-

Comprehensive three-bureau credit monitoring

-

Dark web and social media alerts

-

Data shared with third parties for targeted advertising

Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Fraud and identity theft cases are continually increasing, having tripled over the last decade.[1] But don’t be too alarmed. Experian identity theft solutions, like its Experian IdentityWorks service, have useful features that monitor sensitive personal and financial information to ensure it is not compromised on the dark web or stolen by cybercriminals.

IdentityWorks also offers up to $1 million in identity theft insurance if you become an identity theft victim, so you don’t have to navigate recovering your identity and money alone. It’s features like these that make Experian IdentityWorks one of our top recommended identity theft protection services.

Keep reading to learn more about these features, pricing, and benefits in our Experian IdentityWorks review.

What does Experian IdentityWorks protect against?

Experian IdentityWorks features

Our experience with Experian IdentityWorks

Does Experian keep your data safe?

Experian IdentityWorks compatibility

Experian customer support

Experian IdentityWorks prices and subscriptions

Experian IdentityWorks FAQs

Bottom line: Is Experian IdentityWorks good?

Experian IdentityWorks review at a glance

| Price | $24.99–$34.99/mo |

| Identity theft insurance | Up to $1 million |

| Credit monitoring | Yes |

| Credit reports | Yes — Experian, Equifax, TransUnion |

| Credit score | Yes |

| Identity recovery | Yes |

| Dark web alerts | Yes |

| Social media account alerts | Yes |

| Learn more | View Experian IdentityWorks Plans |

On the flip side, there’s one major hitch we stumbled upon. Experian's habit of sharing user data with third parties might put off those who value their privacy, especially since it states your data may be used to create targeted advertising. Still, we've found Experian IdentityWorks to be a great option, especially if you crave top-notch credit monitoring and identity theft insurance coverage.

Experian credit monitoring, credit reporting, identity theft monitoring, dark web alerts, and more are offered by IdentityWorks. With three plans available, ranging from a basic free plan to a paid premium (about $5 per month) and a family plan (about $35 per month), individuals and families can take a step toward protecting themselves from identity theft and fraud.

We found the Experian IdentityWorks free plan is not as comprehensive as the paid plans, but it is very helpful for monitoring credit and personal information. After all, some protection is better than none.

The paid Premium and Family plans aren’t the cheapest — you’ll find better deals from Norton LifeLock, for example — but they do offer exceptional identity monitoring and protection features. These include social media and home title monitoring, two features LifeLock doesn’t offer.

Experian identity theft protection pros and cons

- Comprehensive three-bureau credit monitoring

- Up to $1 million in identity theft insurance

- Dark web and social media alerts

- Data shared with third parties for targeted advertising

- Data breach in 2015

What does Experian IdentityWorks protect against?

The Experian IdentityWorks service protects against these common identity theft situations:

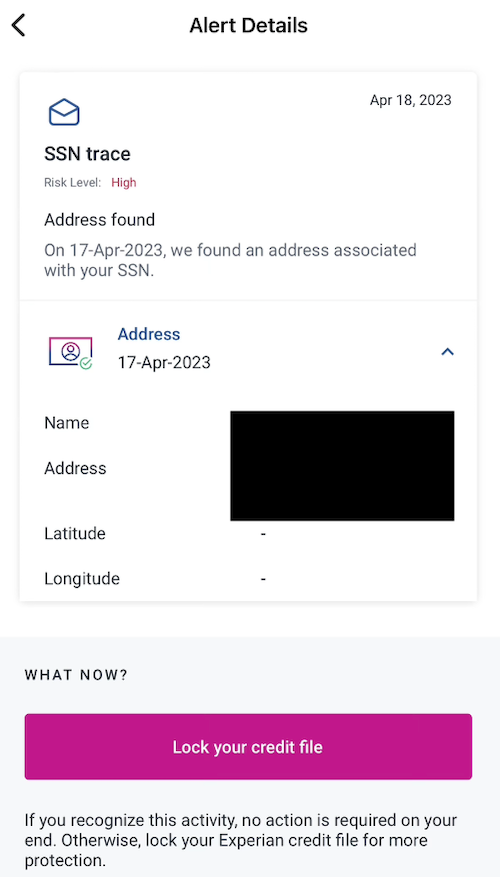

- Social Security number and personal identifying information (PII) theft with dark web scans

- Credit card fraud — IdentityWorks’ paid plans let you lock or freeze your credit

- Medical identity theft

- Home title theft

- Child identity theft

- Financial account takeover (by monitoring your bank accounts and credit cards as well as monitoring your credit scores on Experian, TransUnion, and Equifax)

Experian IdentityWorks features

Experian IdentityWorks offers an impressive array of features to help you safeguard your personal information and monitor your credit. Some standout features include credit monitoring from all three credit bureaus, dark web alerts, and social media account alerts.

However, the lack of two-factor authentication is a notable drawback in terms of account security. Even so, you may find IdentityWorks’ identity protection features worthwhile. Here’s what you can expect.

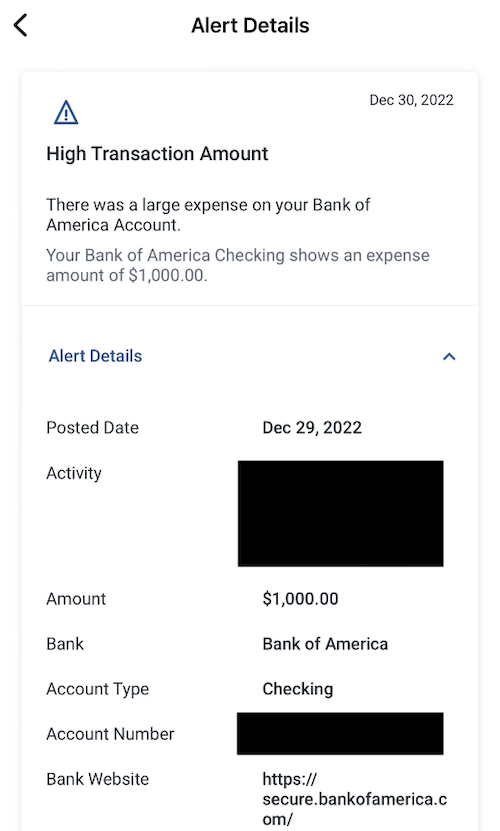

Credit monitoring

Experian IdentityWorks monitors your credit reports from Experian, Equifax, and TransUnion. It updates your credit scores and credit reports at least once a month. The service alerts you of significant changes in your financial accounts, such as new loans, credit card activity, and changes to your account balances.

If any issues are detected, you'll be promptly notified. If you find you’ve become a victim of identity theft, Experian IdentityWorks provides identity theft insurance of up to $1 million, depending on your plan.

Experian IdentityWorks provides financial account alerts for the following:

- Bank accounts: High transaction amounts, low balance, and suspicious activity

- Loans: Alternative lending activity, new installment loans, new accounts, and payday loans

- Credit cards: An increase or decrease in credit limit, hard inquiries, unauthorized inquiries on locked credit files, opened new accounts, and delinquent payments

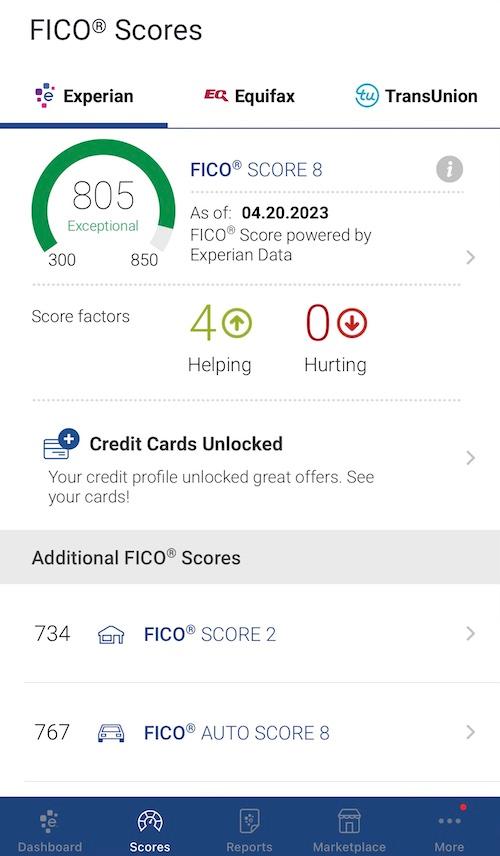

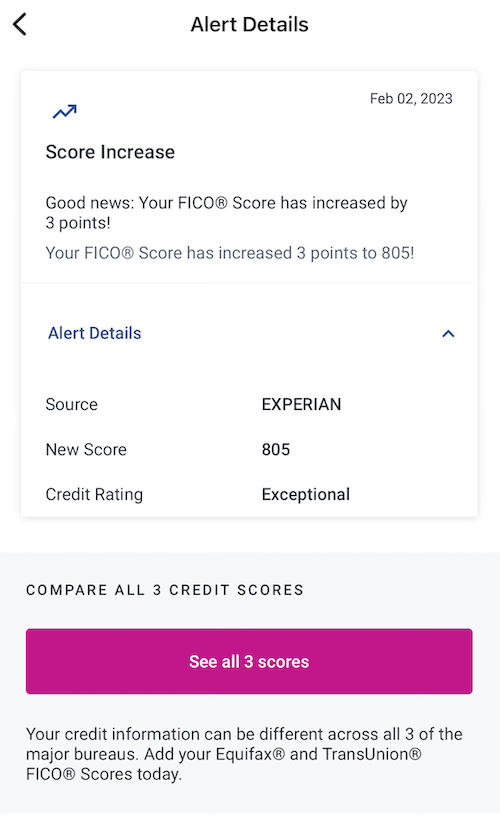

Credit reports and credit scores

It's super important to keep a close watch on your credit reports, FICO score, and credit score for many reasons. By regularly looking at your credit reports, you can spot any mistakes, red flags for fraud, or even signs of identity theft — and then do something about it right away.

Staying in the loop with your FICO score and credit score helps you know how creditworthy you are, which is really useful when making big financial choices like applying for loans, credit cards, or mortgages.

Experian IdentityWorks is a handy service that keeps you updated on your credit reports and scores. It gathers reports from all three credit bureaus (Experian, Equifax, and TransUnion) to make sure you have a complete picture of your credit situation.

Depending on the plan you choose, you could get monthly or even daily updates on your credit reports and scores. The IdentityWorks Premium plan updates your tri-bureau FICO score and credit reports every quarter, while your Experian FICO score is updated daily. The Family plan updates your credit score and reports on the same cadence except, and you’ll also get a daily update for your Experian credit report.

These frequent updates mean you stay ahead of the game and tackle any issues as they come up.

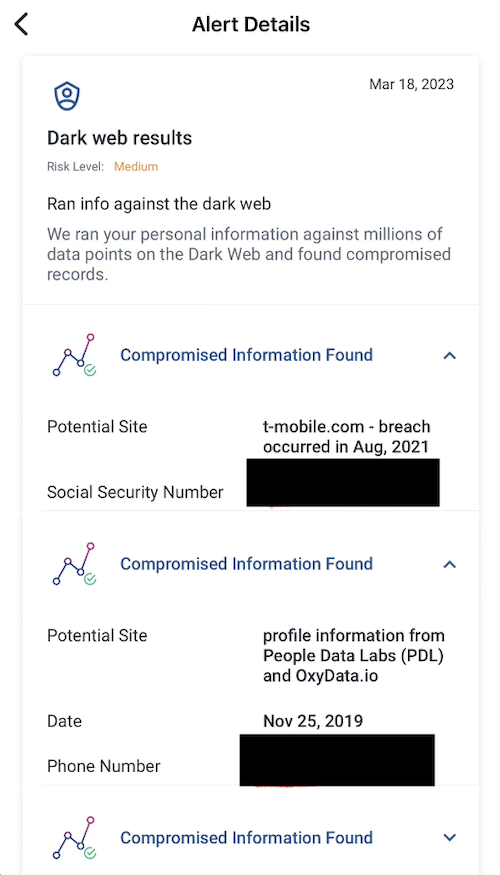

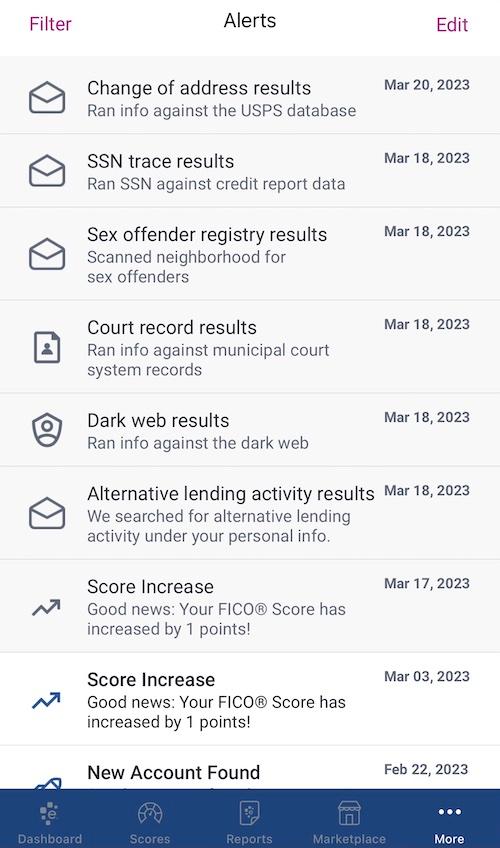

Alerts

Safeguarding your personal information is crucial in today's digital age. Identity theft protection services help you stay vigilant by offering a variety of alerts that keep you informed about any suspicious activities that could compromise your security.

Here are some of the common alerts provided by Experian IdentityWorks that will notify you of potential security risks:

- Dark web monitoring that helps you spot compromised personal information

- Social media account alerts, including suspicious activity

- Sex offender registry alerts notify you if and when a sex offender moves in nearby

- Court record and arrest record alerts

- USPS change of address alerts

Our experience with Experian IdentityWorks

We’ve used Experian IdentityWorks for over a year, and our journey has been quite a pleasant ride for the most part. The service is a breeze to use and comes packed with a lot of nifty features to shield against identity theft.

Among these, the credit monitoring feature really shines, giving us the latest scoop from all three major credit bureaus. Plus, the dark web and social media monitoring act as our watchful guardians, sniffing out potential risks before they wreak havoc.

On the flip side, there’s one major hitch we stumbled upon. Experian's habit of sharing user data with third parties might put off those who value their privacy, especially since it states your data may be used to create targeted advertising.

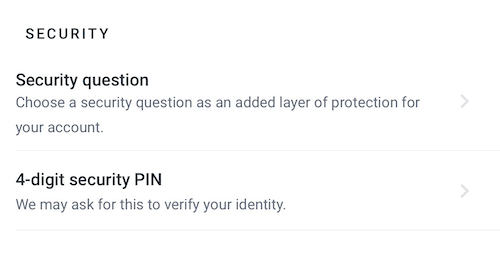

Additionally, Experian IdentityWorks didn’t originally offer two-factor authentication, which is, in our minds, a required layer of additional security. Thankfully, it now offers the option of a security question or PIN to further secure your account.

Despite these bumps in the road, we've found Experian IdentityWorks to be a trustworthy identity theft protection companion, especially for folks who crave top-notch credit monitoring and identity theft insurance coverage.

Does Experian keep your data safe?

Experian is a reputable credit reporting agency that also provides identity theft protection. Keeping your data safe is vital when selecting such a service. Here are some essential points from Experian's privacy policy and security measures:

- Data collection: Experian gathers a variety information, including personal identification, financial details, and data on your devices and online activities.

- Data usage: Experian uses the collected data to offer and improve their services, secure their databases, and communicate with users about products and services.

- Data sharing: Experian may share your information with third parties in specific situations, such as service providers, affiliates, or as required by law. This includes sharing your data to allow third parties to target you with personalized advertising.

- Encryption: Experian's website uses Secure Sockets Layer (SSL) technology for secure communication between your browser and its servers. This is concerning since SSL is a deprecated technology that was replaced by Transport Layer Security (TLS) in 1999.

- Two-factor authentication (2FA): As of September 2021, Experian didn't explicitly mention two-factor or multi-factor authentication, but we’ve noted it now offers a security question or PIN to lock down your account.

In conclusion, Experian takes data security seriously and uses standard measures to protect user information. However, it's essential to thoroughly review their privacy policy and stay updated on any changes to their security or data-sharing practices.

Experian IdentityWorks compatibility

Experian IdentityWorks knows how essential it is for users to have easy access to their identity theft protection services, which is why they offer their mobile app for Apple and Android users.

Apple users can find the Experian IdentityWorks app on the Apple App Store, while Android users can download the Experian IdentityWorks app from the Google Play Store. At the date of this article, apps for both platforms were highly rated.

- iOS: Rated 4.7 out of 5 stars

- Android: Rated 4.7 out of 5 stars

Keep in mind, though, that ratings can change over time. So, it's always a good idea to check the app stores for the latest ratings and user reviews to uncover any potential bugs or issues before you encounter them.

Experian customer support

Experian IdentityWorks’ customer service portal is packed with easy-to-follow online guides and resources that cover everything from the basics of identity theft protection to the nitty-gritty of using the platform's features.

As a whole, Experian rates 3.7 out of 5 stars on Consumer Affairs, and users of its services offer a mixed bag of reviews, with some reviewers noting they never got an option to speak to another person.[2] This means your experience with Experian customer service could be good or bad.

If you aren’t satisfied with the help you receive, we recommend contacting them again at another time to get a different representative or asking if you can speak to someone else.

Experian IdentityWorks prices and subscriptions

Experian IdentityWorks offers three identity protection plans: Basic, Premium, and Family. The prices are competitive compared to other identity theft protection services, though some services like LifeLock or Allstate Identity Protection may come at a lower price point. Still, the value offered by Experian IdentityWorks makes the cost worth it for many users.

Experian IdentityWorks plans comparison

| Plan | Basic | Premium | Family |

| Price per month | Free | $24.99/mo | $34.99/mo |

| Free trial | N/A | Yes, 30 days | Yes, 30 days |

| Who’s covered | 1 adult | 1 adult | 2 adults, 10 children |

| Identity theft insurance | Up to $1 million | Up to $1 million | |

| Credit monitoring | |||

| Financial activity alerts | |||

| Credit reports | Yes — Experian only | Yes — Experian, Equifax, TransUnion | Yes — Experian, Equifax, TransUnion |

| Credit score | |||

| FICO score | |||

| Dark web alerts | |||

| Credit lock and freeze | |||

| Identity recovery | |||

| Social media account alerts | |||

| Social Security Number monitoring | |||

| Home title monitoring | |||

| USPS address change alerts | |||

| Details | View Plan | View Plan | View Plan |

Experian IdentityWorks FAQs

Is Experian IdentityWorks worth it?

Experian IdentityWorks is worth considering if you’re seeking comprehensive credit monitoring, dark web surveillance, and identity theft insurance. It's particularly beneficial for individuals and families looking for a service that offers a wide range of features at a reasonable price.

Is it safe to give Experian your Social Security number?

Experian is a well-established credit reporting agency that handles sensitive financial information for millions of individuals. They have security measures in place, like AES-256 encryption and two-factor authentication, to protect your data, including your Social Security number.

However, as with any online service, there is always some level of risk involved. Make sure to follow best practices for online safety, such as using a strong password and enabling two-factor authentication. You might even want to use a password manager to create a strong password and remember it for you.

What’s the difference between Experian and Experian IdentityWorks?

Experian is one of the three major credit reporting agencies in the United States, responsible for collecting and maintaining consumer credit information.

Experian IdentityWorks is a specific product offered by Experian, designed to provide identity theft protection and credit monitoring services.

While Experian primarily deals with credit reporting, Experian IdentityWorks focuses on helping you protect your personal information and monitor your credit for signs of fraud or identity theft.

Who owns Experian IdentityWorks?

Experian IdentityWorks is owned by Experian plc, a multinational consumer credit reporting company headquartered in Dublin, Ireland. Experian is one of the three major credit bureaus in the United States, alongside Equifax and TransUnion.

Is Experian IdentityWorks the same as Costco Complete ID?

Experian IdentityWorks and Costco Complete ID are not the same, but they are related. Costco Complete ID is an identity theft protection service provided by Costco in partnership with Experian.

While both services offer similar features, such as credit monitoring, identity theft insurance, and fraud resolution support, Costco Complete ID is exclusively available to Costco members at a discounted rate.

Bottom line: Is Experian IdentityWorks good?

Experian IdentityWorks stands out in the identity theft protection and credit monitoring arena, offering a wide array of features to shield you from various identity theft risks. The service’s paid plans cover all three major credit bureaus, delivering comprehensive credit monitoring and regular credit reports and scores.

You’ll also get up to $1 million in identity theft insurance, identity recovery help, dark web alerts, social media account alerts, and alerts for potential fraud linked to payday loans and court records.

On the downside, Experian IdentityWorks can be pricey, with the Premium plan starting at $24.99/mo. Additionally, the added monitoring services in the Premium plan may not be necessary for some users. We’re also disappointed to see Experian shares data with third parties for the purpose of targeted ads, and its security measures (SSL) may be outdated.

In summary, Experian IdentityWorks is an excellent choice for those seeking all-encompassing identity theft protection and credit monitoring services, especially for individuals with multiple financial accounts or active social media presence. Despite potentially high prices, Experian IdentityWorks is worth it if you value top-notch protection and are willing to invest in a dependable service.

If IdentityWorks doesn’t sound like a right fit in terms of budget, features, or security measures, you might prefer Norton LifeLock or Allstate Identity Protection, two other companies that offer some of the best identity theft protection available.

-

Comprehensive three-bureau credit monitoring

-

Dark web and social media alerts

-

Data shared with third parties for targeted advertising