Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

With dating apps just a few clicks away and even dating integrations in social media platforms, it’s not uncommon to find a DM from someone that leads to a new conversation. Though meeting people online allows for a new type of connection, the veil of anonymity on the internet can also create security risks.

Catfishing, the act of using a fictional online persona to lure someone into a (typically fake) relationship, has become an all-too-common scam in modern times, costing American victims more than $500 million in 2021.

With Valentine’s Day on the horizon and love on the minds of many, our team at All About Cookies used FBI and Federal Trade Commission (FTC) data to determine which states are hardest hit by catfishing scams, how prevalent problems are for different age groups, and find out how much catfishing scams are costing residents in each state. We'll also share tips on how to prevent catfishing scams and how the best identity theft protection services can keep your money and data locked down.

Key findings

- In 2022, catfishing scams cost an average of $132.5 million per quarter, an 11.2% increase from 2021.

- Alaska has the highest number of catfish victims per capita, while Louisiana has the lowest number of catfish victims per capita.

- The average catfishing scam cost victims aged 70+ more than $30,000, over 8 times more than victims under 30.

Age groups who are affected by catfishing the most

Which states have the most catfishing victims?

Which states have the fewest catfishing victims?

Victims in these states lose the most money in catfishing scams

Victims in these states lose the least money in catfishing scams

Bottom line

Methodology

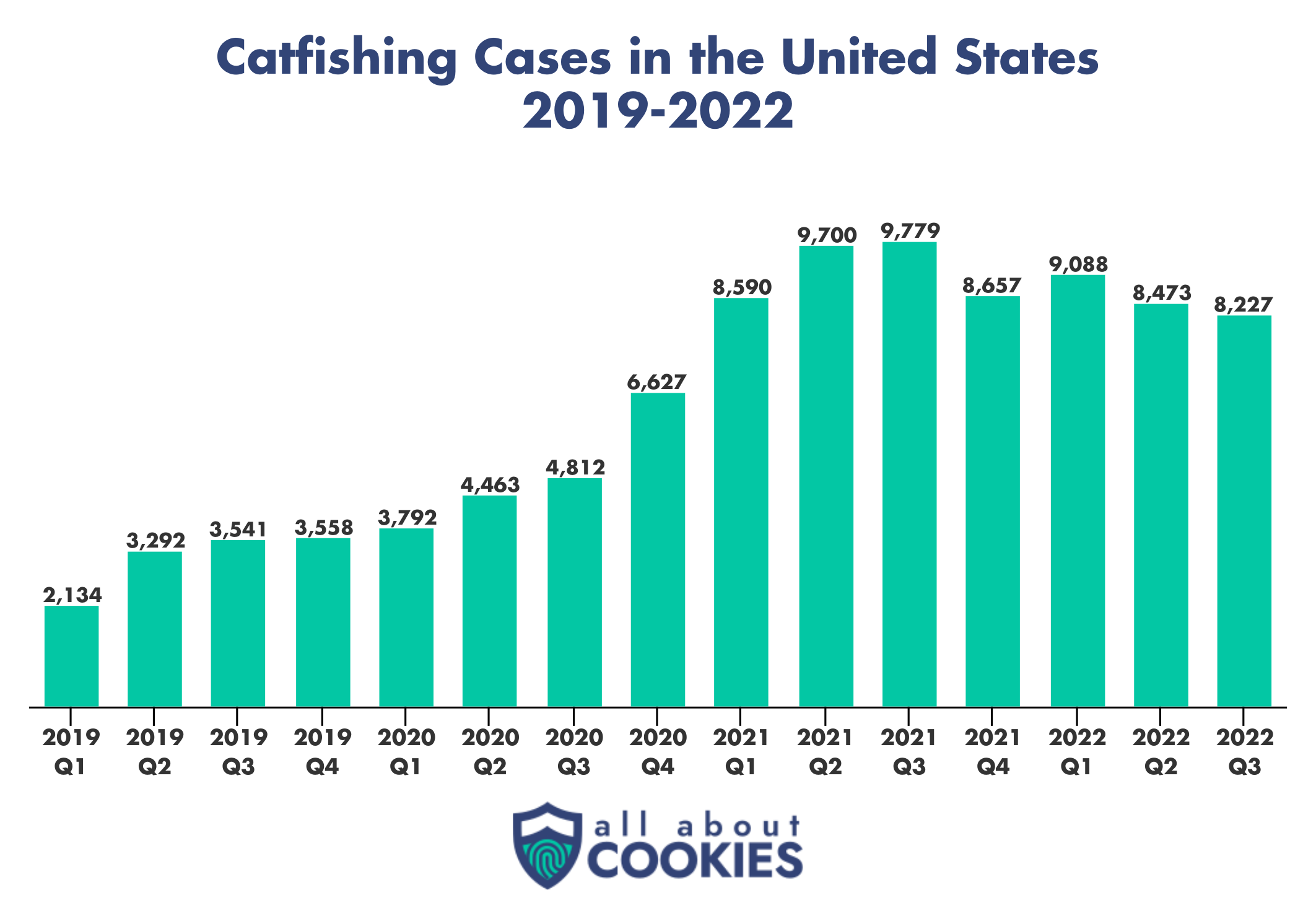

Catfishing trends over time

Though originally gaining notoriety as a scam with the 2010 documentary Catfish and subsequent MTV show of the same name, data from the FTC shows that catfishing became a much more common problem in recent years.

In the first quarter of 2019 the agency registered 2,134 catfishing reports, a number that steadily increased quarter over quarter until it peaked at 9,779 reports in the third quarter of 2021, a 358% increase in just two and a half years.

Since 2019, the average number of quarterly reports jumped from 3,131 in 2019 to 8,596 in 2022, an increase of more than 174%. Today, it’s estimated there are approximately 4 times as many reports of catfishing scams than there were at the beginning of 2019.

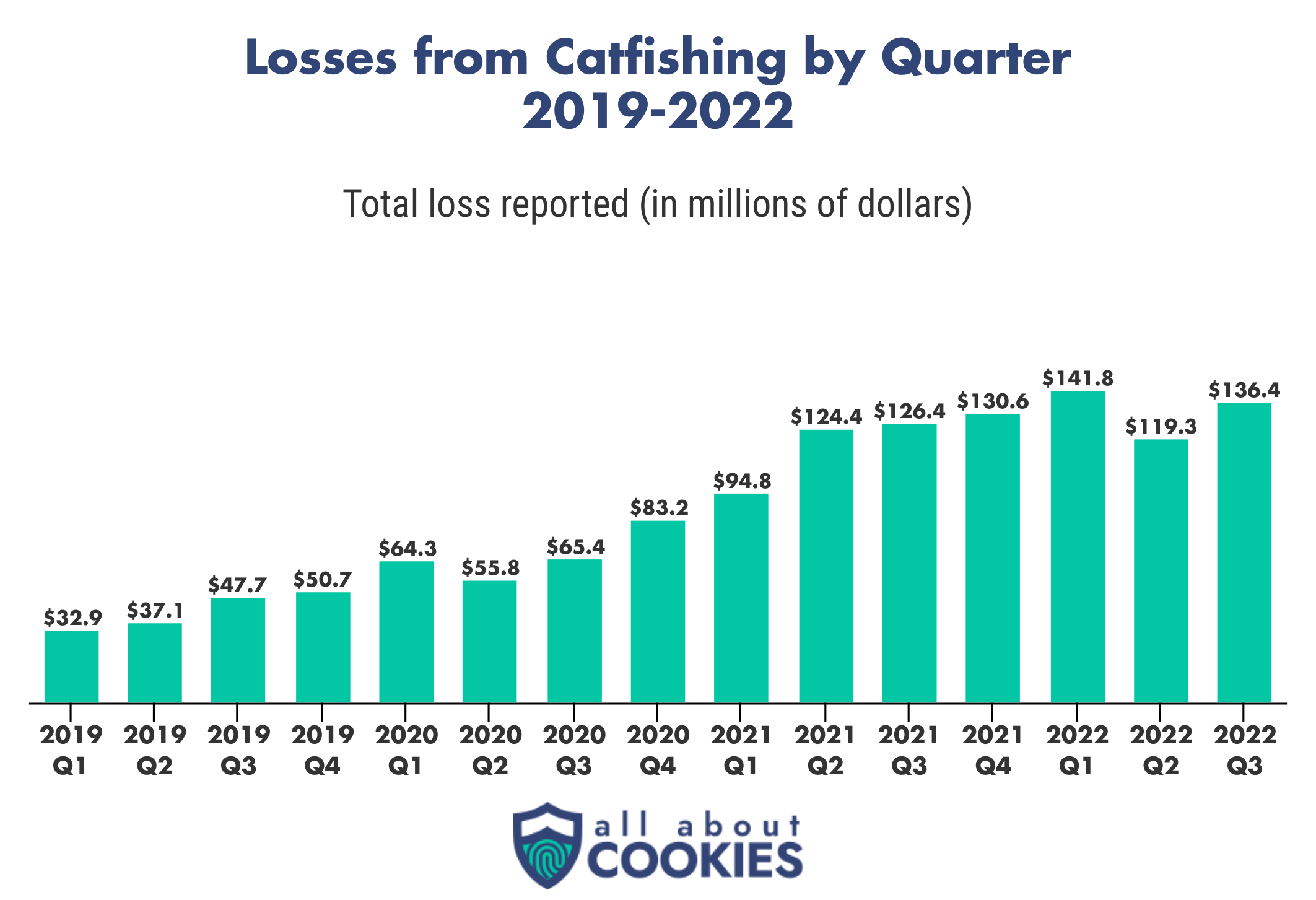

As cases of catfishing go up, it makes sense that the amount of money lost to these kinds of scams would rise as well, which the data confirms is happening. Catfishing fraud accounted for $32.9 million in money lost by victims at the start of 2019, a number that rose to $141.8 million two years later at the start of 2022, a 331% increase.

In 2022, the FBI reported average quarterly losses of $132.5 million, the highest average of any year to date. That represents a more than 214% increase from 2019 when quarterly losses averaged $42 million.

Age groups who are affected by catfishing the most

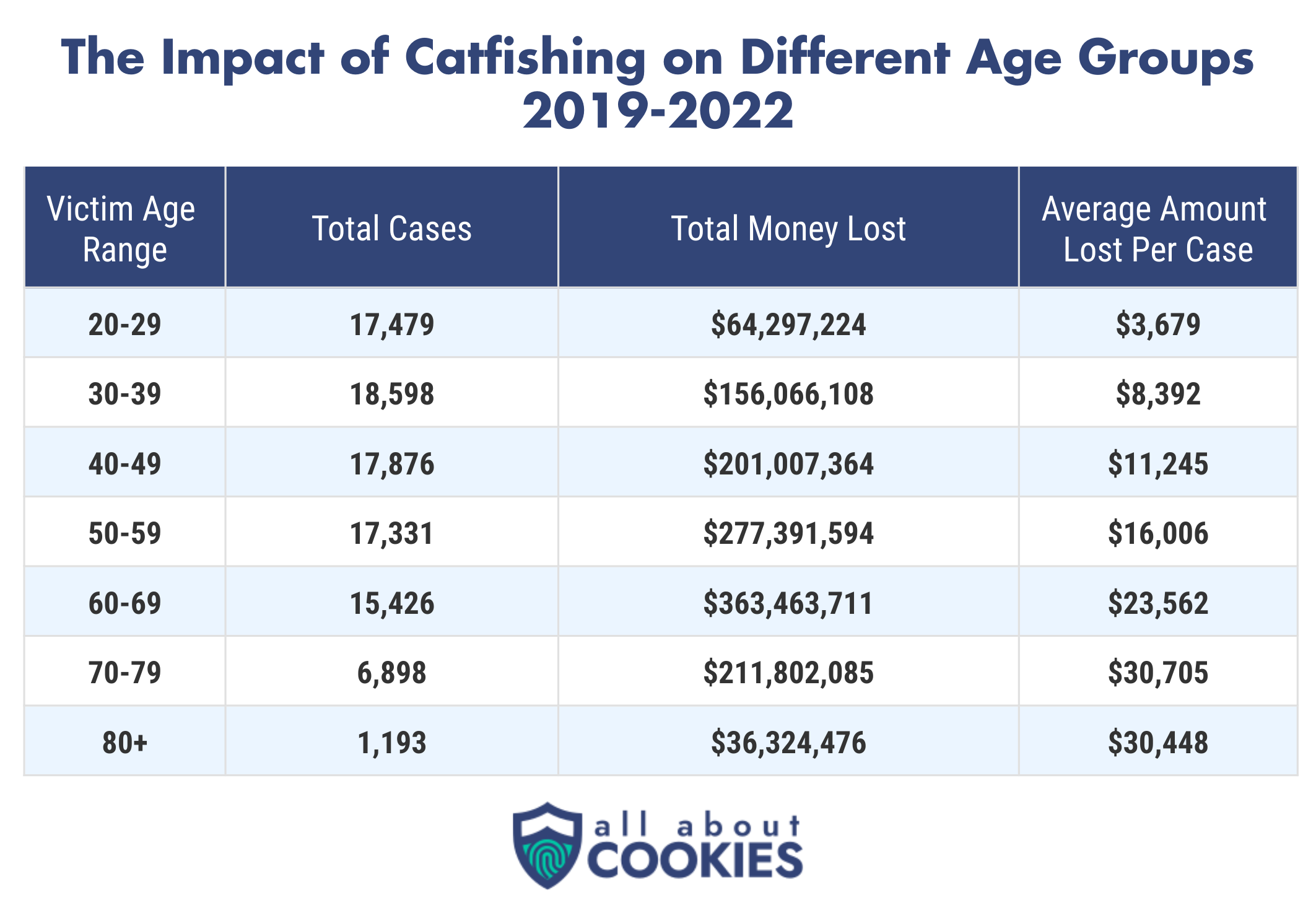

People of different ages are impacted differently by catfishing scams and romance fraud. Despite having the third-fewest number of reported catfishing incidents between 2019 and 2022, 60-69 year-olds have lost more money to these kinds of scams than any other age group — more than $360 million in four years.

Middle-aged people may lose the most money to catfishing, but they aren’t actually the most likely to fall victim to these schemes: 30-39 year-olds reported more incidents of catfishing than any other age group since 2019.

While the number of people targeted and victimized by catfishing drops significantly with age, it’s worth noting that older Americans are disproportionately affected financially in these scams. On average, romance scams cost Americans 70 and older more than $30,000 per incident — a rate more than eight times higher than cases involving victims under 30.

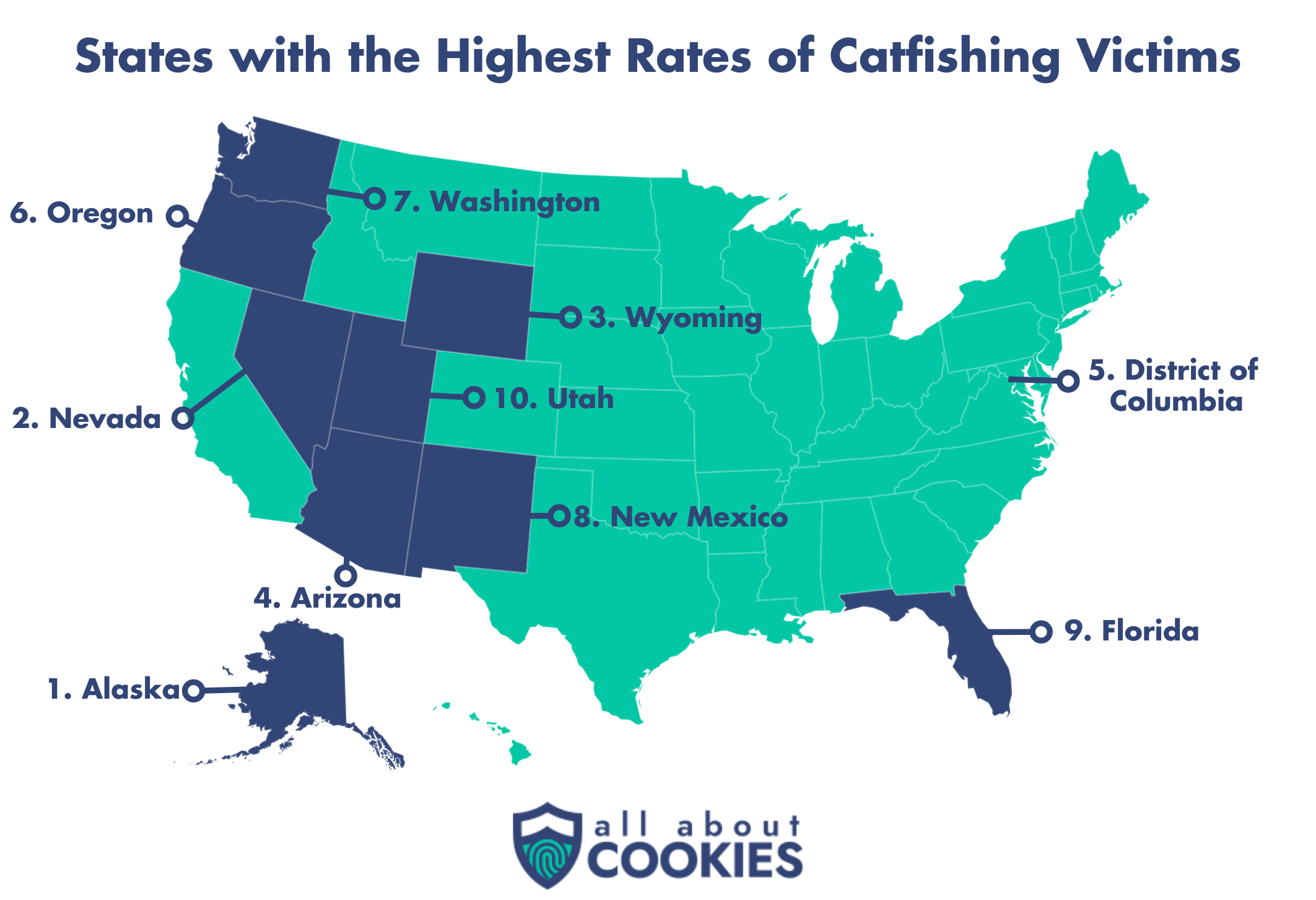

Which states have the most catfishing victims?

Relative to population size, residents of Alaska and Nevada have the nation’s biggest catfishing problems. Those are the only two states that reported more than 10 incidents of catfishing per 100,000 people in 2021, coming in at 11.9 in Alaska and 11.2 in Nevada.

Two more states as well as the District of Columbia reported at least nine victims per 100,000 people to round out the top five.

States with the most total catfishing victims per 100K

| State | Number of victims per capita |

| 1. Alaska | 11.9 |

| 2. Nevada | 11.2 |

| 3. Wyoming | 9.5 |

| 4. Arizona | 9.0 |

| 5. District of Columbia | 9.0 |

| 6. Oregon | 8.5 |

| 7. Washington | 8.5 |

| 8. New Mexico | 8.1 |

| 9. Florida | 8.0 |

| 10. Utah | 7.7 |

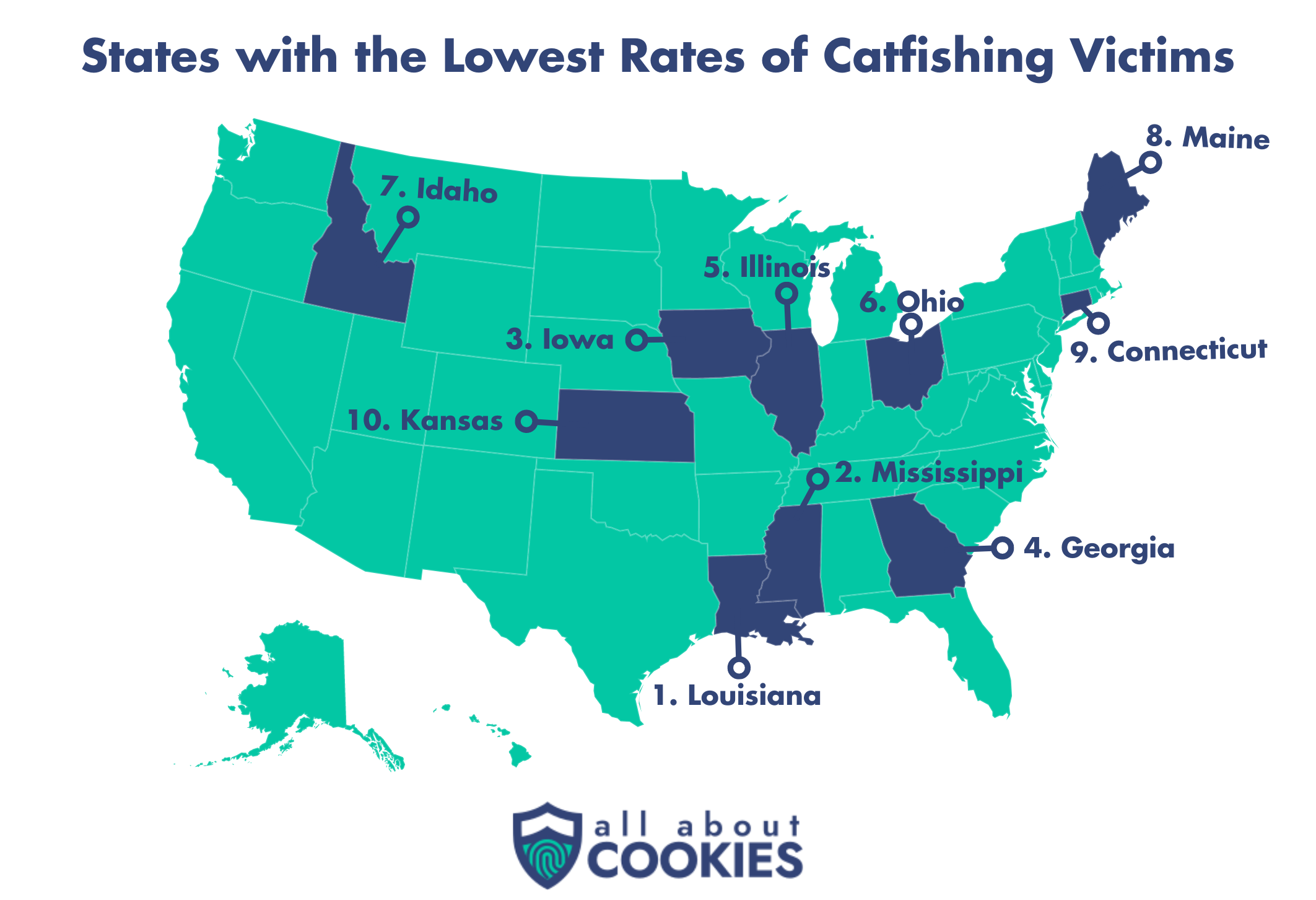

Which states have the fewest catfishing victims?

Louisiana is the only state that’s home to fewer than four catfish victims per 100,000 people, coming in at 3.8.

The neighboring state of Mississippi has the second-lowest rate in the country with just 4.3 victims per 100,000. Iowa takes bronze in this regard with a rate of 4.4 victims per 100,000 people, and is also the last state with a rate lower than 4.5 per 100,000.

States with the fewest total catfishing victims per 100K

| State | Number of victims per capita |

| 1. Louisiana | 3.8 |

| 2. Mississippi | 4.3 |

| 3. Iowa | 4.4 |

| 4. Georgia | 4.6 |

| 5. Illinois | 4.7 |

| 6. Ohio | 4.7 |

| 7. Idaho | 4.8 |

| 8. Maine | 4.9 |

| 9. Connecticut | 4.9 |

| 10. Kansas | 5.0 |

Victims in these states lose the most money in catfishing scams

When it comes to the average amount of money lost to catfishing, one state stands out above the rest. While there were just 58 total instances of catfishing in the state of North Dakota reported to the FBI in 2021, those 58 cases resulted in over $12 million lost, which averages over $200,000 per victim.

After North Dakota there’s a major drop in the average amount of money lost per victim in the rest of the country, as Rhode Island’s average loss of $62,773 is just over $140,000 less than North Dakota’s average loss. California is the only state other than those two where the average catfishing victim lost more than $60,000 in 2021.

Top 10 states with the most money lost per catfishing victim

| State | Average amount lost |

| 1. North Dakota | $209,289 |

| 2. Rhode Island | $62,773 |

| 3. California | $60,843 |

| 4. New Jersey | $58,303 |

| 5. Louisiana | $57,991 |

| 6. Colorado | $55,040 |

| 7. Massachusetts | $52,522 |

| 8. New York | $49,296 |

| 9. Washington | $48,644 |

| 10. Hawaii | $46,084 |

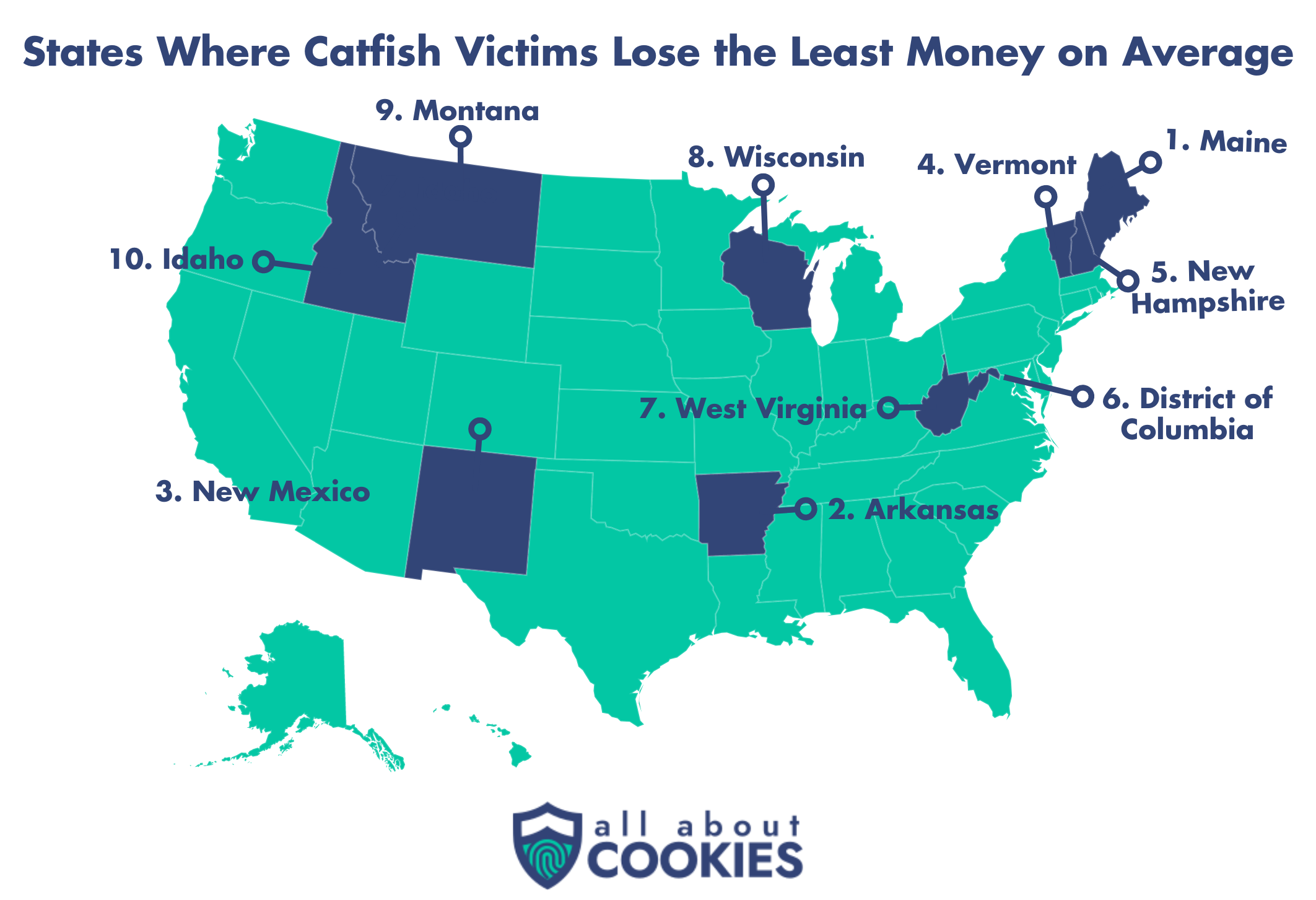

Victims of these states lose the least money in catfishing scams

Residents of New England appear to be among the luckiest in the country when it comes to avoiding big losses at the hands of catfishers. Maine residents lost just $5,775 per victim on average in 2021, the lowest rate in the country.

Two nearby states, New Hampshire and Vermont, also make the top five with less than $15,000 lost on average. In between those New England states are Arkansas, the only state other than Maine where victims lost less than $10,000 on average, and New Mexico. New Mexico is notable as the state that’s actually in the top 10 in terms of catfishing victims per 100,000 people (8.1), meaning that while residents fall victim to catfishing frequently, they’re losing very little money when they do.

Top 10 states with the least money lost per catfishing victim

| State | Average amount lost |

| 1. Maine | $5,775 |

| 2. Arkansas | $7,977 |

| 3. New Mexico | $11,571 |

| 4. Vermont | $12,296 |

| 5. New Hampshire | $14,295 |

| 6. District of Columbia | $14,362 |

| 7. West Virginia | $15,348 |

| 8. Wisconsin | $21,629 |

| 9. Montana | $21,755 |

| 10. Idaho | $21,835 |

Bottom line

Whether you live in a state with the most catfishing scams or in a state where romance scammers steal the most money, it’s always important to protect yourself and your identity online. Here are some precautions you can take to avoid being a victim of a catfishing scheme:

- Don’t give out sensitive information: Be sure to watch what information you share about yourself. Avoid giving out personally identifiable information, such as your name, address, or Social Security number. Avoid giving out your phone number, which also exposes you to various risks.

- Monitor and update your online settings: Certain apps and websites — such as dating platforms — could share your data. Make sure to monitor and update your privacy settings often.

- Consider using a VPN: By creating a secure and private internet connection, you’re giving yourself and your personal information another layer of security. Find out how to set up a VPN with our guide, and check out our guide to the best VPN apps for our recommendations.

- Take the next steps: If you discover that a contact or a person you’ve been communicating with is, in fact, a catfish, be sure to alert the authorities and file a police report if your losses are significant. It's also a good idea to purchase identity theft protection — even if you're not sure you're being catfished.

The best identity theft protection services 2024

It's a leap of trust to choose an identity theft protection service. After all, you're relying on it to not only safeguard your personal data but your bank accounts and online profiles as well. That's why we put dozens of ID theft protection services to the test to see which ones come out on top for security and helpful features. These are our winners.

- LifeLock: Hands-down this is one of the best ID theft protection service, if not the best. LifeLock offers a wide range of monitoring services that keep tabs on your home title, social media accounts, bank accounts, and even check the dark web for your info. You can also get up to $3 million in ID theft insurance if you opt for LifeLock's top-tier plan.

See LifeLock Plans | Read Our LifeLock Review - Aura: Another one of our favorites, Aura, comes loaded with not just identity protection features but digital protection features as well. This includes credit monitoring from all three credit bureaus, parental controls, and cyberbullying alerts. Oh, and it has a senior discount.

See Aura Plans | Read Our Aura Review - ID Watchdog: If you need help restoring your identity and recovering from a catfishing scam, check out ID Watchdog. It offers a comprehensive set of restoration services, including dedicated specialists and 24/7 customer support. We also like that it allows you to share any monitoring alerts with other family members so everyone is in the know.

See ID Watchdog Plans | Read Our ID Watchdog Review

-

Top-rated identity theft protection service

-

Provides up to $3 million in coverage

-

Multiple monitoring features including dark web, home title, and social media monitoring

-

Customer support experience is lacking

Methodology

All About Cookies collected data on victims and perpetrators of confidence fraud/romance scams and social media fraud for every state from the FBI's 2021 Internet Crime Complaint Center annual report. Data included the number of fraud victims and perpetrators in each state, as well as the total amount of money lost by victims and taken by perpetrators.

Data relating to romance scams across different age ranges came from the FTC's Fraud Reports Tableau page and includes data from January 2019 through September 2022. This data includes the number of romance fraud reports and money lost for the following age groups: 20-29, 30-39, 40-49, 50-59, 60-69, 70-79, and 80+.

Total number of catfishing victims and losses by state and Washington D.C.

| State | Population | Number of romance scam reports | Reports per 100K | Total amount of money lost to romance scams | Average amount lost per report |

| Alabama | 5,039,877 | 259 | 5.1 | $6,552,331 | $25,299 |

| Alaska | 732,673 | 87 | 11.9 | $3,532,020 | $40,598 |

| Arizona | 7,276,316 | 653 | 9.0 | $18,827,346 | $28,832 |

| Arkansas | 3,025,891 | 153 | 5.1 | $1,220,454 | $7,977 |

| California | 39,237,836 | 3,023 | 7.7 | $183,928,230 | $60,843 |

| Colorado | 5,812,069 | 445 | 7.7 | $24,492,897 | $55,040 |

| Connecticut | 3,605,597 | 178 | 4.9 | $6,340,173 | $35,619 |

| Delaware | 1,003,384 | 62 | 6.2 | $2,568,048 | $41,420 |

| District of Columbia | 670,050 | 60 | 9.0 | $861,723 | $14,362 |

| Florida | 21,781,128 | 1,738 | 8.0 | $70,483,554 | $40,554 |

| Georgia | 10,799,566 | 500 | 4.6 | $13,771,534 | $27,543 |

| Hawaii | 1,441,553 | 91 | 6.3 | $4,193,665 | $46,084 |

| Idaho | 1,900,923 | 91 | 4.8 | $1,986,957 | $21,835 |

| Illinois | 12,671,469 | 591 | 4.7 | $19,785,612 | $33,478 |

| Indiana | 6,805,985 | 369 | 5.4 | $8,942,073 | $24,233 |

| Iowa | 3,193,079 | 142 | 4.4 | $3,522,928 | $24,809 |

| Kansas | 2,934,582 | 147 | 5.0 | $4,487,069 | $30,524 |

| Kentucky | 4,509,394 | 227 | 5.0 | $7,386,818 | $32,541 |

| Louisiana | 4,624,047 | 178 | 3.8 | $10,322,446 | $57,991 |

| Maine | 1,372,247 | 67 | 4.9 | $386,894 | $5,775 |

| Maryland | 6,165,129 | 464 | 7.5 | $20,678,621 | $44,566 |

| Massachusetts | 6,984,723 | 415 | 5.9 | $21,796,694 | $52,522 |

| Michigan | 10,050,811 | 579 | 5.8 | $20,403,018 | $35,238 |

| Minnesota | 5,707,390 | 340 | 6.0 | $11,823,203 | $34,774 |

| Mississippi | 2,949,965 | 127 | 4.3 | $3,219,615 | $25,351 |

| Missouri | 6,168,187 | 372 | 6.0 | $8,852,970 | $23,798 |

| Montana | 1,104,271 | 82 | 7.4 | $1,783,925 | $21,755 |

| Nebraska | 1,963,692 | 115 | 5.9 | $3,315,392 | $28,829 |

| Nevada | 3,143,991 | 352 | 11.2 | $15,095,654 | $42,885 |

| New Hampshire | 1,388,992 | 71 | 5.1 | $1,014,970 | $14,295 |

| New Jersey | 9,267,130 | 517 | 5.6 | $30,142,767 | $58,303 |

| New Mexico | 2,115,877 | 171 | 8.1 | $1,978,627 | $11,571 |

| New York | 19,835,913 | 1,168 | 5.9 | $57,577,392 | $49,296 |

| North Carolina | 10,551,162 | 539 | 5.1 | $17,352,320 | $32,194 |

| North Dakota | 774,948 | 58 | 7.5 | $12,138,780 | $209,289 |

| Ohio | 11,780,017 | 553 | 4.7 | $14,964,916 | $27,061 |

| Oklahoma | 3,986,639 | 239 | 6.0 | $5,656,884 | $23,669 |

| Oregon | 4,246,155 | 361 | 8.5 | $12,077,829 | $33,457 |

| Pennsylvania | 12,964,056 | 723 | 5.6 | $30,055,491 | $41,571 |

| Rhode Island | 1,095,610 | 72 | 6.6 | $4,519,628 | $62,773 |

| South Carolina | 5,190,705 | 294 | 5.7 | $6,821,160 | $23,201 |

| South Dakota | 895,376 | 52 | 5.8 | $1,282,228 | $24,658 |

| Tennessee | 6,975,218 | 366 | 5.2 | $14,569,398 | $39,807 |

| Texas | 29,527,941 | 1,752 | 5.9 | $65,430,519 | $37,346 |

| Utah | 3,322,389 | 256 | 7.7 | $7,710,025 | $30,117 |

| Vermont | 645,570 | 43 | 6.7 | $528,709 | $12,296 |

| Virginia | 8,642,274 | 613 | 7.1 | $22,143,549 | $36,123 |

| Washington | 7,738,692 | 657 | 8.5 | $31,958,914 | $48,644 |

| West Virginia | 1,782,959 | 95 | 5.3 | $1,458,019 | $15,348 |

| Wisconsin | 5,895,908 | 348 | 5.9 | $7,526,797 | $21,629 |

| Wyoming | 578,803 | 55 | 9.5 | $1,713,763 | $31,159 |

| Entire country | 331,878,159 | 20,910 | 6.3 | $849,184,549 | $40,611 |

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates