Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

If you fall victim to identity theft, you must act quickly to minimize the damage.

Reporting identity theft to the police is a good place to start since banks and creditors often require a police report when you contest fraudulent charges. Additionally, credit reporting agencies may want to see a police report before removing information related to identity theft from your record.

Let’s go over the steps you need to take to report identity theft to the police and other relevant governmental organizations. We'll also advise you on how to protect against identity theft with the best identity theft protection, VPNs, and other tips.

Other essential steps after identity theft

How to protect against identity theft

Identity theft FAQs

Bottom line

How to file a police report for identity theft

If you notice clear signs that someone is using your identity, the first step you should take is to report the identity theft to the Federal Trade Commission (FTC). You should do this even before filing a police report, as the police may ask for a copy of your FTC report.

Begin with reporting the identity theft to the FTC

Before submitting a police report, you should submit a report online or via phone with the FTC. When you submit the report online, you can create an account where you can receive a personalized recovery plan.

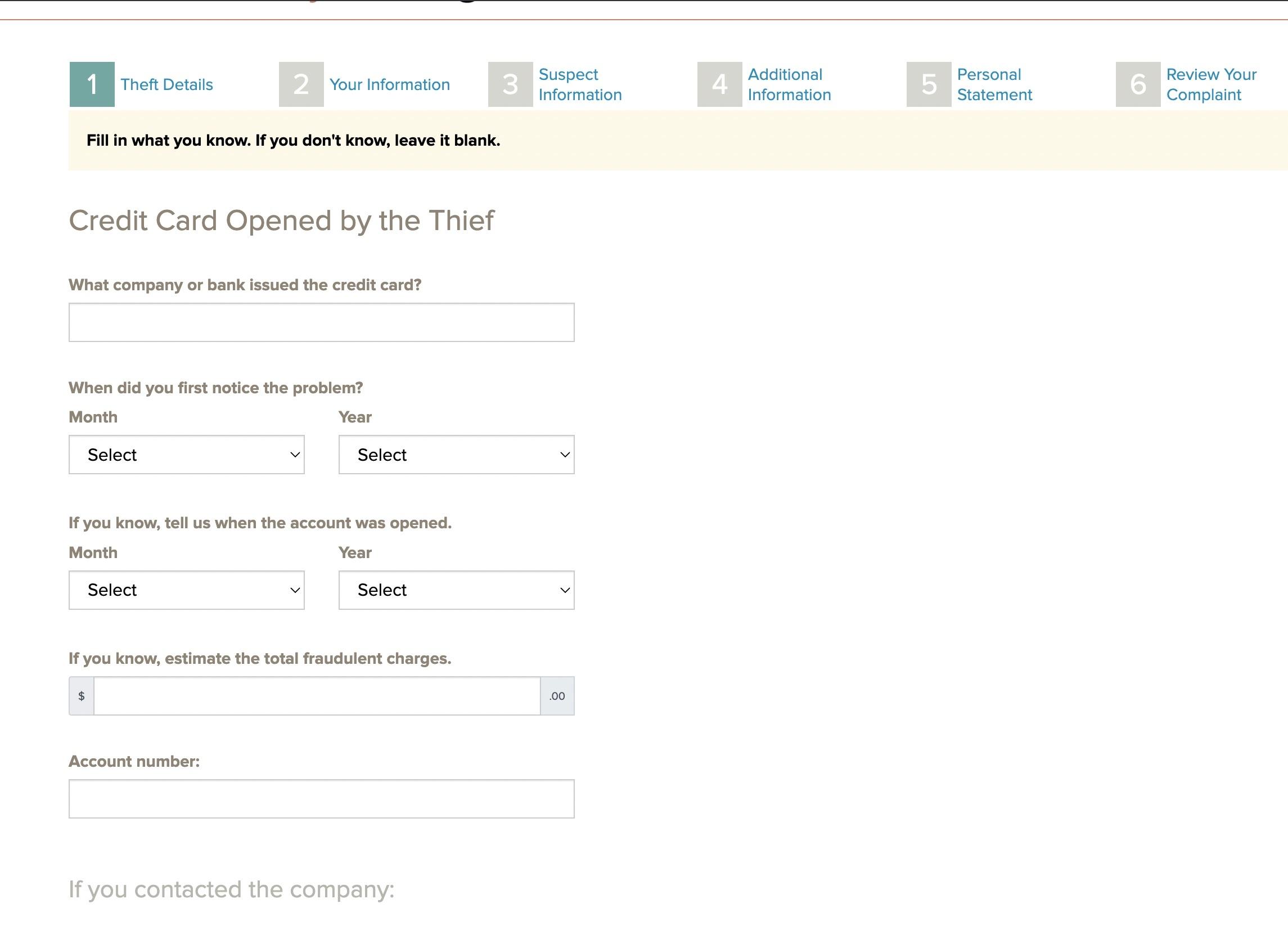

Here are the steps to file a report with the FTC:

- To report via phone, call 877-438-4338. To report online, visit IdentityTheft.gov. Once there, click on Get Started.

- Choose the report type you need to make, such as tax return scams or personal information exposure due to a data breach.

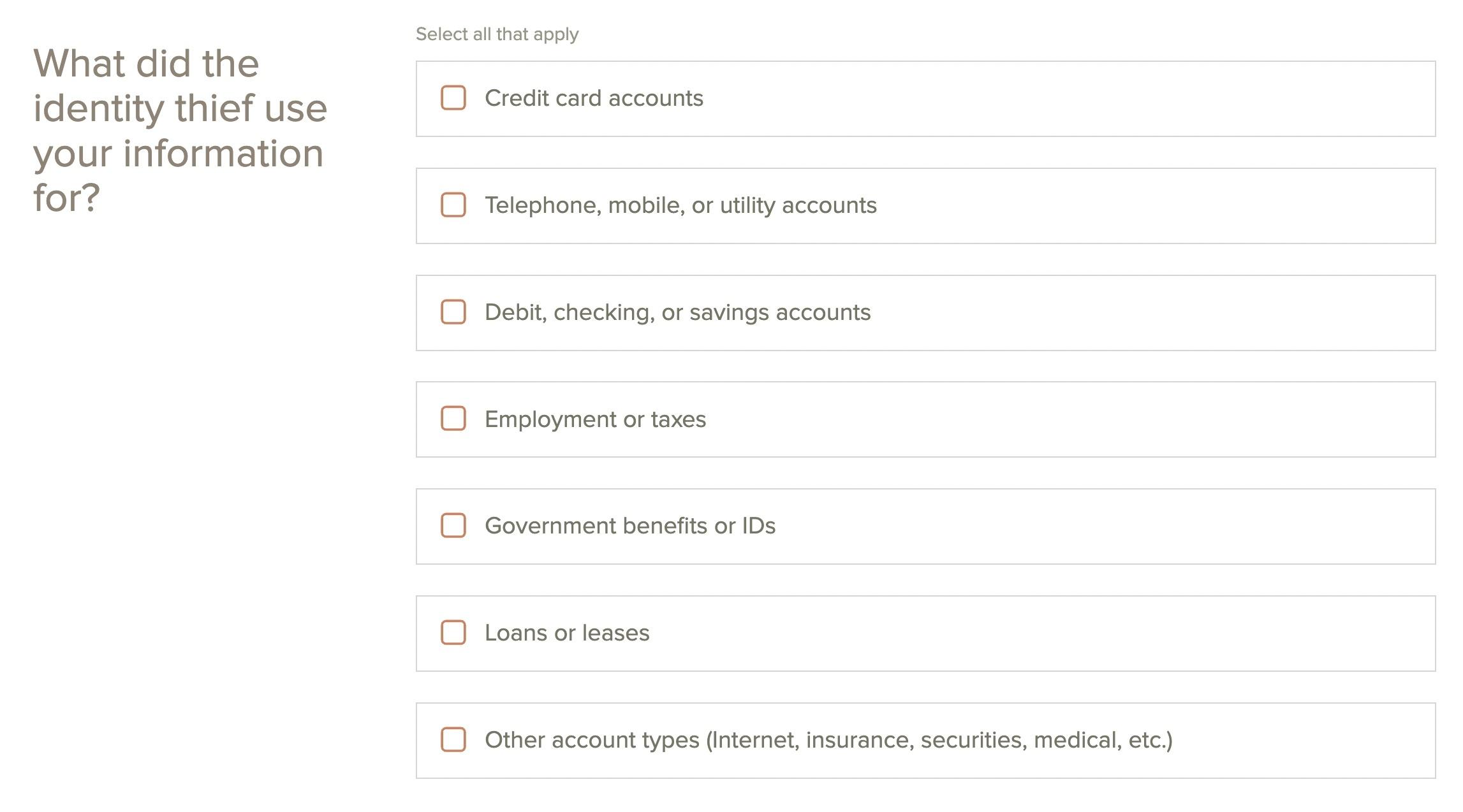

- Provide more information about the identity theft you’re dealing with, such as the type of information, ID, or account that was misused.

- The FTC needs specific details that are used to generate your identity theft report and create a recovery plan.

- Type in your personal details and any information you have about the identity theft activity and the potential suspect. You can also include a personal statement.

- When you are done providing the information you have, the FTC will create your identity theft report — also known as an ID theft affidavit — and prepare a recovery plan.

File an identity theft police report

After filing your FTC report, you can contact your local police department to submit it and receive a case number. Credit card companies and financial institutions may require this police report to remove fraudulent charges.

To file a police report:

- Call or visit your local police department. You can find the phone number online, in a telephone book, or by calling directory assistance.

- Provide proof of your identity and address, such as a government-issued ID and a mortgage statement showing your address.

- Describe to the police what happened, providing as many details as you can about the identity theft, any suspects, and the actions the thief took.

- Provide proof that the theft occurred and give the police your FTC report.

- Once your report is filed, request a copy and a case number.

Your police department may not investigate every individual case of identity theft but making your report helps them to identify trends. Your report also provides the proof you need to resolve the consequences of identity theft.

Other essential steps after identity theft

If you become a victim of identity theft, filing a report with the FTC and a law enforcement agency are the beginning steps you need to take to recover.

Knowing what to do if your identity is stolen is essential for your recovery. You can take additional steps to stop the identity thief from causing additional damage and ensure you aren't held liable for fraudulent accounts, such as protecting your credit file and securing your bank accounts.

Contact the three major credit bureaus

If your personal information falls into the wrong hands, you should contact Equifax, Experian, and TransUnion, the three major credit reporting agencies.

Reach out to the fraud department in each agency to put a freeze on your credit report. Freezing your credit report means no one — including you — will be able to open accounts in your name without providing a special PIN.

Place a credit file security freeze:

You should also request a free copy of your credit report from each agency each year at AnnualCreditReport.com. Review your report to see if there are any new accounts you did not open or activities you don’t recognize. If so, filing credit report disputes with these reporting agencies will allow you to get the information removed.

File a credit file dispute:

Inform your banks and financial institutions

Inform your bank, credit card issuer, and other financial institutions of the identity theft and alert them about any unauthorized charges or debits.

If you promptly report fraudulent activities and provide a copy of your FTC or police report, chances are that you will not be responsible for them. Federal law limits your liability for fraudulent credit card transactions to $50, but many financial institutions offer zero-liability protection when you act quickly.

For example, if a thief stole your debit card, your liability for any unauthorized or fraudulent transactions is limited based on how quickly you reported it:

- You cannot be held responsible for any unauthorized transactions if you reported the loss or theft of your card promptly.

- You can be responsible for up to $50 if you report the transactions within two days.

- You can be responsible for up to $500 or face full liability if you don't notify the bank within 60 days after receiving the bank statement that contains the unauthorized charges.

Secure your compromised accounts

Make sure to secure every account the identity thief accessed. It can also be wise to secure any account that uses similar credentials.

Change your password to a new, strong password and sign up for two-factor authentication to provide an added layer of security. Accessing your account with two-step verification requires entering your password, followed by a code that is typically sent to your email or telephone number.

-

Strong encryption and security

-

User-friendly interface

-

Free version is limited to one device at a time

How to protect against identity theft

It is often easier to prevent identity theft than to deal with its consequences. There are steps that you can take to keep your personal information safe. While these steps are not foolproof, they can go a long way toward reducing your identity theft risk.

Take these steps to reduce your identity theft risk:

- Don't carry your Social Security card with you or give out your Social Security number to persons or companies you don’t fully trust.

- Avoid sharing personal information such as your birthdate unless there is a good reason to do so.

- Keep your driver’s license number private to avoid ID theft.

- Regularly check your mail and review your internet, phone, and utility bills.

- Use an identity theft protection and credit monitoring service that can send you fraud alerts.

- Avoid public Wi-Fi networks unless you use a virtual private network (VPN).

- Review your bank and credit card statements for transactions you do not recognize.

- Shred paperwork that contains personally identifiable information.

- Use secure passwords for your financial accounts.

- Frequently check your credit reports for unusual activity.

Why use identity theft protection?

There are several benefits to identity theft protection. These services provide proactive prevention by monitoring your identity, credit, and other sensitive information. They can also notify you of any suspicious activity. If you become a victim of identity theft, these services also offer identity recovery services, such as identity theft insurance and dedicated specialists to help you in your time of need.

If you're interested in identity theft protection but don't know where to start, here are some recommendations:

- LifeLock: LifeLock is a comprehensive ID theft protection service that monitors the dark web, your home title, your social media accounts, and more. If you opt for the Ultimate Plus plan, you can also get up to $3 million in identity theft insurance coverage.

- McAfee: On top of being an excellent antivirus program, McAfee also includes identity theft protection in some of its security suites. McAfee provides up to $1 million in identity theft insurance, credit monitoring, identity recovery support, and bonus features like a VPN and a password manager for complete cybersecurity.

Get McAfee | Read Our McAfee Identity Theft Protection Review

- Identity Guard: Identity Guard is another ID theft protection service that offers multiple tiers for individuals and families, making it accessible to a variety of budgets. It's an easy-to-use service with plenty of options for identity monitoring and credit monitoring, depending on the tier you choose.

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Identity theft FAQs

Do the police investigate identity theft?

Police might not investigate every identity theft case, but they record reports and aim to identify patterns. Your local police department often can’t investigate this type of crime since the thief might not be within its jurisdiction. Additionally, many police departments may not have the budget and staff to conduct a complex identity theft investigation.

How to prosecute someone for identity theft?

Prosecuting someone for identity theft can be tricky unless you know who stole your identity. If you can identify the person who misused your personal information and report the crime to the police, your case may be prosecuted by the state’s attorney general. You can also file a civil court lawsuit if you know the perpetrator. If you win the lawsuit, you may receive compensation.

Can you file an identity theft police report online?

Depending on your local law enforcement agency, some police departments may have an online portal to file a police report. For example, the Los Angeles Police Department has an online form to file a police report. You can also report identity theft to the Federal Trade Commission at IdentityTheft.gov or by calling the 877-438-4338 hotline.

Bottom line

Identity theft can have serious financial consequences. That’s why you should report it as soon as possible to have proof that you were a victim of identity theft. You can use this proof to remove fraudulent items from your credit reports and bank accounts. The best identity theft protection comes with identity recovery services should you fall victim to identity theft.

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates