Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

It’s no secret that online shopping is here to stay. As with anything where lots of money is changing hands, however, there comes risk from people looking to take advantage.

And just as online shopping continues to grow and evolve, scammers are evolving right alongside it. They're developing new tricks and techniques for getting their hands on other peoples’ money, making sufficient identity theft protection all the more important.

To better illustrate the current extent of the problems related to online shopping, the All About Cookies team dug into data released by the Federal Trade Commission (FTC) to find trends and changes relating to online shopping scams in recent years. Read on to see how the number of scam reports has changed over time, how much money is stolen via these scams, and the states where shoppers are being victimized most.

Online shopping fraud trends over time

States with the highest rates of online shopping fraud

States with the lowest rates of online shopping fraud

Bottom line

Methodology

Key findings

- Washington, D.C. has the highest rate of online shopping fraud per capita in the country, while South Dakota has the lowest.

- Virginia experiences the highest rise in online shopping fraud during and after the holidays.

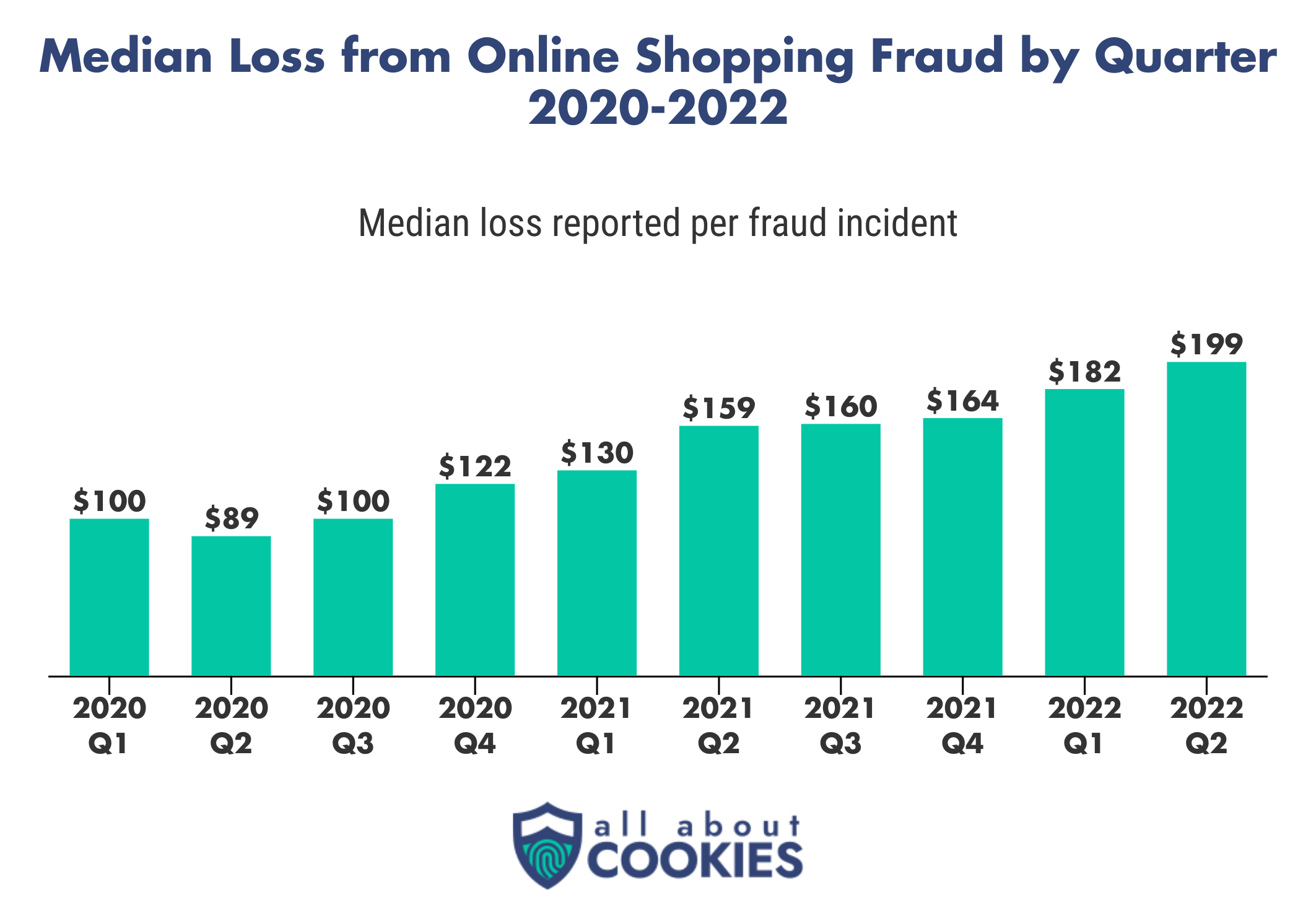

- Since Q3 2020, the median amount of money stolen in online shopping fraud cases has risen every quarter.

Online shopping fraud trends over time

The year 2020 brought major changes to many people worldwide as the pandemic forced offices to shut down and kept people in their homes. Around the same time as the pandemic took hold, there was a major increase in reports of online shopping fraud — the number of reports more than doubled from quarter one to quarter two of 2020.

While there were some fluctuations, more than 100,000 online shopping fraud reports were filed in the United States every quarter until the end of 2021. Since then, fraud report frequency has been trending down every quarter of 2022.

As the number of online shopping fraud reports rose, so did the money amount scammers stole from shoppers. In the first quarter of 2020, scammers took $40.6 million via online shopping fraud, but that number rose every quarter until it peaked at $105 million in the first quarter of 2021.

While the number of quarterly reports and stolen money amounts have been falling since the end of 2021, the money amounts are declining slower than the number of incidents. That may be because scammers are taking more money from each victim than in the past. The median amount of money lost per online shopping scam more than doubled from $89 in the second quarter of 2020 to $199 in the second quarter of 2022.

States with the highest rates of online shopping fraud

Top 10 states with the most online shopping fraud cases per 100K residents, 2020-2022

| State | Average number of quarterly fraud reports per 100,000 people |

| 1. Washington, D.C. | 34.3 |

| 2. Delaware | 30.0 |

| 3. New Hampshire | 28.4 |

| 4. Maryland | 27.4 |

| 5. Colorado | 27.0 |

| 6. Nevada | 26.5 |

| 7. Oregon | 26.0 |

| 8. Virginia | 25.8 |

| 9. Washington | 25.7 |

| 10. Massachusetts | 25.5 |

The nation’s capital has the lead as the part of the country most afflicted by online shopping fraud. For every 100,000 people living in Washington, D.C., there have been, on average, 34.3 online shopping fraud reports filed every quarter since the start of 2020.

There are five other East Coast states in the top 10 in addition to Washington, D.C. Delaware (30.0 reports per 100,000 people), New Hampshire (28.4), Maryland (27.4), Virginia (25.8), and Massachusetts (25.5) are all among the states with the biggest online shopping fraud issues.

Beyond geographic location, there does appear to be some correlation between the median earnings of each state’s residents and the number of online shopping fraud reports.

Where median income is concerned, Washington, D.C. ($90,088), New Hampshire ($88,465), Maryland ($90,203), Colorado ($82,254), Washington ($84,247), and Massachusetts ($89,645) are also among the top 10 states in the entire country, while Delaware ($71,091), Oregon ($71,562), and Virginia ($80,963) are all among the top 20.

States with the lowest rates of online shopping fraud

Top 10 states with the fewest online shopping fraud cases per 100k residents, 2020-2022

| State | Average number of quarterly fraud reports per 100,000 people |

| 1. South Dakota | 15.6 |

| 2. North Dakota | 16.3 |

| 3. Mississippi | 17.0 |

| 4. Louisiana | 17.1 |

| 5. Arkansas | 17.2 |

| 6. Oklahoma | 17.9 |

| 7. Iowa | 18.0 |

| 8. Nebraska | 18.3 |

| 9. Alabama | 18.8 |

| 10. Texas | 19.1 |

Conversely, when it comes to states with the lowest rates of online shopping fraud, South Dakota and North Dakota, respectively, are first and second. In fact, South Dakota’s average quarterly rate of 15.6 reports per 100,000 people and North Dakota’s rate of 16.3 per 100,000 are less than half that of Washington, D.C.

Five of the 10 states that experience online shopping fraud the least are also among the bottom states in the country when it comes to median income. Mississippi ($48,716), Louisiana ($52,087), Arkansas ($52,528), Oklahoma ($55,826), and Alabama ($53,913) are all in the bottom 10 states in terms of median income and are also among the least targeted for online shopping fraud.

States where online shopping fraud increases the most during the holidays

While online shopping fraud occurs year-round, there are certain times of the year when scammers ramp up their efforts. According to the FBI’s Internet Crime Complaint Center, the agency “receives a large volume of complaints in the early months of each year, suggesting a correlation with the previous holiday season’s shopping scams.” This indicates that the holidays are a vital period for fraudsters.

The FTC’s data on online shopping fraud complaints backs up the FBI’s assertion. Over the last two years, most states across the country have seen a quarterly increase in fraud report rates between the fourth quarter of a year and the first quarter of the new year.

That increase occurred in 49 of 50 states, as well as Washington, D.C., between the fourth quarter of 2020 and the first quarter of 2021, with Tennessee being the only state that avoided a bump. The increase also happened in 30 states between the fourth quarter of 2021 and the first quarter of 2022.

While the holiday-fueled increase in online shopping fraud has been present across the country for the last two years, the change has been greater in some states compared to others.

From 2020 to 2022, Virginia saw the biggest average increase in fraud reports from the end of one year and the start of another, with online shopping fraud increasing by 27.8% on average from Q4 to Q1 in the Old Dominion state. Four other states see average fraud increases greater than 15% around the holidays, as West Virginia (18.7%), Wyoming (18.4%), Texas (17.8%), and Vermont (15.1%) all exceeded that amount over the last two holiday seasons.

Bottom line

While there will always be scammers and fraudsters trying to get a hold of your money online, there are plenty of ways to keep yourself safe on Amazon, Facebook Marketplace, and other online shopping sites. An essential strategy is using one of the best identity theft protection services:

- Norton LifeLock: LifeLock is a comprehensive ID theft protection service from a well-known and respected company. With up to $3 million in identity theft insurance coverage, it's here to help prevent identity theft and also provide assistance if it ever happens to you.

- Aura: We were really impressed with Aura and its comprehensive security suite, which includes a virtual private network, antivirus, and password manager. It even offers fraud/theft remediation services and lost wallet remediation to protect your peace of mind.

- Identity Guard: Identity Guard is a budget-friendly service with various tiers for both individuals and families. We also found it to have a clean and easy-to-use dashboard for anyone who's new to identity theft protection.

Methodology

Data on “Online Shopping and Reviews Fraud” was collected from the Fraud Reports workbook available via the Federal Trade Commission’s Tableau Public account. Data were collected for the time frame covering Q1 2020 through Q2 2022. Data were collected in October and November of 2022. Median income data comes from the Kaiser Family Foundation and is based on the median income for households in each state for 2021.

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates