Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Best for Basic Protection & Low Cost

-

Low price

-

Easy-to-use dashboard

-

No credit monitoring

Best for Comprehensive Security

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Identity theft is a growing global issue, and the consequences of identity theft can be devastating. New financial accounts, stolen healthcare benefits, and out-of-pocket financial losses can be some of the many different effects of identity theft. ID theft protection plans monitor your personal information, credit files, web activity, and alert you of suspicious or fraudulent activity.

If you’re wondering if identity theft insurance is worth the price, the short answer is yes. The question is which protection plan is right for you. While there are multiple identity theft protection services and plans available, we dove deeply into Zander Identity Theft Protection and Norton LifeLock to discover their pros and cons.

Our opinion? We think Lifelock is a more comprehensive option. The monthly cost is higher, but you’ll receive premium security features, including more secure data protection, three-bureau credit monitoring, and up to $3 million in credit restoration. Zander Identity Theft Protection plans are a good option though for those looking for basic identity theft protection. Read ahead to see which protection plan is best for you.

Zander Identity Theft Protection vs. Norton LifeLock: prices

Zander Identity Theft Protection vs. Norton LifeLock: monitoring and alerts

Which is safer, Zander Identity Theft or Norton LifeLock?

Zander Identity Theft Protection vs. Norton LifeLock: compatibility and ease of use

Zander Identity Theft Protection vs. Norton LifeLock: customer service

Zander Identity Theft Protection vs. Norton LifeLock FAQs

Zander Identity Theft Protection vs. Norton LifeLock: which is better?

Zander Identity Theft Protection vs. Norton LifeLock

Zander Identity Theft Protection and Norton LifeLock are both excellent identity theft protection products, but they vary in significant ways and are designed with different audiences in mind.

Generally speaking, Norton LifeLock places more weight on data protection. Zander Identity Theft Protection, endorsed by financial professional Dave Ramsey, leans more heavily on the recovery aspect of identity theft, helping users get back on track after identity theft occurs.

- Zander Identity Theft Protection: Best for those wanting basic identity theft protection at a low cost.

- Norton LifeLock: Best for users who are willing to pay a little more for a comprehensive protection plan.

Zander Identity Theft Protection vs. Norton LifeLock review at a glance

Zander Identity Theft Protection |

Norton LifeLock |

|

| Price | $6.75-$19.49/mo | $7.50–$38.99/mo for first yr |

| Identity theft insurance | Up to $2 million | Up to $3 million |

| Credit monitoring | ||

| 3-bureau credit reports | ||

| Credit score | ||

| Identity recovery | ||

| Dark web alerts | ||

| Social media account alerts | ||

| View Plans

Read Zander ID Theft Review |

View Plans

Read Norton LifeLock Review |

While the protection offerings look similar at a glance, the two identity theft protection plans are quite different, starting with cost. With Zander Identity Theft Protection, users pay a low monthly cost but sacrifice some privacy since the site has cookies and trackers from third-party affiliates. If users are willing to put in a little extra work to disable those, the budget-friendly price might be worth it.

Norton LifeLock, on the other hand, charges a higher monthly rate but boasts one of the most extensive identity theft protection plans on the market. It offers VPNs, virus protection, triple bureau credit reports, and financial alerts.

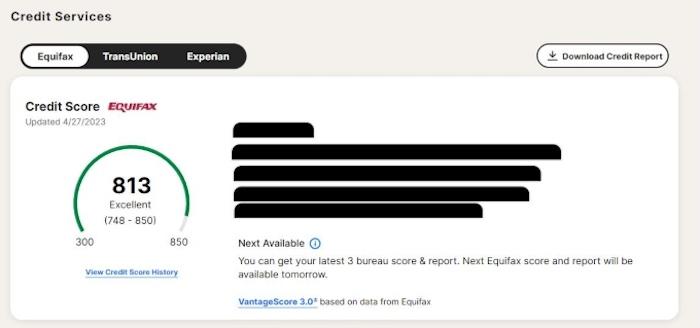

Another obvious difference is the lack of credit reporting from Zander ID Theft Protection. With Zander, credit monitoring can be secured through a free, third-party website like AnnualCreditReport.com because it is not offered through Zander itself.

If you have children and want to protect their identity, Zander allows a more economical approach for large families. A Zander ID Theft Protection plan for families covers two adults and up to ten children, whereas Norton LifeLock’s family plan covers two adults and up to five children.

Zander Identity Theft pros and cons

- Low monthly price for ID protection

- Easy-to-use dashboard

- Monitor personal information to detect fraudulent activity

- No credit monitoring

- Trackers and third-party affiliate cookies on site

Norton LifeLock pros and cons

- Monitors three credit bureaus, credit score, and credit reports

- Provides up to $3 million in recovery damages

- Doesn’t sell personal information

- Higher monthly price point

- Less economical family coverage

- Poor customer service

Zander Identity Theft Protection vs. Norton LifeLock: prices

Zander Identity Theft Protection |

Norton LifeLock |

|

| Monthly price range | $6.75-$19.49/mo | $7.50–$38.99/mo for first yr |

| Yearly price range | $75.00–$215.00/yr | $99.48–$491.88/yr |

| Best value plan | Elite Cyber Bundle (Individual) for $9.99/mo | LifeLock Ultimate Plus Individual for $19.99/mo for first yr |

| Identity theft insurance | Up to $1 million | Up to $3 million |

| View Plans

Read Zander ID Theft Review |

View Plans

Read Norton LifeLock Review |

Zander Identity Theft plans

Zander ID theft plans provide two levels of protection for families and individuals, the Essential Plan and the Elite Cyber Bundle. Zander doesn’t advertise a free trial, but with rock-bottom monthly pricing, users can try it for a low monthly cost and then cancel if the protection plan doesn’t live up to the hype.

Essential Plan

The Essential Plan is Zander’s basic plan that covers the following:

- All types of identity theft

- Home title fraud

- Unlimited recovery services up to $1 million for stolen funds and expenses

- Dark web monitoring

- Social Security number monitoring

- Change of address monitoring

- Data breach updates

- Lost Wallet Service that quickly terminates and re-orders the contents of a lost wallet or purse

- 24/7 recovery services

Family plans offer the same coverage for up to ten minor children. Each family member is eligible for up to $1 million in reimbursement for stolen funds.

Elite Cyber Bundle

The Elite Cyber Bundle offers the same benefits as the Essential Plan plus:

- VPN

- Antivirus

- Account takeover notifications

- New account alerts

Norton LifeLock plans

All three of Norton LifeLock identity protection plans offer a high degree of account monitoring and features. Individual plans cover one adult, but there are two family plans available. One covers two adults, and the other covers two adults and up to five dependent children.

Try Norton LifeLock for free with a 7-day trial, but come prepared with credit card information as it is required for the free trial. LifeLock also offers a 60-day money-back guarantee for annual memberships, and you should also keep in mind it offers reduced pricing for your first year of service.

Standard

The Standard plan offers:

- $1 million in lawyer and expert coverage

- $25,000 in stolen funds reimbursement if you become a victim of identity theft

- $25,000 in personal expense compensation

- Identity and SSN alerts

- One-bureau credit monitoring

Advantage

An Advantage plan by Norton offers an increased amount of coverage at $1,200,000; $1 million in lawyer and expert fees, and up to $100,000 in both stolen funds reimbursement and personal expense compensation.

In addition to the benefits of the Standard plan, the Advantage plan offers:

- Crime alerts in your name

- Buy now, pay later alerts

- Phone takeover monitoring

Ultimate Plus

The Ultimate Plus plan is the best value for your money, offering all the benefits of the previous plans and up to $3 million in coverage.

The Ultimate Plus plan also gets you:

- Three-bureau monitoring

- Credit reports and scores

- Dark web monitoring

Zander Identity Theft Protection vs. Norton LifeLock: monitoring and alerts

| Feature |  Zander Identity Theft Protection |

Norton LifeLock |

| Credit monitoring | ||

| Financial activity alerts | ||

| 3-bureau credit reports | Yes — Experian, Equifax, TransUnion | |

| Credit score | ||

| FICO score | ||

| Credit lock and freeze | ||

| Identity recovery | ||

| Dark web alerts | ||

| Social media account alerts | ||

| Social Security number monitoring | ||

| Home title monitoring | ||

| Address change alerts | ||

| View Plans

Read Zander ID Theft Review |

View Plans

Read Norton LifeLock Review |

The main difference between a Norton LifeLock plan and a Zander ID Theft Protection plan comes down to credit monitoring. All Norton LifeLock plans include some form of credit monitoring and credit bureau reports, while Zander Identity Theft Protection plans encourage users to monitor that information through other free services.

Norton LifeLock plans also allow users to try the product in a free, seven-day trial, whereas Zander Identity Theft Protection plans immediately start charging for services.

Another glaring difference is obviously the price. The discrepancy between the two monthly prices cannot be ignored. But while Norton LifeLock plans start at a steeper price, they also offer more services and features to protect your identity. And the premium plan offers more restoration coverage to help you deal with the consequences of identity theft.

Which is safer, Zander Identity Theft or Norton LifeLock?

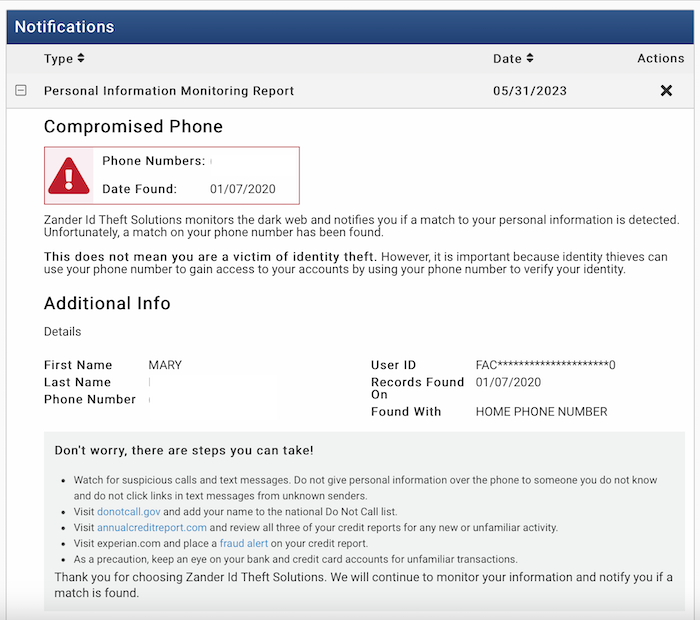

Both providers collect a reasonable amount of data as part of enrollment for services. If you want your information monitored, you have to provide it in the first place. Zander and Norton collect identifying and sensitive information like Social Security numbers, driver’s license numbers, bank information, passport numbers, and insurance information. This allows Norton LifeLock and Zander ID theft protection plans to monitor your identity.

Both Zander and Norton offer added security through two-factor authentication.

Zander Identity Theft Protection vs. Norton LifeLock data security

Zander Identity Theft Protection |

Norton LifeLock |

|

| Two-factor authentication | ||

| Multi-factor authentication | ||

| Collects data | ||

| Shares data with third parties | ||

| View Plans

Read Zander ID Theft Review |

View Plans

Read Norton LifeLock Review |

Out of necessity, identity theft protection plans collect and store some of your personal data. Both providers might have to share some of your information with third-party services for monitoring as well. This is common with identity theft protection plans.

According to Norton LifeLock’s privacy plan, it doesn’t sell your data and only uses your information to provide services.

According to its privacy policy, Zander does share your information with third parties, and the site allows third-party cookies and trackers—though you do have the option to block cookies and opt out of data sharing.

Zander Identity Theft Protection vs. Norton LifeLock: compatibility and ease of use

| Platform |  Zander Identity Theft Protection |

Norton LifeLock |

| Windows | ||

| macOS | ||

| Android | ||

| iOS |

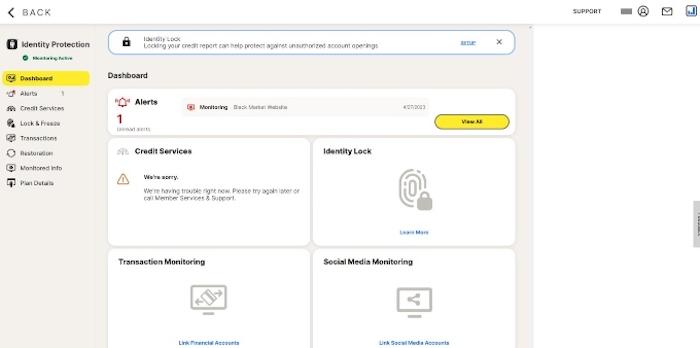

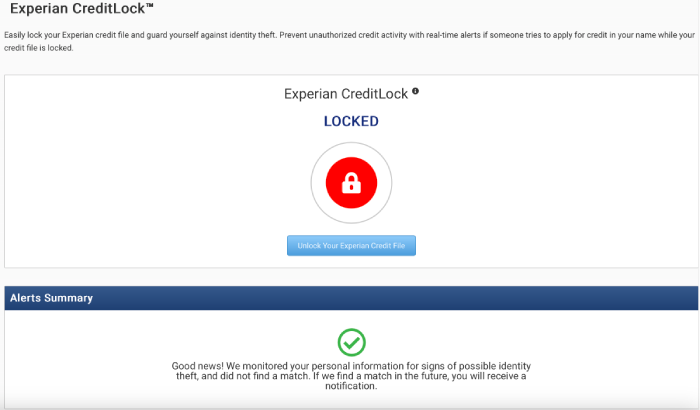

Each service offers easy-to-use, intuitive websites and mobile apps for both Android and Apple products. We had no problem setting up an account with Norton LifeLock's identity protection service. There is no need to install anything on your browser, as the dashboard is available by logging into your account. The dashboard was intuitive and easy to navigate with an alert notification prominent on the main page.

Similarly, a Zander Identity Protection account is easy to set up, and we encountered no issues accessing the web portal. Like Norton LifeLock, the main dashboard displays alerts and notifications.

Zander Identity Theft Protection vs. Norton LifeLock: customer service

Zander Identity Theft Protection |

Norton LifeLock |

|

| 24/7 live chat | ||

| Phone | ||

| Support forums | ||

| Online guides |

Our customer experience with Norton LifeLock customer service agents left a lot to be desired. We found Zander ID Theft’s customer service equally disappointing.

We contacted Norton LifeLock customer service representatives via the live chat option on their website, and when we asked about specific monitoring, the customer service agent responded with unrelated information. Eventually, the representative told us the LifeLock Advantage plan provides monitoring for both Equifax and TransUnion bureaus, which isn’t correct, as the website claims that plan only offers Equifax. The rep then ended the chat.

We opened another chat and got the same customer service rep, who then changed their answer to Equifax, which is correct, but the entire experience didn’t instill the level of confidence we’d like to see.

Zander Identity Theft doesn’t offer a live chat, instead offering a Contact Us form and a phone number for customer service inquiries. Just finding Zander’s support center proved to be a challenge, as the website routed us to multiple pages before we finally found a Contact Us page. It took us more than 24 hours to receive a non-helpful response, but the representative was polite.

Zander Identity Theft Protection vs. Norton LifeLock FAQs

Is Zander ID Theft Protection good?

If you have a tight budget and need identity theft protection services, Zander Theft is a good option. Put in the extra work to block cookies and opt out of data sharing, and you have identity theft monitoring for a very reasonable price.

Is LifeLock good?

While a steeper monthly cost than Zander, the services and features of LifeLock protection plans are hard to beat. LifeLock provides an above-average identity protection service based on our testing and research.

What’s the difference between Zander and LifeLock?

When it comes to identity protection plans, the main difference between Zander and LifeLock is the credit monitoring services offered by LifeLock. Zander offers no credit monitoring, while LifeLock offers access to three credit bureaus as well as preventative measures and protections to keep your identity from being compromised in the first place.

Zander Identity Theft Protection vs. Norton LifeLock: which is better?

Identity theft protection is an important step in securing your privacy and security, but choosing an identity protection plan that fits your needs and budget can be challenging.

A Zander Identity Theft Protection plan is a more budget-friendly option that still provides the same benefits of identity protection and monitoring. A Norton LifeLock protection plan may cost more, but it entails more security features and protection.

While some protection is better than none, if your budget permits, we recommend investing in a Norton LifeLock protection plan.

Zander vs LifeLock identity theft protection alternatives

If Zander and LifeLock don't fit your needs, there are other options out there. Here's what we recommend checking out next:

- Aura: If you don't mind the price, Aura's protection covers almost every facet of modern life, including your child's online safety. Features like spam call protection and anti-cyberbullying software make this one of the best identity theft protection services all around.

Get Aura | Read Our Aura Review - Identity Guard: Another low-cost option, Identity Guard provides extra features you might feel are missing from Zander. This includes credit monitoring, bank account alerts, and a password manager.

Get Identity Guard | Read Our Identity Guard Review

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking