureaus |

| Credit reports | Yes, annually — Experian, TransUnion, Equifax | Yes, biannually — Experian, TransUnion, Equifax | Yes, monthly — Experian, TransUnion, Equifax | |

| Credit score | ||||

| Identity recovery | ||||

| Dark web alerts | ||||

| SSN monitoring | ||||

| USPS address change alerts | ||||

| Details | View Plan | View Plan | View Plan | View Plan |

IdentityIQ FAQs

Is IdentityIQ worth it?

Yes, IdentityIQ is worth it. The identity fraud prevention service offers several features that can help you avoid identity fraud and help you recover if you become a victim of identity theft.

What type of credit score does IdentityIQ use?

IdentityIQ offers access to your VantageScore. VantageScore is similar to a FICO score, but it calculates the score a bit differently based on your credit usage, payment history, age of credit history, and more.

Is IdentityIQ legit?

Yes, IdentityIQ is a legit company that offers identity theft services. IdentityIQ is owned by Identity Intelligence Group, LLC. It has a 1.67-star rating from the Better Business Bureau, a 3.6-star rating in the Google Play Store, and a 4.5-star rating in the Apple App Store.

How do I cancel IdentityIQ?

The only way to cancel your IdentityIQ subscription is by calling customer service at 1-877-875-IDIQ (4347).

Bottom line: Is IdentityIQ good?

Overall, IdentityIQ is a solid solution to protect your identity. We liked the variety of plans with different offerings, so you can choose a plan that works for your needs. A less expensive plan may be the right amount of information you need to keep your identity safe. If you’ve recently had your information exposed or have greater concerns, you may want to consider a plan that gives you greater access to your credit report and scores.

However, IdentityIQ doesn’t allow you to freeze your credit and we spent about an hour trying to reach and communicate with customer support. For an identity theft protection service that has a credit freeze function and more customer support, read our Norton LifeLock review.

-

Variety of plans to meet your needs

-

Unlimited monitoring for children

-

Nearly impossible to contact customer support