Advertiser Disclosure

All About Cookies is an independent, advertising-supported website. Some of the offers that appear on this site are from third-party advertisers from which All About Cookies receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

All About Cookies does not include all financial or credit offers that might be available to consumers nor do we include all companies or all available products. Information is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Editorial Policy

The All About Cookies editorial team strives to provide accurate, in-depth information and reviews to help you, our reader, make online privacy decisions with confidence. Here's what you can expect from us:

- All About Cookies makes money when you click the links on our site to some of the products and offers that we mention. These partnerships do not influence our opinions or recommendations. Read more about how we make money.

- Partners are not able to review or request changes to our content except for compliance reasons.

- We aim to make sure everything on our site is up-to-date and accurate as of the publishing date, but we cannot guarantee we haven't missed something. It's your responsibility to double-check all information before making any decision. If you spot something that looks wrong, please let us know.

Best for tech-savvy users

-

Easy-to-use identity theft protection service

-

Includes extra features like a password manager

-

No dedicated remediation assistance available

Best for families and users on a budget

-

Provides up to $1 million in identity theft insurance

-

Covers up to two adults and five children on one plan

-

Only available to Costco members

Safeguarding your personal information has never been more crucial. Although cases of identity theft are on the rise, you can invest in services like Identity Guard and Complete ID for top-tier solutions to protect your online identity. But which one suits your needs best?

Identity Guard is renowned for its advanced artificial intelligence technology and identity monitoring services, catering to tech-savvy individuals who desire a sophisticated defense against identity theft. On the other hand, Complete ID, which is backed by the credit bureau Experian, offers a comprehensive package at a budget-friendly price, making it an attractive option for families and those seeking substantial coverage without breaking the bank.

We’ll break down Identity Guard and Complete ID so you can make an informed decision on how to best protect yourself against identity thieves.

Identity Guard vs. Complete ID: prices

Identity Guard vs. Complete ID: monitoring and alerts

Identity Guard or Complete ID: which is safer?

Identity Guard vs. Complete ID: compatibility and customer support

Identity Guard vs. Complete ID FAQs

Identity Guard vs. Complete ID: Which is better?

Identity Guard vs. Complete ID review at a glance

Identity Guard and Complete ID offer different strengths and focus areas. While Identity Guard uses innovative AI technology, making it suitable for tech enthusiasts, Complete ID offers a comprehensive and budget-friendly option that’s well-suited for family protection.

- Identity Guard: Best for tech-savvy users

- Complete ID: Best for families or users on a budget

Identity Guard vs. Complete ID compared

Identity Guard |

Complete ID |

|

| Price | $6.67–$19.99/mo | $8.99–$18.99/mo |

| Identity theft insurance | Up to $1 million | Up to $1 million |

| Credit monitoring | ||

| 3-bureau credit reports | ||

| Credit score | ||

| Identity recovery | ||

| Dark web alerts | ||

| Social media account alerts | ||

| Learn more | Get Identity Guard Read Identity Guard Review |

Get Complete ID Read Complete ID Review |

Despite the similarities in features such as credit monitoring, identity recovery, and insurance coverage, Identity Guard and Complete ID differ in the way they present their plans. With its tiered pricing system ranging from $6.67–$19.99/mo, Identity Guard offers a flexible and customizable approach to identity protection.

On the other hand, Complete ID provides a more straightforward and budget-friendly approach with plans ranging from $8.99–$18.99/mo and delivering substantial coverage without complex tiers.

The number of people covered also varies. With Identity Guard, you can choose an individual plan or a family plan, which covers five adults and unlimited children. Complete ID emphasizes family coverage at an attractive price point. It currently offers plans for one adult, two adults, one adult plus five children, and two adults plus five children. All plans include the same features with added coverage for the additional members on the plan.

Identity Guard pros and cons

- Cutting-edge AI technology

- Comprehensive dark web monitoring

- Social media account protection

- More expensive in higher tiers

- Limited customization in lower-tier plans

Complete ID pros and cons

- Family-friendly pricing

- Backed by Experian credit bureau

- Easy to use

- Less sophisticated technology

- Missing customized alerts

Identity Guard vs. Complete ID: prices

Identity Guard |

Complete ID Best Pricing

|

|

| Monthly price range | $6.67–$19.99/mo | $8.99–$18.99/mo |

| Best value plan | Total Individual for $10.00/mo | One Adult for $8.99/mo |

| Identity theft insurance | Up to $1 million | Up to $1 million |

| Learn more | Get Identity Guard Read Identity Guard Review |

Get Complete ID Read Complete ID Review |

Identity Guard plans

Identity Guard offers a spectrum of plans designed to cater to various needs and preferences. Unfortunately, the service offers no free trial, but you can take advantage of the 60-day money-back guarantee if you’re hesitant to commit. All plans are available for individuals or families (five adults, unlimited kids). Below are the details for each plan.

- Value: Value is a basic plan that offers a solid foundation in identity protection, including up to $1 million in identity theft insurance; data breach notifications; dark web monitoring; high-risk transaction monitoring; a safe browsing tool; and a password manager. However, it lacks credit monitoring services and specialized account alerts.

- Total: The Total plan adds significant value by including everything in the Value plan plus bank account monitoring, three-bureau credit monitoring, and a monthly credit score. However, it misses out on specialized monitoring like social media and home title monitoring.

- Ultra: Ultra provides the most comprehensive coverage with everything in the Total plan plus social media monitoring; debit and credit card monitoring; 401(k) and investment account monitoring; home title monitoring; criminal and sex offense monitoring; USPS address change monitoring; Experian CreditLock; and three-bureau annual credit reports.

Complete ID plans

Complete ID offers various plans that are tailored to fit different family structures. We didn’t find an option for a free trial or money-back guarantee. All Complete ID protection plans include the following:

Identity protection features

- Dark web monitoring

- Financial account takeover services

- Neighborhood watch monitoring, which monitors for registered sex offenders that live in or move into your area

- Social Security number (SSN) identity monitoring

- Alternative loan monitoring

- Criminal record monitoring

- Mail change alerts

- A suite of digital privacy features, including a password manager, safe browser, and virtual private network (VPN)

Credit monitoring features

- Credit monitoring from the major bureaus (Experian, Equifax, TransUnion)

- Monthly credit updates

- Annual three-bureau credit reports

- Credit alerts

- Experian CreditLock

Identity restoration services

- 24/7 customer support

- Direct contact with a designated restoration specialist

- Up to $1 million in identity theft insurance

- Lost wallet replacement assistance

Identity Guard vs. Complete ID: monitoring and alerts

| Feature |  Identity Guard |

Complete ID |

| Credit monitoring | ||

| Financial activity alerts | ||

| 3-bureau credit reports | Yes — Experian, TransUnion, Equifax | Yes — Experian, TransUnion, Equifax |

| Credit score | ||

| FICO score | ||

| Credit lock and freeze | ||

| Identity recovery | ||

| Dark web alerts | ||

| Social media account alerts | ||

| Social Security Number monitoring | ||

| Home title monitoring | ||

| Address change alerts | ||

| Learn more | Get Identity Guard Read Identity Guard Review |

Get Complete ID Read Complete ID Review |

Identity monitoring and alerts are vital tools to protect yourself from becoming a victim of identity theft. Identity Guard and Complete ID offer similar monitoring and alert features, such as financial activity alerts, dark web alerts, and social media account alerts. However, Identity Guard stands out for offering home title monitoring, while Complete ID doesn’t.

Identity Guard provides an extensive suite of credit and financial monitoring tools, like three-bureau credit monitoring and monthly credit score updates. Its top-tier Ultra plan also includes annual credit reports from the major credit bureaus and Experian CreditLock, two features that are essential for protecting consumers against unauthorized credit inquiries.

Complete ID also offers comprehensive credit monitoring features, and they’re included with all of its plans. This includes credit monitoring, monthly credit score updates, annual three-bureau credit reports, and more.

Identity Guard or Complete ID: which is safer?

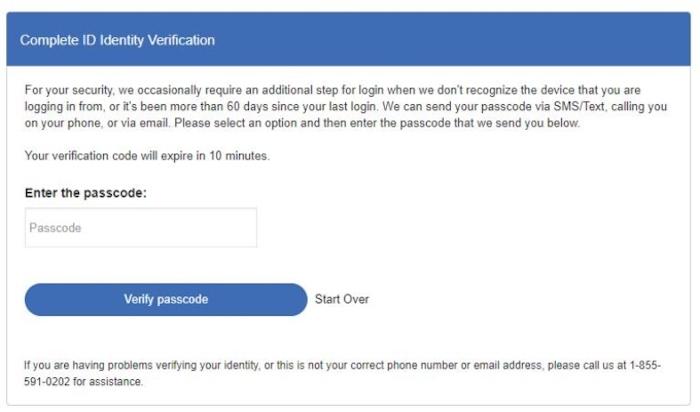

When it comes to identity theft protection services, security is an important concern. After all, these services are entrusted with sensitive personal and financial information. Key features such as two-factor authentication (2FA) and multi-factor authentication (MFA) provide additional layers of protection.

With 2FA, your account would require a password and secondary information like a text code, while MFA might include a biometric confirmation such as a fingerprint. Reasonable data collection for account administration, payment, and monitoring is standard across the industry, but understanding how this data is used and shared is crucial.

Identity Guard vs. Complete ID data security

Identity Guard |

Complete ID |

|

| Two-factor authentication | ||

| Multi-factor authentication | ||

| Collects data | Some | Some |

| Shares data with third parties | ||

| Learn more | Get Identity Guard Read Identity Guard Review |

Get Complete ID Read Complete ID Review |

Identity Guard and Complete ID both offer two-factor authentication, enhancing account security by requiring an additional verification step. Unfortunately, neither currently provides multi-factor authentication, which might add an even more stringent level of protection.

Both services do collect some personal data, which is necessary for monitoring and alert services, and may share this data with third parties in line with their respective privacy policies. They are also both very open about what data they collect and share; Identity Guard even states that it evaluates third parties before sharing any data with them. Overall, both data-sharing policies aren’t something to be worried about as they are not out of the ordinary.

Identity Guard vs. Complete ID: compatibility and customer support

Identity Guard |

Complete ID Best Support

| |

| Windows | ||

| macOS | ||

| Android | ||

| iOS | ||

| 24/7 customer support | ||

| Customer support options | Phone, email, online guides | Phone, online guides |

| Learn more | Get Identity Guard Read Identity Guard Review |

Get Complete ID Read Complete ID Review |

Identity Guard and Complete ID both offer an extensive array of platform support, including Windows, macOS, and mobile apps for Android and iOS. Interface-wise, both services are designed with user-friendliness in mind.

When it comes to customer support, only Complete ID offers 24/7 phone support, which is vital in the event of an identity theft emergency. Identity Guard also offers phone support, but its hours are limited, and it’s only available Monday through Saturday. However, Identity Guard has an advantage by providing email support, adding an extra layer of convenience for users who might prefer this communication method.

Identity Guard vs. Complete ID FAQs

Is Identity Guard worth it?

Identity Guard offers comprehensive identity theft protection services with features such as credit monitoring, dark web alerts, and multi-platform compatibility. Depending on your specific needs and the level of coverage you're looking for, Identity Guard can be a worthwhile investment.

What are the benefits of Complete ID?

Complete ID offers robust ID theft protection, including credit monitoring, financial activity alerts, and multiple options for family plans.

Can I cancel Identity Guard at any time?

Yes, you can cancel Identity Guard at any time. However, it is advisable to review the specific terms of your subscription and contact their customer support to ensure a smooth cancellation process.

Is Complete ID as good as LifeLock?

Complete ID and LifeLock offer different features and pricing structures, so the best choice depends on individual needs and preferences. While LifeLock might provide more comprehensive and specialized features, Complete ID offers essential protections at potentially lower costs.

Identity Guard vs. Complete ID: Which is better?

Identity Guard shines with its tiered pricing system, which allows for customized protection. It also offers an extensive range of features, including dark web alerts, three-bureau credit reports, and social media account alerts. However, the varied pricing may seem complex to some, and it lacks multi-factor authentication.

Complete ID, on the other hand, focuses on simplicity and affordability, and it provides essential ID theft protection features. While it may not offer a limited range of features found in Identity Guard, it covers the basics effectively.

Choosing between Identity Guard and Complete ID depends on your individual needs and preferences. If you're seeking detailed customization and a wide array of features, Identity Guard is your best bet. If affordability and simplicity are key concerns, Complete ID might be the ideal choice. Analyzing your specific requirements and the value you place on different features will guide you to the best identity theft protection service for you.

Identity Guard vs. Complete ID alternatives

If Identity Guard and Complete ID don't quite match your requirements, there are a few other ID theft protection services worth exploring.

- LifeLock: Known for its comprehensive identity theft protection and Norton 360 antivirus integration, LifeLock offers multiple-tiered plans that cater to various needs.

Get LifeLock | Read Our LifeLock Review - Experian IdentityWorks: Experian IdentityWorks offers identity theft protection, credit monitoring, and up to $1 million in identity theft insurance.

Get Experian IdentityWorks | Read Our Experian IdentityWorks Review - Zander Insurance: An affordable option with a straightforward approach, Zander Insurance offers identity theft protection with unlimited recovery services and personal information monitoring.

Get Zander Insurance | Read Our Zander Insurance Review

-

Excellent identity theft protection service

-

Includes a password manager and VPN

-

Robust tools for children’s security

-

Provides VantageScore and not FICO score updates