-

Access to TransUnion credit information

-

Premium plan offers other great identity theft services

-

Unclear about its product offerings

Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Before you apply to finance a new car or a mortgage, the lender is likely to ask if you know your credit score. Banks use your credit score, among other things, to evaluate to whom they should lend money. The credit score is part of a larger credit report, which details your financial history and debts to help make those decisions.

There are many different ways to check your credit report. Federal law gives consumers the ability to access a copy of their credit report once every 12 months. This includes information from the three credit bureaus: Equifax, TransUnion, and Experian.

However, if you want to access your credit report more often, you can use a service like Credit Sesame. These credit monitoring services give you additional access to your credit report and include other benefits, like identity theft monitoring, wallet protection, and more.

We tried a free Credit Sesame account to learn about its credit monitoring features and more.

What does Credit Sesame protect against?

Credit Sesame features

Does Credit Sesame keep your data safe?

Credit Sesame compatibility

Credit Sesame customer support

Credit Sesame prices and subscriptions

Credit Sesame FAQs

Bottom line: Is Credit Sesame good?

Credit Sesame review at a glance

| Price | $9.57-$15.95/mo (for paid plans) |

| Credit monitoring | Yes |

| Credit reports | Yes — TransUnion, Experian, and Equifax |

| Credit score | Yes |

| Credit builder account | Yes |

| Identity monitoring | Yes (with Premium plan) |

| Mobile app | Yes — iOS and Android |

| Identity theft insurance | Up to $1 million (with Premium plan) |

Credit Sesame offers robust free services to monitor your credit, which makes identity theft protection worthwhile. With its Basic plan, you can keep an eye on your credit report for any changes and prevent any identity theft that may take place with your information. With Credit Sesame, you can also access your TransUnion credit information and VantageScore 3.0 credit score, which is updated daily.

Credit Sesame’s Basic plan includes free credit monitoring, so you can receive notifications any time there is a credit score update. These could be caused by new credit inquiries or if your credit usage changes. This plan is a great option for anyone who wants to keep track of their credit but doesn’t need in-depth analysis. From your free credit report, you will be able to have a general idea of your credit score. This can be helpful when looking at interest rates and overall approval odds for new debt.

Credit Sesame pros and cons

- Access to TransUnion credit information

- Offers extensive credit monitoring

- Premium plan offers other great identity theft services

- Transparency into the Premium plan is lackluster

- Unclear about its product offerings

What does Credit Sesame protect against?

Credit Sesame helps you protect your identity and personal finances. By regularly checking your credit score and report, you can more easily find out if someone has stolen your identity. However, Credit Sesame doesn’t protect your identity if you are not monitoring your credit activity.

If you notice something suspicious from your credit monitoring, you will still need to take the necessary steps to remedy the issue. If you opt for a Premium account, Credit Sesame can help with your recovery efforts. Credit Sesame offers Premium users up to $1 million in identity theft insurance. This insurance covers legal fees and expenses resulting from any of the following situations:

- Fraud or embezzlement

- Theft

- Forgery

- Data breach

- Stolen identity event

Credit Sesame also offers free subscribers up to $50,000 in identity theft protection to help offset any identity theft losses.

Credit Sesame features

Credit Sesame offers quite a few features to help you understand your overall credit situation and to help you plan for the future.

Credit monitoring

Credit Sesame helps you monitor your credit for any fraudulent or suspicious activity. You can set up notifications based on your preferences, including email or push notifications from the mobile app. You can also access these alerts from the Credit Sesame dashboard or sign up for text message alerts.

You will receive alerts when there are changes to your credit report, such as:

- An increase or decrease in credit score

- A new inquiry into your credit report from a lender

- New accounts opened

- Delinquent payments

- Changes to or new public records

Credit monitoring alerts can help you catch identity theft quickly. For instance, you may receive an alert that a new credit inquiry was made on your credit report. However, you may not have applied for any new credit or loans in the last few days. In this scenario, you could report this concern to the credit bureaus before a fraudster can open an account in your name.

Credit reports and credit scores

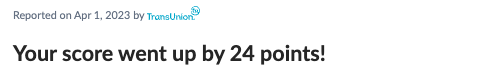

Credit Sesame provides Basic users with a credit dashboard that shows your latest TransUnion credit score, along with a debt analysis and credit analysis. The credit analysis will compare your last credit score with the most recent and highlight any changes to your score between the two.

If you try to access your TransUnion credit report while using the Basic plan, Credit Sesame will ask you to upgrade your plan. However, you can still access basic information from your TransUnion credit report by going through each section of the credit analysis section to see what’s impacting your score. A Premium account gives you access to all three full credit reports and credit scores.

Your credit report and credit scores indicate how you’ve handled debt in the past and how likely you are to repay new debts. The higher the credit score, the more likely you are to pay back your lenders.

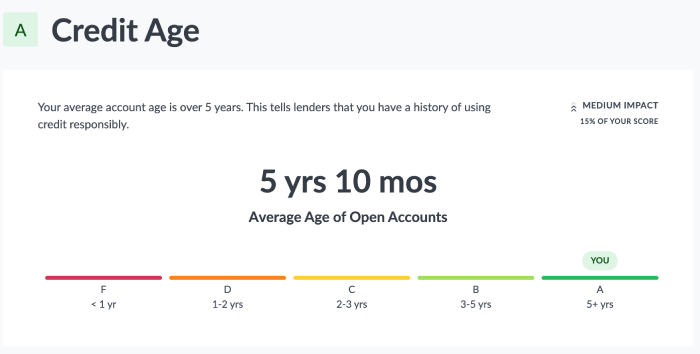

Your credit score is calculated based on the following:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- New credit: 10%

- Credit mix: 10%

Your credit report will give lenders detailed information about your credit score. This will include all of your open accounts, outstanding balances, and closed accounts. They can also see how many times you’ve applied for credit and any public records including liens or foreclosures. When reading your credit report, you’ll want to look through each of these sections for any incorrect or inaccurate information.

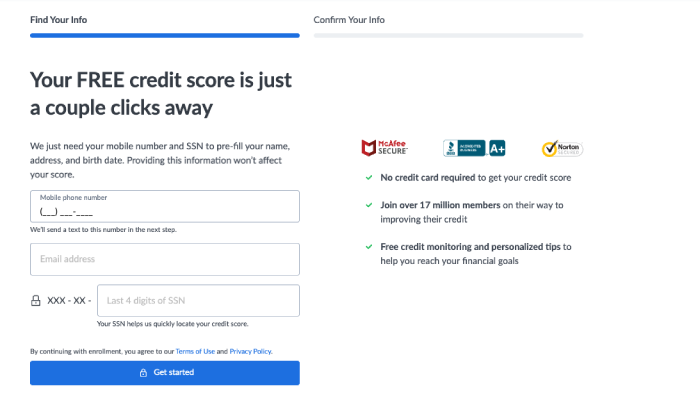

Our experience with Credit Sesame

Signing up for Credit Sesame is simple and easy. You’ll just need to provide a few bits of information, including your email address, phone number, and Social Security number to get started. Credit Sesame can pull your information from there to create your account.

Once you set up your account, you’ll see the Credit Sesame overview, which gives you details about your credit score as well as a credit and debt analysis. To accurately use the debt analysis, you’ll want to fill out your profile to include your income, too. When we first signed up, it had a prepopulated income for us and we’re not sure where it came from.

Throughout the overview, Credit Sesame will recommend credit cards that you’re likely to be approved for and other action items that could help you improve your overall credit score.

The notifications tab shows you every change from Credit Sesame’s credit monitoring tool. Keep in mind that companies report to the credit bureaus only once a month, so some of these notifications may seem behind. However, if your credit is pulled for a new loan, you will receive notification almost instantly.

Credit Sesame also grades you individually on each portion of your credit score, such as inquiries or credit age. We found this useful because it helps you look at each portion of the credit score so you can see what you are doing well and where you could improve if you wanted to increase your overall score.

Credit Sesame will provide a variety of information about your financial health and credit score, but not all of it will be accurate. You’ll see a debt analysis, which shows your total debt, monthly payments, and your debt-to-income ratio. We updated our income level to an accurate amount and it didn’t change the debt-to-income ratio, so it may not be as accurate as it seems. Your debt-to-income ratio is another indicator for lenders of how much debt you have relative to how much money you bring in.

We found it hard to find any information about the Premium plan unless you’re signed in with the Basic plan. And once you upgrade to the Premium plan, it’s hard to find the Premium features that were previously promoted so clearly on the sidebar.

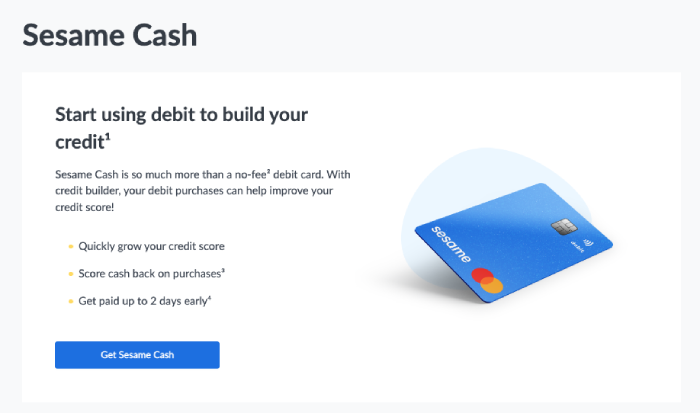

Sesame Cash

Sesame Cash is an additional product offered by Credit Sesame. Sesame Cash is a prepaid debit card that allows you to get your direct deposit funds up to two days earlier than your payday.

As part of Sesame Cash, you can also use Credit Builder, which acts as a credit card and is reported to the credit bureaus. Credit Builder uses money deposited into the account from your Sesame Cash account. In essence, you’re acting as your own bank to borrow money to a credit card, which Credit Sesame then reports to help you build credit.

Additional features

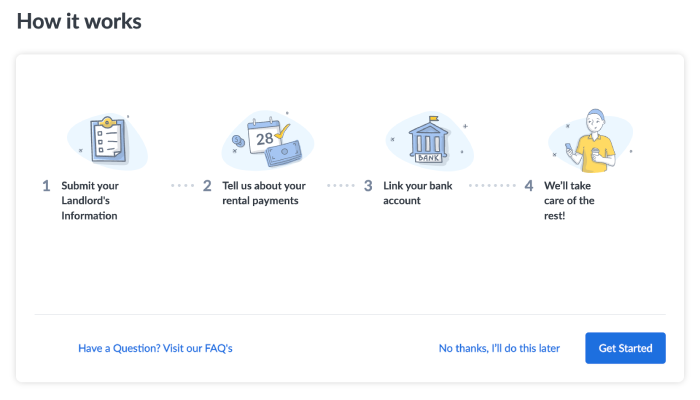

You’ll find a few more helpful features if you sign up for the Premium membership, which may be more comprehensive in protecting your identity or improving your credit score. Rent reporting is a helpful way to improve your credit score by showing your on-time rent payments. Typically, only mortgage payments are reported to the credit bureaus. However, Credit Sesame lets you show your consistent, on-time rental payments to boost your score.

The Premium plan also touts an ID monitoring solution, but we’re not sure if it scans the dark web for your information or if it just tracks activity on your credit report to help reduce ID theft. Another great Premium feature is wallet protection. With wallet protection, you contact Credit Sesame’s experts to help you cancel credit cards or replace any stolen cards or identification.

Does Credit Sesame keep your data safe?

Credit Sesame uses AES 256-bit encryption and SSL 128-bit SSL encryption. It also touts that its security practices have been verified by Verisign, TRUSTe, and McAfee SECURE.

In addition, Credit Sesame outlines a fairly robust privacy policy on its website, stating that it does not sell user information. We didn’t see anything that was worrisome in its privacy policy.

Credit Sesame compatibility

Credit Sesame has an easy-to-use website that you can access on any browser. In addition, it also has an iOS and Android app, which makes it easy to access your credit information from your phone. The Credit Sesame app has a 4.7-star rating in the Google Play store and a 4.8 rating in Apple’s App Store.

Credit Sesame customer support

Credit Sesame has limited customer support for free members. It offers a comprehensive help center, but you must submit a request form if you cannot find your answer through this platform.

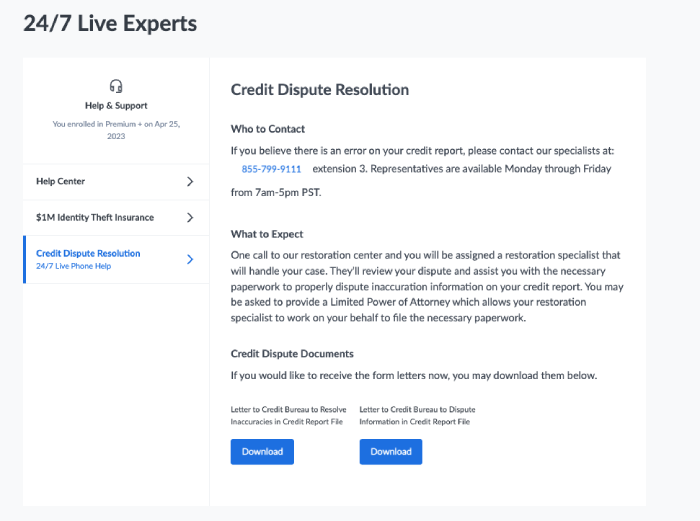

However, Premium members gain access to 24/7 support. This includes credit dispute resolution resources, identity theft insurance, and any other question that requires customer support. Premium members also have a phone number that they can call to speak to a Credit Sesame representative.

Credit Sesame prices and subscriptions

Credit Sesame offers two different types of plans. The Basic plan gives you access to your credit report, credit score, and credit monitoring, all based on information from TransUnion. The Premium plan gives you access to all three of your credit reports and scores, as well as advanced credit monitoring, $1 million in identity theft insurance, wallet protection, and ID monitoring. You can sign up for the Premium plan month-to-month, so if you needed to look at all three credit scores or have more active monitoring, you could do that for just a month or two.

Credit Sesame also offers a 7-day free trial for its Premium plan, but this trial doesn’t provide access to all three credit reports. You have to convert to a paying customer to gain access to them.

Credit Sesame does not offer a plan that includes more than one individual or that allows you to monitor your children’s credit reports. However, with the free plan, you could create an account for each person you’d like to monitor. This can help you prevent child identity theft.

Credit Sesame plans comparison

| Plan | Credit Sesame Free | Credit Sesame Premium |

| Price per month | Free | $9.57/mo |

| Who’s covered | 1 adult | 1 adult |

| Identity theft insurance | Up to $50,000 | Up to $1 million |

| Credit monitoring | Yes — TransUnion | Yes — TransUnion, Experian, and Equifax |

| Financial activity alerts | ||

| Credit reports | Yes — TransUnion | Yes — TransUnion, Experian, and Equifax |

| Credit score | Yes — TransUnion | |

| FICO score | ||

| Credit builder account | ||

| Rent reporting | ||

| Credit dispute resolution support | ||

| Physical wallet protection | ||

| Identity monitoring | ||

| Details | View Credit Sesame Plans | View Credit Sesame Plans |

Credit Sesame FAQs

Is Credit Sesame worth it?

Credit Sesame’s free plan will give you access to your credit report and credit score from TransUnion. This information is valuable to you so you can protect your identity and credit. Overall, Credit Sesame is worth it.

What is the most accurate credit score app?

There isn’t a credit score app that is more accurate overall. All of the credit score apps pull from the three credit bureaus to provide the information. In most cases, your credit report is updated monthly by your lenders, so at any given time, it could have some inaccuracies.

Is Credit Sesame legit?

Yes, Credit Sesame is legit. It monitors and analyzes your credit report to help you protect yourself against identity theft and make sound financial decisions. Credit Sesame also uses industry-standard encryption to keep your information safe.

How much does it cost to use Credit Sesame?

Credit Sesame offers a free account, which gives you access to your TransUnion credit report. A Premium account is $15.99 a month, which gives you access to all three credit bureaus.

Bottom line: Is Credit Sesame good?

Credit Sesame is a valuable tool if you are looking to understand and easily access your credit score and credit report information. If you’re looking for something that also monitors your identity, you may want to look for a different solution, such as Allstate Identity Protection. Although Credit Sesame includes identity monitoring as part of its Premium plan, we weren’t able to access it or find information about what it entails.

While Credit Sesame may be branded as an identity monitoring service, it is more of a credit monitoring tool instead. As a credit monitoring service, it is pretty great — even with just the free plan. With Credit Sesame’s Basic plan, you can access your TransUnion credit score. With the Premium plan, you can access all three credit bureaus to see if you have any differing information between the three.

Overall, we thought Credit Sesame’s free plan was adequate for someone looking to gain insight into their credit score. The Premium plan seemed a bit confusing and lacked enough information to make us feel like we needed it. You can get copies of the three credit reports once a year, which may be enough to keep your identity safe if you’re using the Credit Sesame free plan too. If you’re looking for an all-in-one solution, you may want to consider Credit Sesame’s Premium plan. However, if you’re okay with combining solutions, you could just go with the Credit Sesame free plan.

-

Access to TransUnion credit information

-

Premium plan offers other great identity theft services

-

Unclear about its product offerings