-

Provides up to $1 million in identity theft insurance

-

Covers up to two adults and five children on one plan

-

Only available to Costco members

Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

We recommend Costco Complete ID protection if you’re a Costco member who wants a low-cost identity monitoring and restoration solution. Starting at $8.99/mo for Costco Executive members, Complete ID is quite affordable for up to $1 million in identity theft insurance.

Keep in mind that you have to be a Costco member to use this service and the price can vary depending on your Costco membership level. If you’re not a Costco member, you’d have to pay $60 to $120 per year for a membership and then you could access Complete ID.

Let’s jump into our Costco Complete ID protection review to see if this is the right identity monitoring service for you.

What does Costco Complete ID protect against?

Costco Complete ID features

Our experience with Costco Complete ID Theft Protection

Does Costco Complete ID keep your data safe?

Costco Complete ID compatibility

Costco Complete ID customer support

Costco Complete ID prices and subscriptions

Costco Complete ID FAQs

Bottom line: Is Costco Complete ID theft protection good?

Costco Complete ID review at a glance

| Costco Executive Member price | $8.99–$18.99/mo |

| Costco Business or Gold Member price | $13.99–$29.99/mo |

| Identity theft insurance | Up to $1 million |

| Credit monitoring | Yes |

| Credit reports | Yes — Experian, TransUnion, and Equifax |

| Credit score | Yes — VantageScore |

| Identity recovery | Yes |

| Dark web alerts | Yes |

| Social media account alerts | Yes |

| Details | Get Costco ID Protection |

We think Costco Complete ID theft protection makes sense if you’re a Costco member and want a low-cost service to help protect against identity theft. You can customize plans for just yourself or get a family plan for up to two adults and five children.

Costco Complete ID offers one type of protection plan that varies in price depending on how many people you want to add to your subscription and what kind of Costco membership you have. The price ranges from $8.99–$18.99/mo if you're an Executive Member and $13.99–$29.99/mo for Gold and Business Members.

All plans receive up to $1 million in identity theft insurance and the same benefits, including identity theft monitoring, credit monitoring, and identity restoration services. It’s nice that Complete ID has three-bureau credit monitoring because you don’t get that with all identity theft monitoring services.

Whether ID theft protection is worth it for you depends on what you’re looking for. The best identity theft protection service for you is the one that has all the features you need to give you more peace of mind. Overall, we think Costco provides a good product in partnership with Experian, and the starting price of $8.99/mo is relatively low.

Costco identity theft protection pros and cons

- Provides up to $1 million in identity theft insurance

- Offers identity, financial, dark web, criminal record, mail change, SSN, and alternative loan monitoring services

- Can help protect up to two adults and five children on one plan

- Only available to Costco members

- Low-rated mobile apps

What does Costco Complete ID protect against?

Costco Complete ID helps protect you against these identity theft situations:

- Identity theft: Complete ID monitors information related to your identity to help protect you from identity theft losses. This includes monitoring your credit reports, your Social Security number (SSN), USPS address changes, the dark web, public records of criminals, financial accounts, and more.

- Child identity theft: You can add up to five kids to a Complete ID subscription plan if you want a way to protect your child and help prevent child identity theft.

- Fraudulent financial activity: Complete ID provides opportunities to monitor different types of financial accounts, including credit or debit cards, bank accounts, and retail or membership cards. Receiving fraud alerts about someone trying to access or use one of your accounts could help you avoid a case of financial identity fraud.

Costco Complete ID features

Some of Costco Complete ID’s top features include credit monitoring, identity monitoring, and identity restoration services. We especially like how many alerts you can set up to help with identity monitoring, such as personal alerts on your phone and email address or financial alerts with credit cards and bank accounts.

It’s also helpful that three-bureau credit monitoring is a base benefit you don’t have to pay more for, as it’s commonly part of higher-priced plans with other identity monitoring services.

Costco Complete ID Theft Protection features

| Feature | Costco Complete ID |

| Who’s covered | Max 2 adults and 5 children |

| Identity theft insurance | Up to $1 million |

| Credit monitoring | |

| Financial activity alerts | |

| Credit reports | Yes — Experian, TransUnion, and Equifax |

| VantageScore | |

| Credit lock and freeze | Yes — Experian CreditLock |

| Identity restoration | |

| Dark web alerts | |

| Social media account alerts | |

| Social Security Number monitoring | |

| Home title monitoring | |

| USPS address change alerts | |

| Details | Get Costco Complete ID |

Costco credit monitoring

Costco Complete ID is a part of Experian, which is one of three major credit bureaus. But Complete ID provides credit monitoring for all three bureaus: Experian, Equifax, and TransUnion.

Complete ID doesn’t really explain how it alerts you about any applicable credit monitoring events, but you should receive an email or text notification about any of your personal information being used to open or apply for a new account.

Credit reports and credit scores

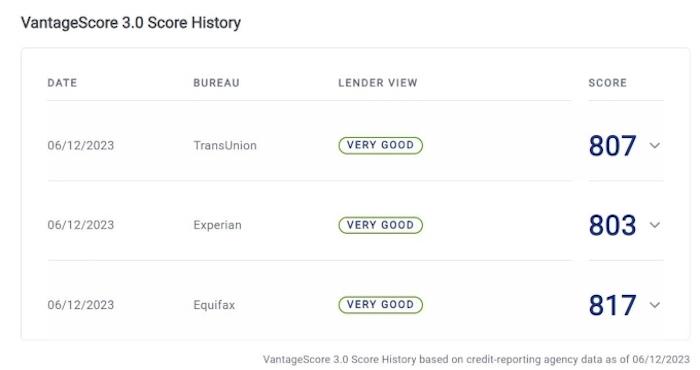

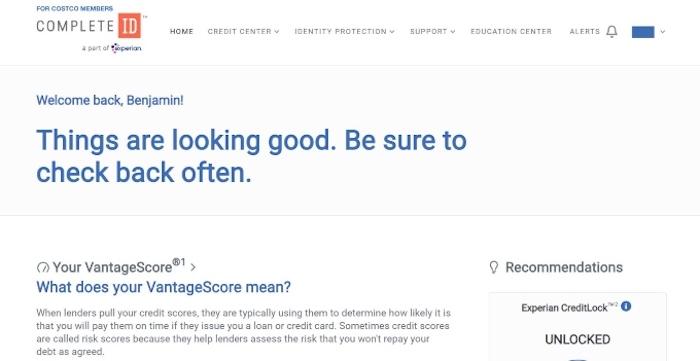

Within our Complete ID account, we found a “Credit Center” tab where we could access “VantageScore Overview” and “Credit Report” areas. Your VantageScore is a type of credit score based on the VantageScore model, similar to a FICO score.

In the VantageScore Overview, you can see a VantageScore 3.0 Score History associated with all three credit bureaus. This could be useful because seeing whether your score has gone up or down over time can lead you to look at your credit reports to see why your score has changed.

You can then go to the Credit Report section and see detailed information about your credit reports from the three credit bureaus. You can check a number of things in this section, including credit inquiries from different companies.

So if you see your credit score drop a few points and you don’t recognize a certain credit inquiry, it might be worth looking into for identity protection purposes, but also to keep your credit history healthy. You can dispute any inquiry you don’t recognize for free through the credit bureaus and potentially have it removed from your credit report.

Note that you can receive annual credit reports from all three credit bureaus through Complete ID. Your Experian VantageScore is updated on a monthly basis, while the TransUnion and Equifax VantageScores are updated on an annual basis.

Identity monitoring

Costco Complete ID theft protection provides a variety of monitoring features and alerts, including:

- Dark web surveillance: Monitors the dark web for any instances of your personal information being shared, including email addresses and phone numbers.

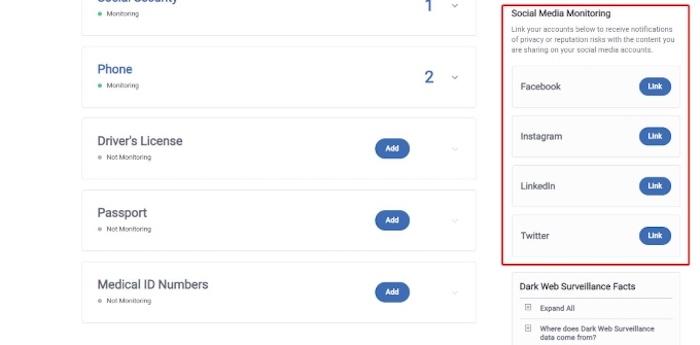

- Personal information monitoring: Monitors for suspicious activity related to your personal information. Complete ID automatically starts monitoring your email address, SSN, and phone number when you create your account. But you can also add your driver’s license, passport, and medical ID numbers. You can also add multiple email addresses and phone numbers.

- Financial account monitoring: Complete ID automatically starts to monitor the payment method you used to pay for your subscription. In our case, that was a credit card. You can also add more credit cards, debit cards, bank accounts, and retail or membership cards for monitoring.

- Criminal record monitoring: Tracks court system records to see if any of your personal information matches any criminal records. This could be useful if a criminal is using a false identity.

- Neighborhood watch: Monitors registered sex offenders that live in or move into your area. Also monitors to see if any registered sex offenders have your identity.

- Alternative and payday loan monitoring: Monitors alternative and quick-cash loans related to your identity.

- Mail change: Monitors if your mail has been redirected to another address in case thieves are trying to steal your personal information.

- Social media: Monitors connected social media accounts for any privacy or reputation risks. You can currently connect Facebook, Twitter, Instagram, and LinkedIn accounts for monitoring.

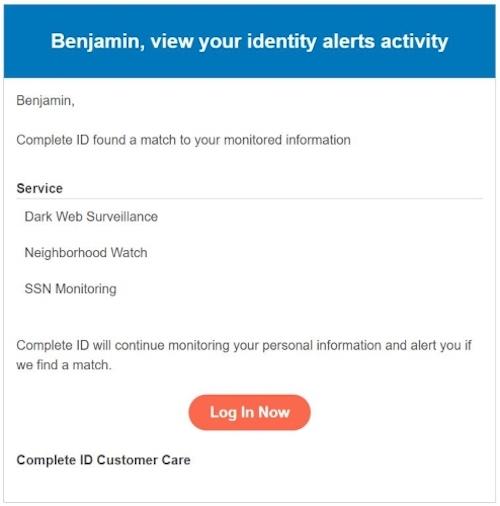

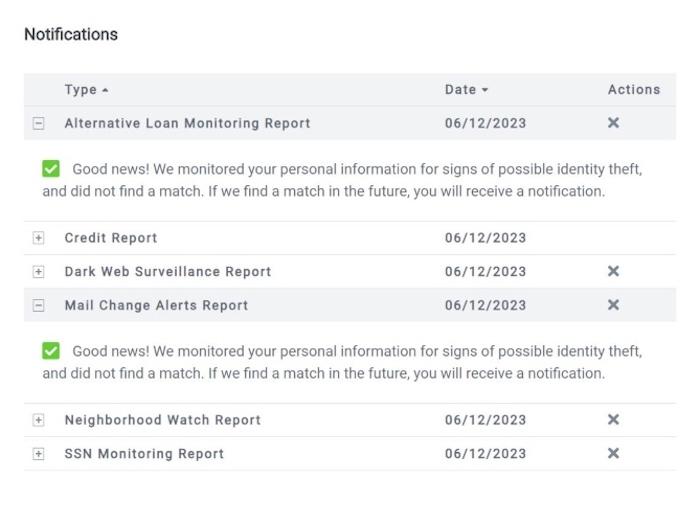

Note that Complete ID will email you about different alerts. You can also choose to receive text message alerts in your account settings. Here’s an example of an email we received with some alert notifications:

Soon after setting up your account, you should receive a few reports that you can check out in your account’s alert notifications. Some of the reports we received didn’t find anything, while others had alerts about personal information being out there.

If you receive an alert related to your personal information, you can contact the customer support team about what to do next.

Identity restoration services

Identity restoration is the process of restoring your identity if you’ve been a victim of identity theft. Complete ID can make the process easier for you by walking you through different steps and potentially doing some of the legwork on your behalf, such as filing paperwork or making calls.

Complete ID plans provide up to $1 million in identity theft insurance with a $0 deductible. This insurance is meant for expenses associated with your identity theft recovery, which could include:

- Lost wages or income

- Attorney and legal fees

- Expenses incurred for refiling of loans, grants, and other lines of credit

- Costs of child care and/or elderly care incurred as a result of identity restoration

The Complete ID customer support team is available 24/7 to help answer questions and get you in contact with a restoration specialist if needed. Complete ID can also help with lost wallet recovery if your wallet has been stolen or lost. That means you can get help securing and replacing important documents, such as your driver’s license and passport.

Note that you have to go through a claims process to take advantage of Complete ID identity theft insurance. This includes calling the Complete ID customer service number to make a claim within 60 days of the date of discovery, which essentially means the date you found out about an identity theft occurrence.

Our experience with Costco Complete ID Theft Protection

We had no issues signing up for a Costco Complete ID account and using the service to set up identity monitoring and alerts. You don’t have to install anything if you’re using a web browser; it’s simply a matter of creating an account and then logging in.

Keep in mind that you can find information about Complete ID on the Costco website, but you will ultimately need to navigate to the Complete ID website if you want to sign up.

Once we logged in to our account, it was easy to navigate through the dashboard and start setting up monitoring and alerts for our personal and financial information.

Note that you have to provide your name and Social Security number when you sign up, so Complete ID will automatically start monitoring certain things upon account creation, such as alternative loans and criminal records.

Not receiving alerts about these types of services doesn’t mean they’re not working, it just means Complete ID hasn’t found any instances of your identity being used. So if you don’t receive alerts from some of the monitoring services, that’s a good thing.

We found Costco Complete ID to be helpful in multiple ways but we especially liked being able to set up different types of monitoring and alerts. We know some of our information is out there simply because we use the internet and sign up for different services, but it’s nice to know whether we should take action or not depending on the type of alert we receive.

For example, our email was found many times on the dark web, but we’ve set up multiple security measures to protect our password and account, so those types of alerts aren’t too worrisome. But if we were to receive an alert about our Social Security number, we might be prompted to do something about it.

As a side note, we had a hard time figuring out whether Complete ID provided any type of social media monitoring. It’s not exactly advertised in plain sight on the Complete ID website and its location in our account isn’t obvious either. But if you’re interested, you can link social media accounts by navigating to the “Identity Monitoring” area in your account and looking down and off to the side for an almost hidden section.

Does Costco Complete ID keep your data safe?

Costco Complete ID, like just about any identity monitoring service, collects a lot of your personal information, including your name and Social Security number. But you can also provide additional information for the service to monitor, such as your driver’s license, passport, medical ID numbers, bank accounts, and more.

It seems wrong to provide all of this information to a service provider that could be hacked, but that’s part of the risk of using an identity protection service. Fortunately, Complete ID outlines how it uses and shares your information, and it doesn’t appear to be anything out of the ordinary.

Complete ID also outlines its security practices to help protect your personal information. In general, sensitive information (such as a credit card number or Social Security number) is encrypted and appropriate tools have been put in place that comply with “relevant legal requirements and best practices.”

Complete ID says it doesn’t “sell or share your personal information with any other third parties for their promotional use or for their marketing purposes.” This is found specifically in a section of the privacy policy about sharing information with Costco, who Experian partners with to provide Complete ID.

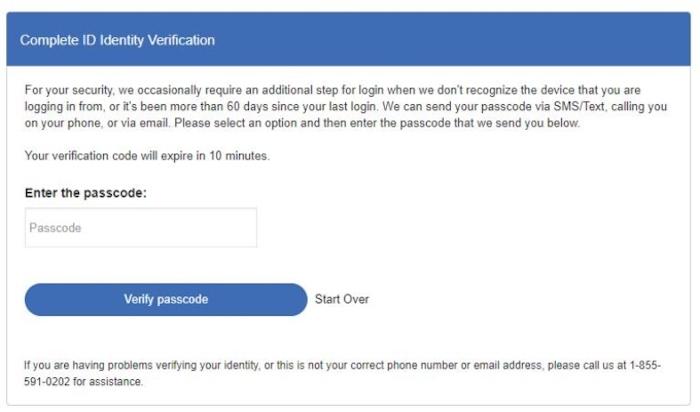

Note that we couldn’t find an option to enable two-factor or multi-factor authentication with our Complete ID account. But when we tried to log in to our account through a web browser, we were required to go through an identity verification process, which was nice to see.

Costco Complete ID compatibility

Costco Complete ID is available on web browsers and mobile apps. However, we recommend using a web browser to access your account because the mobile apps have poor ratings.

The Complete ID iOS app in the App Store has a 2.1 out of 5 rating, while the Complete ID Android app in Google Play has a 2.2 out of 5 rating.

In general, Complete ID reviews mention multiple errors while using the apps, which makes the experience unreliable. Note that we had a great experience using Costco Complete ID in a Chrome browser on our desktop computer.

Costco Complete ID customer support

Costco Complete ID has one live support option, which is calling its customer service line at 1-855-591-0202. The Complete ID support team is available 24/7, 365 days a year.

For help learning more about identity theft protection and different Complete ID services, you can check out the Education Center. This is a blog where you can find different types of educational posts. You don’t need a Complete ID account to access the Education Center.

If you have an active Complete ID account, you can access the Digital Privacy Help Center under the “Support” tab in your account. This lets you explore information about the password manager, VPN, and safe browser included with your membership.

Costco Complete ID prices and subscriptions

Costco Complete ID costs between $8.99–$18.99/mo for Executive Members and $13.99–$29.99/mo for Gold and Business Members, depending on how many people are on the plan. This pricing is similar to what you can find from other popular identity theft protection products:

- Norton LifeLock: $7.50–$38.99/mo for first yr

- Allstate Identity Protection: $9.99–$36.00/mo

- Identity Guard: $6.67–$19.99/mo

Note that all Complete ID plans are charged on a monthly basis, while other identity theft protection companies typically provide you with a choice for a monthly or annual subscription. In most cases, annual subscriptions are cheaper per month than monthly plans, so it’s unfortunate that Complete ID doesn’t provide that option.

Keep in mind that Complete ID plans require a Costco membership. If you purchase a Complete ID subscription for multiple adults, each adult is required to be an active Costco member with the same Costco membership level.

As of the time of writing, it costs $60 per year for a Costco Gold Star membership, while an Executive membership costs $120 per year. Costco Executive members receive better Complete ID pricing compared to Gold Star members.

For example, it costs $8.99/mo for a Costco Executive member to purchase a Complete ID subscription for one adult. The same plan costs $13.99 per month for a Gold Star member.

Costco Complete ID theft protection prices

| Plan | Monthly cost | Who’s covered | Details |

| One Adult |

Executive Members: $8.99/mo Business & Gold Members: $13.99/mo |

1 adult | View Plan |

| One Adult + Children |

Executive Members: $11.98/mo Business & Gold Members: $17.98/mo |

1 adult + up to 5 children | View Plan |

| Two Adults |

Executive Members: $15.99/mo Business & Gold Members: $25.99/mo |

2 adults | View Plan |

| Two Adults + Children |

Executive Members: $18.99/mo Business & Gold Members: $29.99/mo |

2 adults + up to 5 children | View Plan |

Costco Complete ID FAQs

Is Costco Complete ID worth it?

It’s worth it if you’re a Costco member and want a low-cost service to help with identity protection, credit monitoring services, and identity restoration. With up to $1 million in ID theft insurance and starting at $8.99/mo, Costco Complete ID could make a lot of sense for Costco Gold Star or Executive members.

Is IdentityWorks the same as Complete ID?

IdentityWorks is an identity theft monitoring service directly from Experian, while Complete ID is a similar service that’s part of Experian, but offered through Costco. If you’re not a Costco member, you could sign up for IdentityWorks. If you’re a Costco member, you could sign up for either service.

How good is Costco identity theft protection?

Costco Complete ID identity theft protection is part of Experian, which is a trusted major credit bureau. In addition, it’s a service that’s specifically reserved for Costco members, so you can typically expect a high-quality experience.

And for up to $1 million in ID theft insurance, it doesn’t get much cheaper than starting at $8.99/mo.

What is Complete ID from Costco?

Complete ID is an identity theft protection service that’s part of Experian, but offered only to Costco members. It costs between $8.99–$18.99/mo for Executive Members and $13.99–$29.99/mo for Gold and Business Members, depending on how many people you add to a plan.

Complete ID provides identity protection, credit monitoring, and up to $1 million in ID theft insurance.

Bottom line: Is Costco Complete ID theft protection good?

We think Costco Complete ID theft protection is an inexpensive service that provides everything you need to get started with identity monitoring. It had three-bureau credit monitoring and loads of alert options starting at $8.99/mo.

Of course, you have to be a Costco member, which costs at least $60 per year, to access Complete ID. That might not be worth the cost if Complete ID is the only reason you want to sign up for a Costco membership.

For more information on how to protect yourself against identity theft, check out our identity theft protection and credit monitoring guide.

-

Provides up to $1 million in identity theft insurance

-

Covers up to two adults and five children on one plan

-

Only available to Costco members